Bringing two families together is a journey of love and new beginnings. But as you build this new life, it's natural to feel concerned about protecting everyone you care about. For blended families in Texas, estate planning isn't just about drafting a simple will; it requires a thoughtful, custom-built strategy to ensure your spouse, your biological children, and your stepchildren are all protected according to your exact wishes.

Planning for the future can feel overwhelming, but understanding your rights and options under Texas law can make it much less intimidating. Without a specific plan in place, Texas inheritance laws could step in and make decisions for you—and those decisions might unintentionally leave some of your loved ones without the security you intended for them.

Why Blended Families Need a Custom Estate Plan

Your primary goal is to protect everyone you love. When you form a blended family, you're merging not just lives and homes, but also assets, financial histories, and two distinct family trees. A cookie-cutter estate plan simply cannot account for this complexity and often leads to unintended consequences that can spark confusion and conflict during an already painful time.

If you don't have a custom plan, Texas’s default inheritance laws—known as intestacy statutes—take over. The problem is, these laws are rigid and follow strict bloodlines.

According to the Texas Estates Code, stepchildren have no legal inheritance rights unless they have been legally adopted. This means if you pass away without a will, your assets could go entirely to your biological children and surviving spouse, leaving your stepchildren with nothing, no matter how close your relationship was.

Overcoming Common Challenges

A custom-tailored approach to estate planning for blended families tackles several critical issues that a simple will often misses. It allows you to provide for your current spouse while also ensuring your children from a previous relationship are looked after. Finding this balance is usually the top priority.

Here is some practical guidance on what your plan should cover:

- Protecting All Children: You can structure your estate to ensure both your biological children and your stepchildren receive an inheritance, reflecting your true wishes.

- Providing for a Surviving Spouse: With the right legal tools, your spouse can live comfortably while the principal assets are preserved for your children’s future.

- Avoiding Family Disputes: A clear, legally sound plan removes ambiguity. This dramatically reduces the chance of expensive and emotionally draining fights between family members.

- Naming Appropriate Guardians: You get to decide who should care for your minor children—a decision that needs careful thought in a blended family.

Think of a custom estate plan as your personal roadmap to peace of mind. It brings clarity to your loved ones and ensures your legacy is one of unity, not division. For more general information, you can find valuable resources for individuals and families.

If you need help navigating divorce, custody, or estate planning in Texas, contact The Law Office of Bryan Fagan today for a free consultation.

The Hidden Dangers of a Standard Will

Many people believe a simple will is all they need to protect their families. For a traditional family structure, that might be sufficient. But for a blended family, that same simple will can become a recipe for unintended heartache and financial chaos.

A standard will is a general roadmap, fine for a straightforward journey. But your family's needs are unique. The reality is, a standard will wasn't built for the specific relationships in a blended family. These documents are straightforward, but your family's needs are anything but.

The Risk of Unintentional Disinheritance

This is the single most common—and devastating—danger we see. Imagine this common scenario: you create a simple "I love you" will leaving everything to your current spouse. You do this with the loving assumption that they will, in turn, provide for your children from a previous relationship in their own will.

Your intentions are perfect, but this creates a massive legal gap. Once your assets pass to your surviving spouse, they become their sole property. Your spouse then has the full legal right to do whatever they want with those assets.

- They could remarry, and a new spouse could influence how assets are eventually distributed.

- They might have more children and change their will to favor them.

- They could face a financial crisis or steep medical bills that completely drain the estate.

- Years could pass, relationships could change, and they might simply have a change of heart.

In any of these situations, your biological children could be left with nothing. This doesn't usually happen out of malice; it’s the cold, hard legal reality when assets are transferred without specific protections locked in place.

Texas Law and Intestacy Statutes

The situation becomes even more precarious if you don't have a will at all. When someone passes away without a will—a situation called dying intestate—the State of Texas steps in. Your property is then divided according to the rigid rules of the Texas Estates Code, which are based strictly on bloodlines.

Crucially, Texas law gives stepchildren zero automatic inheritance rights. Unless you have gone through the formal legal process of adopting your stepchildren, the law does not recognize them as your heirs. This can lead to your assets being split in a way you never would have wanted.

