Power Of Attorney Vs Guardianship

Planning for a loved one’s future health and finances can feel overwhelming—but understanding your rights and options under Texas law can bring clarity and peace of mind. At The Law Office of Bryan Fagan, PLLC, we guide Texas families through estate planning choices with compassion and expertise. Below, we’ll explain the key differences between a power of attorney and guardianship under Texas law so you can make informed decisions that protect your family and preserve their dignity.

Consider these key differences before you decide:

- A durable power of attorney is private, quick to set up, and continues even if the principal becomes incapacitated.

- Guardianship brings formal court oversight, capacity findings, and regular reporting.

- Revoking a power of attorney is straightforward—just execute a revocation document. Ending guardianship means petitioning the court and meeting strict standards.

- Typical POA preparation costs under $200, whereas guardianship filings, medical exams, and attorney fees often push past $1,500.

- Choose POA for flexibility and privacy; turn to guardianship when incapacity is clear and protection is essential.

Quick Reference Table

Below is a snapshot of common situations and the authority that best fits each scenario in Texas.

| Situation | Recommended Authority | Key Considerations |

|---|---|---|

| Aging parent with mild dementia | Power of Attorney | Fast setup, revocable, private |

| Unexpected medical emergency | Guardianship | Court oversight, formal capacity finding |

| Developmental disability | Guardianship | Ongoing reporting, protective duties |

| Short-term travel absence | Power of Attorney | Quick activation, no court hearing |

This Quick Reference Table helps you match your family’s needs—whether you’re aiming to preserve autonomy or establish a protective framework—before diving into the detailed steps for Texas residents.

Understanding Power Of Attorney In Texas

Power of attorney in Texas is governed by Texas Estates Code §751.001. It grants someone you trust—the “agent”—the legal authority to act on your behalf when you can’t or aren’t available. You decide exactly when it kicks in and how broad those powers will be.

Different flavors of POA let you match authority to your needs:

- Durable Power of Attorney stays in effect if you lose capacity.

- Springing Power of Attorney only activates when a predefined event occurs, like a doctor’s certification.

- Medical Power of Attorney covers health-care decisions when you’re unable to speak for yourself.

- General Power of Attorney handles everyday financial tasks, from signing checks to managing real estate.

Execution Requirements

Under Texas Estates Code §751.101, the principal must sign the POA in the presence of two credible witnesses and a notary public. A capacity clause confirms that you understand the document’s scope and consequences.

In practice, agents frequently:

- Pay mortgages, utilities, and other recurring bills.

- Buy, sell, or refinance real property.

- Transfer investments or close bank accounts seamlessly.

“Adding spending caps and periodic reporting requirements keeps agents accountable and gives family members peace of mind,” says a Texas estate planning attorney.

Steps To Complete

- Draft the POA on a statutory form or have an attorney create a customized version.

- Review every clause with your lawyer to ensure clarity.

- Sign before witnesses and have it notarized to make it legally enforceable.

Screenshot Example

Below is a screenshot illustrating the typical power of attorney form structure from Wikipedia.

This layout highlights sections for principal information, agent powers, and signature blocks.

Real Use Cases

Texans often rely on POAs to avoid court delays and preserve autonomy:

- Financial Transfers: An agent moves funds to cover a parent’s mortgage or tax payments.

- Bill Payments: Utility and medical bills get paid on time when the principal is traveling or incapacitated.

- Healthcare Decisions: Hospital staff consults the designated agent on treatment options when the principal can’t decide.

Customizing Authority

Build safeguards right into the document:

- Set caps on spending or limit transactions to certain asset classes.

- Name successor agents if your first choice is unavailable.

- Require annual or quarterly statements sent to a family member or co-agent.

- Include a revocation clause so you can cancel the POA at any time.

Key Insight: Precise calibration of powers and careful agent selection are your best defenses against misuse.

Review your POA regularly—especially after major life events—to ensure it still reflects your wishes.

Tips To Safeguard Your POA

- Appoint an agent who is both trustworthy and accessible.

- Use clear, specific language to avoid misunderstandings.