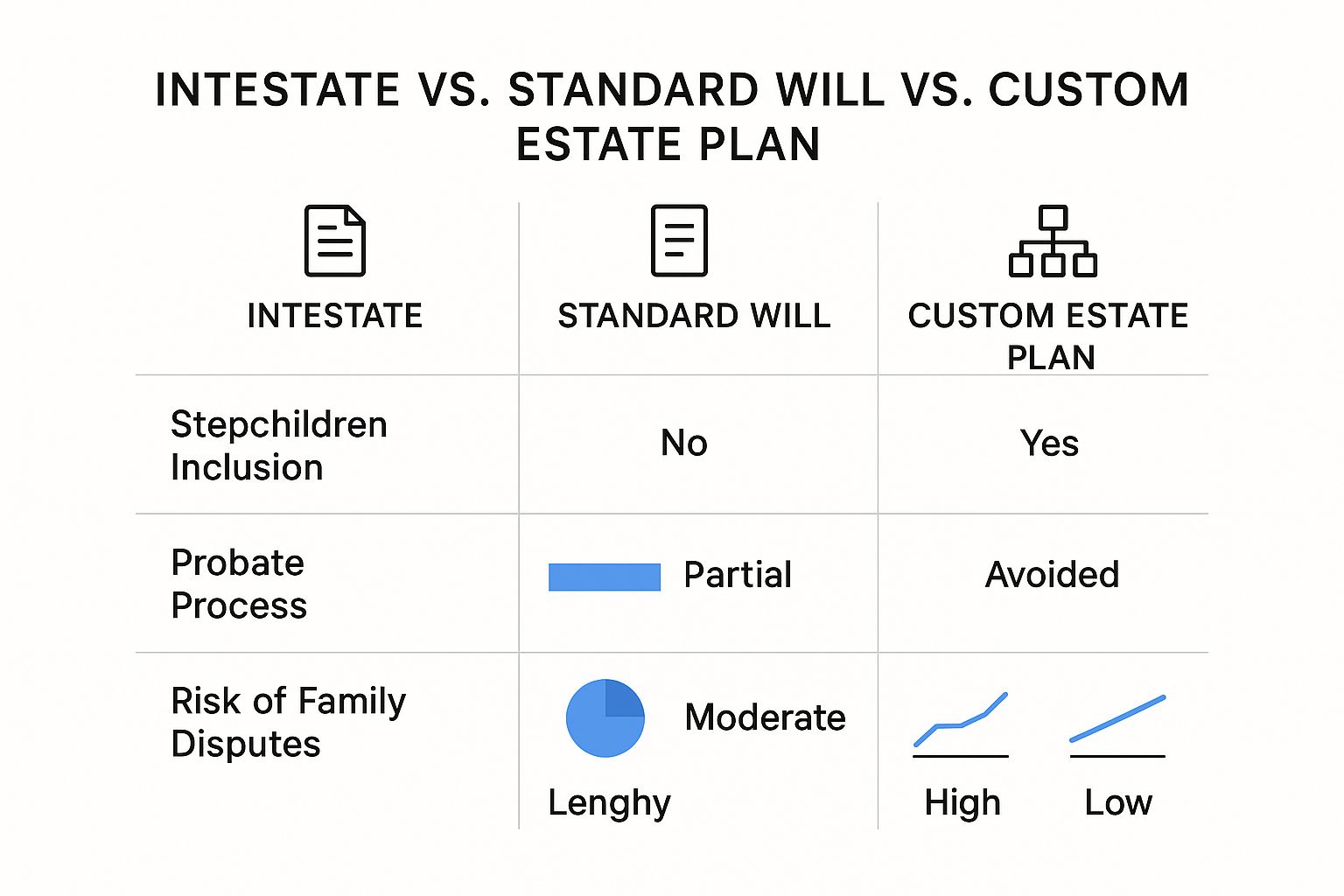

The chart below illustrates how different planning approaches can dramatically change the outcome for your family. It shows just how risky it is to rely on intestacy or a standard will compared to a plan built for your family's reality.

As you can see, a custom estate plan is the only way to guarantee your stepchildren are included, keep the process out of the public and lengthy probate courts, and dramatically lower the odds of family conflict.

This isn't a niche problem. In the U.S., about 16% of children live in blended families, meaning that today, roughly 40% of all American families are blended. This demographic shift makes proactive estate planning for blended families more critical than ever.

Because traditional inheritance laws often treat biological and non-biological children differently, the potential for conflict is higher without clear, specific legal documents. You can learn more about the challenges blended families face and see why a tailored plan is vital. Proactive, custom legal tools are the only way to create certainty and prevent heartbreaking disputes.