- Distribute certified copies to banks, health-care providers, and your attorney.

- Revoke outdated POAs by following Texas Estates Code §751.152.

Tailoring POA For Texas Needs

Under Texas Estates Code §751.103, you can narrow agent authority to specific assets, locations, or time frames. For instance, restrict real estate transactions to one property or require dual signatures for large withdrawals.

“Clear triggers and narrow scopes guide agents and prevent unintended actions,” observes a Texas notary.

Encourage agents to maintain a transaction log and share it with a third party every quarter.

Safeguarding Against Misuse

You can attach a statutory gift rider under Texas Estates Code §751.105 to cap or prohibit gifts unless expressly permitted. Constrain gift-making authority to avoid surprises.

Consult your attorney after major milestones—marriage, divorce, or death—to update gift provisions. Store the original and copies securely in a fire-resistant safe or with your legal team.

Understanding Guardianship In Texas

When someone you care about loses the ability to make everyday choices, guardianship can be a safety net. In Texas, the Probate Code allows the courts to appoint a guardian for individuals who can’t manage personal or financial matters on their own.

This process kicks in only when a power of attorney isn’t in place or no longer suffices. Below, we’ll walk you through what it takes to start guardianship and how the probate court keeps an eye on everything.

Types Of Guardianships

Texas law recognizes three main forms of guardianship. Each one balances protection with preserving as many rights as possible:

- Full Guardianship grants the guardian authority over all aspects of a ward’s life.

- Limited Guardianship narrows duties to specific areas, for example health care decisions.

- Standby Guardianship remains dormant until a triggering event—typically a formal finding of incapacity.

“Guardianship should remove only those rights necessary for safety,” notes commentary on Texas Probate Code §1002.003.

A quick look at the distinctions:

| Feature | Full | Limited | Standby |

|---|---|---|---|

| Scope | All decisions | Defined tasks | Trigger‐based relief |

| Court Oversight | Annual reports | Task‐specific updates | Activation report |

| Revocation | Court petition required | Court petition | Automatic changeover |

Court Process Steps

To begin, file a petition in the probate court where the prospective ward lives. You’ll need:

- A medical affidavit and a formal capacity evaluation under Probate Code §1021.051.

- Notice served to close relatives and other interested parties.

- A hearing where the court appoints an attorney ad litem for the ward, reviews evidence of incapacity, and evaluates the guardian’s fitness.

Next, the judge issues an order that spells out the guardian’s duties, sets a bond amount, and establishes reporting deadlines. Court and evaluation fees generally range from $500 to $1,800.

Guardian Responsibilities

Once appointed, a guardian steps into a highly regulated role:

- File an initial care plan within 90 days (Probate Code §1221.051).

- Post a bond—usually 1.2 times the estate’s value—to protect the ward’s assets.

- Submit annual inventories, accountings, and request court approval before selling property or making major life‐altering decisions.

“Failing to report can result in removal,” warns a Houston guardianship attorney.

Real‐World Example

John’s daughter sought a limited guardianship after his stroke. She posted bond quickly, filed quarterly accountings on time, and kept annual costs under $1,000—all while John retained his voting rights and independence in other areas.

Timing And Costs

Expect about 3 to 6 months from filing your petition to receiving the final order. Typical expenses break down as:

- Court filing fees: ~$300

- Medical evaluations: $150–$400

- Professional guardian or attorney fees: up to $2,000 per year

Planning with clear financial records can shave weeks off the timeline.

Protective Measures

Before turning to guardianship, consider less restrictive options:

- Draft a medical power of attorney under Estates Code §166.151.

- Use a durable financial power of attorney if capacity remains intact.

- Apply for a mental health warrant for brief decision‐making authority.

“Alternatives often preserve autonomy and reduce court costs,” notes a Texas elder law expert.

Comparison With POA

Guardianship and power of attorney serve similar goals but differ sharply:

- A POA is created by the principal and can be revoked so long as capacity remains.

- Guardianship is court‐imposed and ends only by court petition.

- POAs avoid ongoing court fees and annual reports; guardianship requires both.

By understanding these nuances, many Texas families establish POAs early to sidestep the expense and intrusiveness of court‐ordered guardianship.

Learn more about hospital custody guidelines and visitation rights in Texas in our hospital custody article.

Comparing Power Of Attorney Vs Guardianship

Deciding between a power of attorney and guardianship often comes down to how much control you want and whether court supervision is a help or a hurdle. In Texas, these two tools serve similar ends—making decisions on behalf of someone else—but they work very differently.

Below, we’ll explore:

- Scope of authority

- Complexity and cost

- Court involvement

- Real-world data

- A side-by-side comparison

- Guidance on choosing the right path for your family

Scope Of Authority

Power of attorney springs from the principal’s own instructions. The agent steps in only under the conditions laid out in the document.

- Financial POA lets your agent pay bills, manage investments, or handle property.

- Medical POA focuses on health-care decisions—everything from treatment choices to end-of-life care.

Guardianship, by contrast, comes after a court finds someone incapacitated. Once appointed, a guardian handles both personal and financial matters under Texas Probate Code §1002.

Creation Complexity And Cost

Drafting a durable power of attorney can happen in a single attorney meeting. Most Texans pay under $200 to have a POA tailored, signed, and notarized.

Guardianship is more involved:

- File a petition with the court

- Obtain medical evaluations

- Notify relatives and hold a hearing

- Post bonds and pay ongoing fees

All told, families often spend over $1,500 before a guardian officially takes over.

Court Involvement And Oversight

A valid POA lives privately. No court filings, no annual reports—unless someone contests it. And as long as the principal is competent, they can revoke it at will.

Guardianship opens a court docket. From the moment a judge signs the order, guardians submit:

- Annual inventories of assets

- Regular accountings

- Bond releases

That oversight can protect a vulnerable adult, but it also adds cost and complexity.