Crafting Your Plan With The Right Legal Tools

Building an estate plan that truly protects your blended family means going beyond a simple will. It requires specialized tools to make sure the final structure is strong, secure, and built to last.

This guide will walk you through the most powerful legal instruments we use for blended families in Texas, explaining how each one works with practical, real-world examples. Our goal is to give you the clarity you need to create a secure, conflict-free future for everyone you love. As you shape your plan, looking into effective estate tax planning strategies is also a smart move to minimize tax burdens.

The Revocable Living Trust: Your Foundation For Control

If there's one tool that forms the cornerstone of most blended family estate plans, it's the Revocable Living Trust. It is one of the most versatile and valuable options available.

Unlike a will, which only activates after you pass away, a trust is a legal entity you create and control during your lifetime. You transfer your assets—like your home, investments, and bank accounts—into the trust. You then act as the trustee, managing everything just as you always have.

The real power is revealed after you're gone. Because the trust owns the assets, they completely bypass the lengthy, public, and often expensive probate process. Your successor trustee (someone you handpick) steps in and distributes the assets according to your exact instructions, all done privately and efficiently. This gives you immense control over who gets what and when—a non-negotiable for blended families.

Comparing Estate Planning Tools for Blended Families

To get a clearer picture, it helps to see these tools side-by-side. Each one has a specific job, and choosing the right combination is what makes a blended family plan successful.

| Legal Tool | Primary Function | Key Benefit for Blended Families | Common Scenario |

|---|---|---|---|

| Revocable Living Trust | Holds and manages assets during your life and distributes them after death, avoiding probate. | Provides ultimate control and privacy over asset distribution, preventing public disputes. | Ensuring specific assets go directly to your children while others are set aside for your spouse, all without court involvement. |

| QTIP Trust | Provides lifetime income for a surviving spouse, with the remaining assets passing to other named beneficiaries (like your kids) upon the spouse's death. | Protects children's inheritance from a previous relationship while ensuring the current spouse is financially secure. | You want to provide for your second spouse for the rest of their life, but make sure your assets ultimately go to your own children, not their step-siblings or a new partner. |

| ILIT | Owns a life insurance policy, removing the death benefit from your taxable estate. | Creates immediate, tax-free cash for heirs and can be used to equalize inheritances among different family branches. | Using a life insurance payout to provide a substantial, separate inheritance for your biological children, while leaving retirement accounts directly to your spouse. |

| Marital Agreements | Legally defines separate and community property before (prenuptial) or during (postnuptial) a marriage. | Creates absolute clarity on asset ownership, preventing disputes over what belongs to whom during estate settlement. | Clearly designating the business you owned before your second marriage as your separate property, ensuring it passes only to your children. |

These aren't just legal documents; they're strategic instruments designed to solve the very real challenges that blended families face.

Specialized Trusts For Blended Family Dynamics

While a revocable trust is a great start, blended families often need more specialized tools to handle specific goals. Two of the most effective are the QTIP Trust and the Irrevocable Life Insurance Trust (ILIT).

Qualified Terminable Interest Property (QTIP) Trust

A QTIP trust is designed for one of the most common blended family goals: providing for your spouse while guaranteeing your children’s inheritance is protected.

A QTIP allows you to leave assets in a trust for your surviving spouse's benefit. For the rest of their life, they receive all the income generated by the trust's assets, ensuring their financial security. Crucially, they cannot change the ultimate beneficiaries. Upon their death, the remaining principal passes directly to the beneficiaries you named—typically your children from a prior marriage.

This structure elegantly solves the unintentional disinheritance problem. Your spouse is cared for, but they don't have the power to redirect your legacy.

Irrevocable Life Insurance Trust (ILIT)

An Irrevocable Life Insurance Trust (ILIT) is another strategic tool. It’s a trust created for one purpose: to own a life insurance policy. By placing the policy inside the ILIT, the death benefit is removed from your taxable estate.

For blended families, an ILIT is a game-changer for two reasons:

- Providing Liquidity: The death benefit provides immediate, tax-free cash that heirs can use to pay estate taxes or debts without selling cherished assets like a family home.

- Equalizing Inheritances: You can use an ILIT to create a specific inheritance for your children while leaving other assets, like a 401(k), to your spouse, creating a fair and balanced distribution.