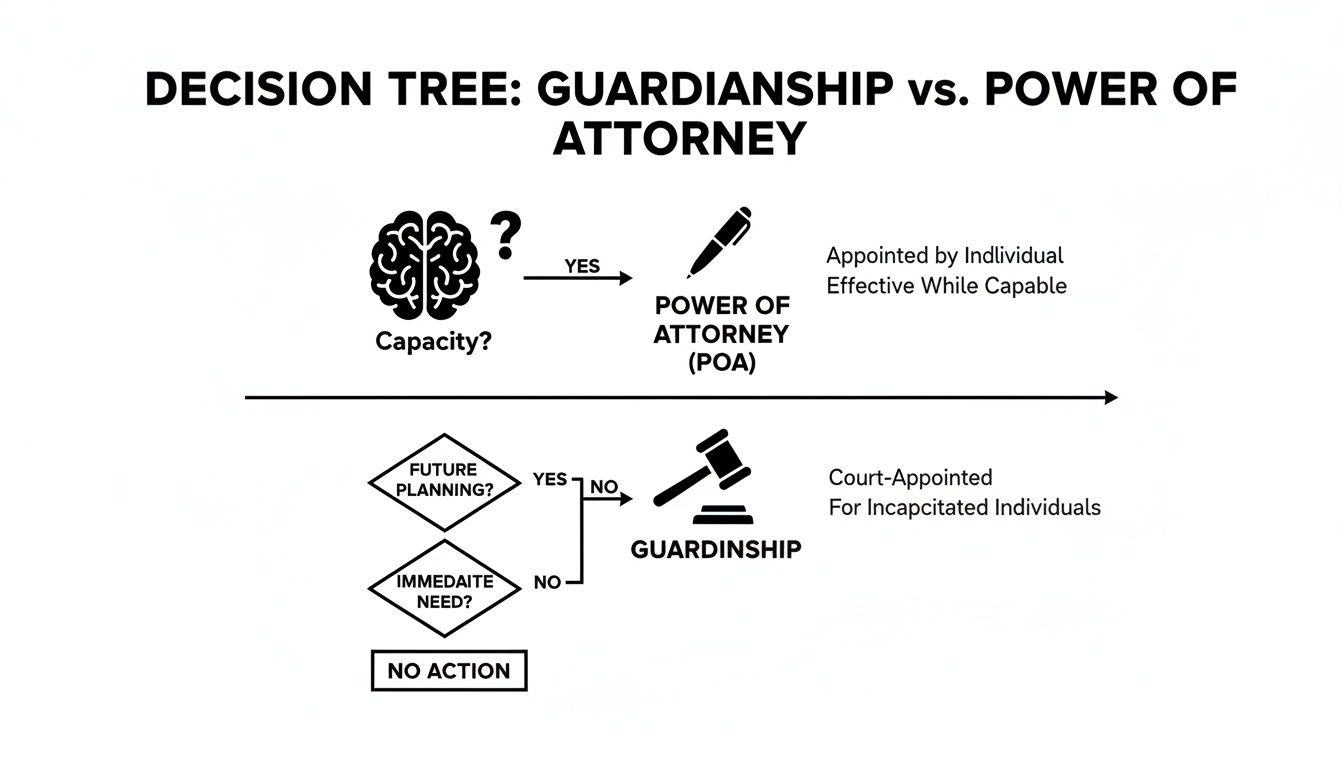

This decision-tree graphic shows how a capacity assessment leads you down one path or the other. When capacity is intact, a POA keeps things out of court. Once a finding of incapacity is made, a guardianship petition becomes necessary.

National Data And Scale

Guardianship remains a last-resort tool across the country, while powers of attorney offer a proactive alternative. Consider these figures from the National Center for State Courts:

- In 2021, 35 states reported 92,117 new adult guardianship cases.

- Meanwhile, 34 states recorded 51,157 conservatorship filings, a financial counterpart to POAs in some jurisdictions.

- Today, roughly 1.3 million adults live under guardianship, overseeing about $50 billion in assets—though experts suspect those numbers are low because reporting standards vary.

A 2010 Government Accountability Office study warned of wards who suffered neglect, abuse, or exploitation when oversight slipped. That drives many families toward POAs, which sidestep court-imposed restrictions on voting or marrying until incapacity strikes. After all, about 85% of guardians are relatives or friends, often without standardized training or clear reporting guidelines. State-by-state gaps in practice only amplify calls for less intrusive planning tools.

Expert Insight

Guardianship’s scale and expense explain why Texans often favor powers of attorney while they remain capable.

Comparison Of Authority Features

Below is a detailed look at how each option measures up across key criteria.

| Feature | Power Of Attorney | Guardianship |

|---|---|---|

| Activation | Private and voluntary; triggers defined by the principal | Court-declared incapacity after a formal hearing |

| Revocability | Fully revocable until the principal loses capacity | Can only end by court order |

| Court Supervision | No ongoing oversight | Requires annual reports, bond filings, and court approvals |

| Cost | Typically <$200 for drafting, notarization, and filing | Often >$1,500 including evaluations, bonds, and attorney fees |

| Rights Impacted | Principal retains most rights until incapacity | Ward may lose rights such as voting, marriage, and contract signing |

In practice, POAs give you flexibility and preserve autonomy. Guardianship steps in when autonomy ends but adds layers of protection—and paperwork.

When To Choose Each Option

• Plan Early

Execute a durable financial or medical POA while capacity is clear.

• Seek Court Backing

If no POA exists and capacity has lapsed, petition for guardianship.

• Layer Protections

Keep a POA current and have guardianship paperwork ready as a backup.

You might also be interested in reading our guide on what assets go through probate in Texas in What In A Will Goes To Probate In Texas.

Every situation is unique. For high-value estates or family disputes, reach out to an experienced Texas attorney sooner rather than later. With thoughtful planning, you can avoid surprises and keep decisions in trusted hands.

Practical Scenarios For Texas Families

These real-life examples show how Texas families weigh power of attorney against guardianship when planning for a loved one’s future. Each scenario highlights key steps, timelines, and costs so you can choose the right path without surprises.

Durable Power Of Attorney For Early Memory Challenges

Mrs. Garcia saw her father’s memory slip when he turned 72. To preserve his independence, she drafted a durable power of attorney under Texas Estates Code §751.101.

She worked with an attorney to:

- Define specific authorities for financial and medical decisions

- Set spending limits and name successor agents

- Add a springing trigger tied to a doctor’s certification

- Get two witnesses, notarization, and distribute certified copies

Typically, a durable POA can be ready in about one week. Once notarized, Mrs. Garcia delivered copies to her dad’s bank and healthcare provider—no court filings needed later if his capacity declines.

“A well-crafted POA keeps personal affairs private and avoids lengthy court proceedings.”

Guardianship For Accident Recovery

After Mr. Lee’s serious accident, his family faced urgent medical choices—yet no POA existed. They petitioned for limited guardianship under Probate Code §1002.004.

Key milestones in their five-month process:

- Filing a guardianship petition in county probate court

- Attaching medical affidavits and notifying next of kin

- Attending a hearing with an attorney ad litem

- Posting a bond and filing an initial inventory within 30 days

Mr. Lee’s wife now manages rehabilitation funds, files annual reports, and even preserves his voting rights. Total legal and evaluation fees ran about $1,200.

Limited Guardianship For Developmental Disabilities

Laura’s adult son earns rental income but struggles with financial paperwork. She chose limited guardianship so she could oversee his finances while he stays independent in daily life.

She paired it with a medical power of attorney to handle health choices without separate petitions. Working with a professional guardian, Laura:

- Filed annual accountings and inventories

- Followed Texas Probate Code reporting deadlines

- Kept her son’s medical POA current for quick healthcare access

By layering tools, Laura balances oversight with autonomy—avoiding court delays for routine decisions.

By 2025, Japan expects 5.53 million dementia cases—up from 3 million in 2005—yet voluntary POA uptake remains low. This shift underscores power of attorney’s flexibility and autonomy benefits for Texas families. Read more at the Guardianship Resource Center.

At-A-Glance Comparison

| Criteria | Power Of Attorney | Guardianship |

|---|---|---|

| Setup Time | ~1 week | ~5 months |

| Court Involvement | Only if capacity is in question | Required from the outset |

| Cost Estimate | Notary + attorney fees | $1,200 (average) |

| Decision-Making Privacy | High | Public court records |

| Flexibility | Can spring or durable | Limited by court order |

Each family’s needs differ. Early planning and clear documents help you avoid delays, unnecessary costs, and court oversight. Discuss your situation with a Texas attorney to determine whether a power of attorney or guardianship is the right tool for your loved one.

Learn more about estate planning basics at the Law Office of Bryan Fagan’s website today.

Establishing, Revoking, and Avoiding Pitfalls

When you plan for incapacity in Texas, laying out clear authority is crucial to protect your autonomy. The Texas Estates Code and Probate Code spell out precise steps for setting up or tearing down a power of attorney (POA) or guardianship.

In this section, we’ll walk through:

- Form Requirements for both POA and guardianship

- Capacity Evidence and court procedures

- Notary Rules, bonds, reporting duties, and best practices

Creating Power Of Attorney

To grant someone the right to act on your behalf, start with the statutory form under Texas Estates Code §751.101. It must clearly state:

- Your capacity at signing

- The effective date and scope of authority

- Specific powers granted (financial or medical)

Execution Checklist:

- Fill out the statutory POA form completely and legibly

- Define financial or medical powers without ambiguity

- Verify capacity language with your attorney

- Sign in the presence of two credible witnesses

- Notarize the document in Texas

Once it’s signed, distribute certified copies to your bank, healthcare providers, and legal counsel. And don’t forget to name a successor agent—that backup plan prevents a decision-making void if your primary agent can’t serve.

Filing Guardianship

When incapacity is evident and there’s no valid POA, a guardianship petition becomes necessary. Under Texas Probate Code §1021.051, you’ll need:

- A medical affidavit and capacity evaluation from a qualified professional

- Notice to close relatives at least ten days before the hearing

Step-By-Step Guardianship Process:

- Prepare and file Form 208 (Application for Guardianship)

- Attach the medical report certifying incapacity

- Serve notice to heirs and close kin per statutory requirements

- Attend the hearing with supporting evidence and witnesses

- Post a bond set by the court and file it with the clerk

After the judge appoints a guardian, you must file an initial inventory within 30 days and submit annual accountings under Probate Code §1251.101.