The Role Of Prenuptial And Postnuptial Agreements

Marital agreements, governed by the Texas Family Code, aren't about expecting a marriage to fail. They're about creating clarity to prevent conflict.

A prenuptial agreement (signed before marriage) or a postnuptial agreement (signed after) lets you and your spouse define what is separate property (what you brought into the marriage) and what is community property (what you acquired together). This classification can prevent massive confusion when it's time to settle an estate.

Managing Finances and Assets with Fairness

When you build a blended family, you're often bringing two different financial worlds together. Facing these realities head-on with clarity and compassion is how you ensure everyone feels seen and respected. The goal isn't always a perfectly even split; it's about creating a plan that feels fair and equitable to everyone involved.

This means getting real about the different assets, debts, and income streams each of you brought into the marriage. Without careful planning, these disparities can lead to feelings of inequality between your biological children and your stepchildren. For blended families, achieving fairness is a mix of open communication and using the right legal tools. You can discover more insights about navigating these complexities and keeping the peace.

The Critical Role of Beneficiary Designations

One of the most devastating mistakes in blended family estate planning involves beneficiary designations. Many valuable accounts, like 401(k)s, IRAs, and life insurance policies, pass directly to the person you name as the beneficiary, completely sidestepping your will or trust. These designations legally override whatever your will says.

For example, an old 401(k) that still lists your ex-spouse as the beneficiary will legally go to your ex, even if your new will states that everything goes to your current spouse and kids.

Actionable Tip: As soon as you experience a major life event—marriage, divorce, the birth of a child—make it a priority to review every single one of your accounts. Log in or call the plan administrators to check and update the primary and contingent beneficiaries on all your retirement accounts and life insurance policies. Don't assume; verify.

Using Life Insurance as a Strategic Tool

Life insurance is a flexible tool for creating fairness in a blended family plan. It delivers clean, tax-free cash that you can use to balance inheritances and protect everyone's interests.

Here is a practical scenario we often solve: You want your current spouse to live comfortably, but you also want to leave a meaningful inheritance for your children from a previous marriage.

- For your spouse: You might leave them the family home and your retirement accounts.

- For your children: You could then purchase a life insurance policy and name your children as the beneficiaries, or have the policy owned by an ILIT.

This approach carves out a separate, designated inheritance for your kids. It prevents your spouse from having to sell assets to pay out the kids' share and ensures your children receive exactly what you intended.

Defining Property with Marital Agreements

Before you can divide assets fairly, you need a clear understanding of who owns what. In Texas, property is either separate (owned before the marriage) or community (acquired during the marriage). Marital agreements, governed by the Texas Family Code, are the best tools for making this distinction ironclad.

- A Prenuptial Agreement: Signed before marriage, it allows you and your partner to spell out which assets will remain separate property.

- A Postnuptial Agreement: Signed after you're married, it's great for clarifying ownership if your financial situation changes.

By legally defining property ownership, you eliminate guesswork and potential arguments, making the entire estate planning process smoother.

Appointing a Guardian to Protect Your Children

For any parent, choosing who would raise your children if you couldn't is one of the most critical decisions you'll ever make. In a blended family, this decision becomes even more complex, demanding thoughtful, proactive planning.

Naming a guardian in your will isn't just checking a legal box; it's a profound act of love. It’s your opportunity to tell a judge exactly who you trust to care for your children. If you don't make this choice clear, the court is forced to decide for you, often without understanding your family's unique dynamics.

Understanding the Legal Realities in Texas

A common, heartfelt assumption is that if a biological parent passes away, their current spouse—the stepparent—will automatically get to keep raising the children. Under Texas law, however, that's rarely the case.

The Texas Family Code gives overwhelming preference to the surviving biological parent. Unless their parental rights have been legally terminated or a court finds them unfit, the other biological parent has the superior legal right to custody. This is true regardless of the stepparent's relationship with the children.

This legal reality can be a gut punch. This is precisely why naming a guardian in your will is so critical. While it can't override the biological parent's rights, it gives the judge powerful insight into what you believed was in your children’s best interest.

Choosing the Right Person for the Role

Picking a guardian is a decision that must be rooted in who can truly provide a stable, loving home. You're looking for someone whose values and parenting style align with the future you want for your kids.

Here are some practical steps for choosing a guardian:

- Values and Beliefs: Does this person share your core values on education, faith, and raising responsible, kind human beings?

- Existing Relationship: How well do they know your children? A strong, existing bond can make a difficult transition smoother.

- Financial Stability: A potential guardian should be financially responsible and capable of managing the resources you leave behind for your children’s care.

- Physical and Emotional Capacity: Are they healthy enough and emotionally ready to take on the responsibility of raising children? Consider their age, energy, and current family situation.

The Power of Open Communication

Once you’ve documented your decision, the work isn't over. You must have honest conversations with everyone involved. Talk to your chosen guardian to ensure they're willing to accept the role. It also means talking through the plan with your ex-spouse and your current spouse.

These aren't easy conversations, but they are essential to get everyone on the same page. By working together, you can build a unified plan that puts your children’s well-being first. This dialogue is a vital piece of a solid estate plan for your blended family.

Keeping Your Plan Strong Means Keeping the Conversation Going

Drafting the right legal documents is a critical step, but a successful estate plan doesn't end there. It must be surrounded by clear, open communication. Talking about your plan with your spouse and—when appropriate—your adult children is what will ultimately preserve family harmony.

The point isn't to debate dollar amounts. It's about sharing the why behind your choices. When you explain the values and intentions that guided you, it helps everyone see that your plan was built thoughtfully to care for the entire family.

Your Plan Is a Living, Breathing Document

Your estate plan is not something you "set and forget." Life is constantly changing, and your plan needs to evolve with it. Your plan needs periodic reviews to stay strong and effective.

Any major life event should trigger a review of your documents. These events include:

- The birth or adoption of a new child or grandchild.

- A marriage or divorce in the family.

- A significant shift in your financial situation.

- The death of a beneficiary or someone you named as an executor.

If you don't address these changes, parts of your plan could become outdated or ineffective.

Why Regular Reviews Are Non-Negotiable

The complex relationships in blended families unfortunately make them more prone to estate disputes. With remarriage so common, there were over 2.4 million stepchildren in U.S. households in 2021, highlighting how many families are navigating these dynamics. One study found that 70% of firms see transparency as key to a successful wealth transfer. When you fail to communicate or update your plan, you risk setting the stage for expensive legal fights and lasting family pain. Discover more insights about smart estate planning for blended families.

Keeping your plan current is the ultimate act of care. By regularly communicating with your family and reviewing your documents, you replace uncertainty with clarity and ensure your legacy is one of peace and unity for everyone you love.

This ongoing cycle of communication and review ensures your wishes are carried out and your entire family is protected.

If you need help navigating divorce, custody, or estate planning in Texas, contact The Law Office of Bryan Fagan today for a free consultation.

Frequently Asked-Questions About Texas Estate Planning

Stepping into estate planning for a blended family can feel like navigating a maze. It’s normal to have questions. Here are straightforward answers to the most common concerns we hear from Texas families like yours, offering practical guidance to help you move forward with confidence.

Can My Spouse Disinherit My Kids?

This is a major concern, and the short answer is yes, they can—if you don't have the right plan in place.

If you leave everything to your spouse in a simple will, those assets become their sole property. Legally, nothing stops them from changing their will later to leave everything to their own children or a new partner. The result is that your biological children could be left with nothing.

This is where a tool like a Qualified Terminable Interest Property (QTIP) Trust is invaluable. It’s a powerful way to provide for your spouse for the rest of their life while legally guaranteeing that the remaining assets go to your children after your spouse passes away.

Do I Have to Treat All Children Equally?

No, there is no law that says you must treat every child—biological or stepchild—in the exact same way. In estate planning, "fair" doesn't always mean "equal." Your plan should be a reflection of your unique family, relationships, and financial situation.

You might decide to leave a larger share to a child with special needs, or provide for your stepchildren with a life insurance policy while leaving the family home to your biological kids. What matters is that your decisions are intentional and clearly spelled out in your documents to prevent confusion.

What Happens if We Both Have Wills from Before We Married?

Relying on old wills from previous relationships is a recipe for disaster. While a will you made before remarrying isn't automatically voided, your new marriage significantly complicates things under the Texas Estates Code. It can create major legal conflicts.

It is absolutely crucial that both you and your current spouse create new, updated estate plans together. This ensures there is one clear, legally sound roadmap for your assets. It’s the only way to make sure your old plan doesn’t clash with your current family structure and cause a legal nightmare.

If you need help navigating divorce, custody, or estate planning in Texas, contact The Law Office of Bryan Fagan today for a free consultation.