“Guardianship orders come with strict reporting deadlines—missing one can trigger costly court enforcement.”

Revoking Documents

When you outgrow a POA or wish to terminate it, Texas Estates Code §751.152 provides a clear path:

- Draft a Revocation of Power of Attorney on the statutory form

- Sign before a notary to validate the revocation

- Send certified copies to all former agents and institutions

- Record the revocation in any county where the original POA was filed

If a guardianship is in place, you petition the probate court for termination—usually by showing restored capacity or that a less restrictive alternative will suffice. Keep copies of every revocation document alongside your estate-planning files for easy reference.

Common Pitfalls To Avoid

Choosing the wrong agent or neglecting updates can lead to serious headaches and legal battles.

• Unsuited Agent Selection: Pick someone who’s available, trustworthy, and understands the responsibilities.

• Outdated Documents: After divorce, remarriage, or adding new assets, revisit your POAs.

• Excessive Authority: Limit gifting and transaction powers if you’re concerned about financial misuse.

• No Successor Agent: Always name a backup to avoid decision-making limbo.

“Too often, families realize their documents are outdated only when it’s too late.”

For tips on safeguarding these documents—whether in a fireproof safe or a secure digital vault—see our Guide on Storing Your Estate Planning Documents.

FAQ

Let’s tackle some of the most common questions about POAs and guardianship in Texas. Understanding your options—and the steps involved—can save you time and protect your loved ones.

How Do I Amend Or Revoke A Power Of Attorney In Texas?

Under Texas Estates Code §751.152, a principal who’s mentally competent can modify or cancel a power of attorney at any time. To do this, you:

- Sign a Revocation of Power of Attorney

- Have it notarized

- Send certified copies to any former agents and relevant institutions (banks, clinics, etc.)

When Should I Contest A Guardianship?

If you believe a guardianship is no longer necessary, you can challenge it under Texas Probate Code §1101.101. You’ll need to file a motion demonstrating that:

- The ward has regained capacity, or

- A less restrictive alternative (like a medical POA) will suffice

This process usually involves a court hearing and updated medical evidence.

“Guardianship revocations hinge on proving restored capacity or changed circumstances,” notes a probate court guide.

Agent Fiduciary Duties

An agent acting under a POA owes the principal duties of loyalty, care, and transparency as outlined in Estates Code §751.0025. In practice, that means:

- Avoiding conflicts of interest

- Keeping meticulous records of every transaction

- Always prioritizing the principal’s best interests

Breach these duties, and the agent risks legal liability.

What Happens When Capacity Returns?

When the principal recovers mental capacity, a Durable POA typically ends on its own—unless the document specifies otherwise. In that scenario, the agent should:

- Immediately stop acting under the POA

- Notify banks, healthcare providers, and other institutions

- File a formal revocation if the durable language remains

Termination Procedures For Guardianship

A ward seeking to end guardianship files a petition under Probate Code §1104.301. The key steps are:

- Obtain an updated medical affidavit showing restored capacity.

- Submit the petition and affidavits to the court.

- Attend the termination hearing, where the judge reviews the evidence and considers returning rights to the ward.

At A Glance: Key Statutes And Steps

| Scenario | Relevant Code Section | Core Action |

|---|---|---|

| Amending or Revoking POA | Estates Code §751.152 | Sign Revocation, notify stakeholders |

| Contesting Guardianship | Probate Code §1101.101 | File motion, submit new medical proof |

| Agent Fiduciary Duties | Estates Code §751.0025 | Maintain loyalty, care, and accurate records |

| Restored Capacity & Guardianship Ends | Probate Code §1104.301 | Petition termination, attend court hearing |

For more on alternatives, see Guardian alternatives.

If you need help navigating divorce, custody, or estate planning in Texas, contact The Law Office of Bryan Fagan today for a free consultation.