Imagine this: you’re at the grocery store with your child, and suddenly they spot their favorite cereal—the one with the cartoon character on the box and a toy inside. You sigh, glance at the rising price tag, and think, “Didn’t this used to be five bucks?” Now multiply that moment by everything else kids need—clothes, shoes they outgrow every six months, healthcare, and all the little extras that make their world feel secure. That’s where the New Texas Child Support Guideline Cap and Percentages comes in. As of September 1, 2025, the state raised the cap to $11,700, meaning support obligations will increase to reflect today’s real costs of raising children.

Here’s the short answer: the update is designed to give kids the financial stability they need and ensure parents are contributing fairly, especially in a world where the cost of just “keeping up” keeps going up. And while it’s a legal change, it’s also a very practical one—because when children have consistency in their day-to-day lives, they feel more secure emotionally and thrive in ways that go far beyond money.

In this article, we’ll walk you through what the new cap and percentages mean in real life, highlight situations most parents don’t realize courts consider, and share practical guidance you can use today. You’ll also see how our attorneys at The Law Office of Bryan Fagan, PLLC help families apply these changes to their unique situations—so that finances become one less thing you have to worry about while protecting your child’s future.

Key Takeaways

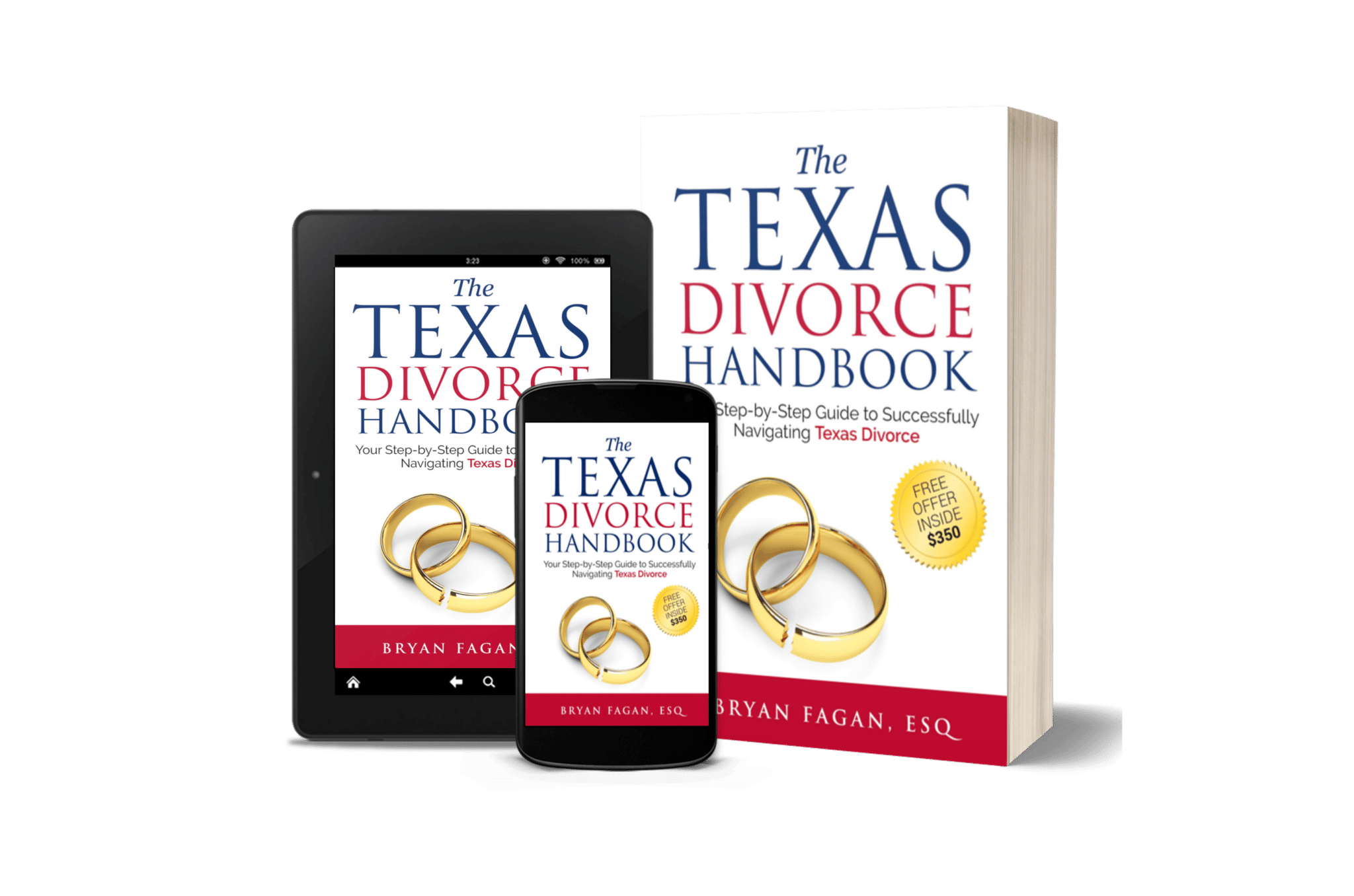

- Starting September 1, 2025, the new Texas child support cap increases to $11,700, raising the monthly obligation for one child from $1,840 to $2,340.

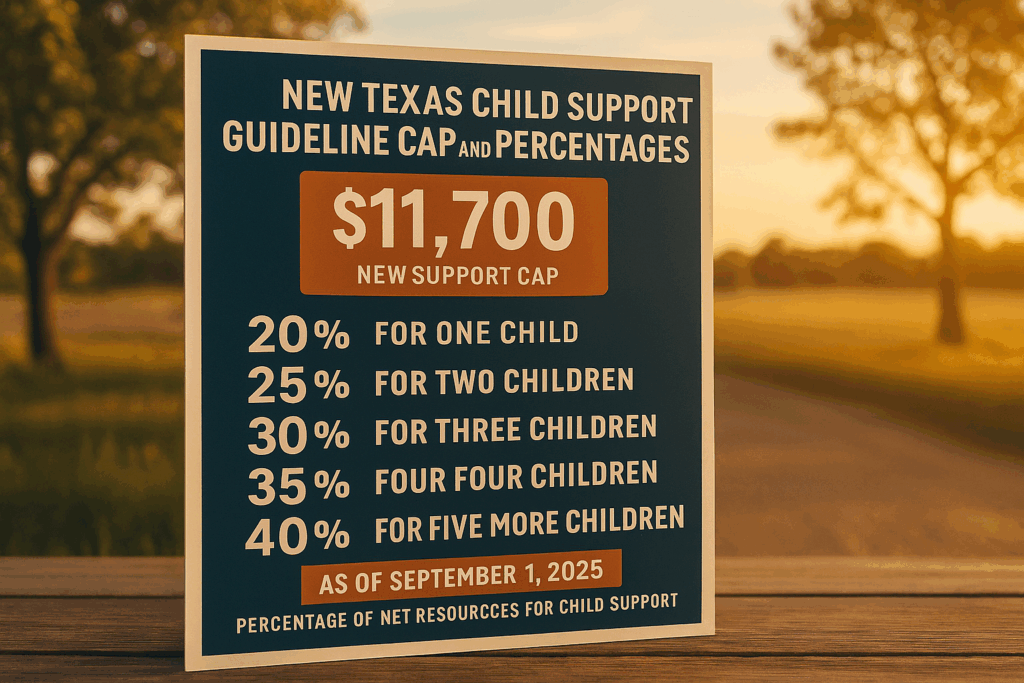

- The updated child support percentages stipulate 20% of net resources for one child, increasing progressively with additional children, ensuring proportional support based on family size.

- Accurate calculation of net resources and documentation of income changes are essential for modifying existing child support orders to align with the new guidelines.

New 2025 Texas Child Support Guideline Cap

Starting September 1, 2025, the New Texas Child Support Guideline Cap and Percentages raise the income cap for child support calculations to $11,700—the first adjustment in six years. This change reflects both inflation and the rising costs of raising children, ensuring that a greater portion of parental income is considered when calculating support obligations under Texas Family Code §154.125. For many families, this update means the monthly guideline support for one child increases from $1,840 to $2,340, better aligning financial contributions with the real expenses of modern parenting.

The purpose of these updates is clear: to reinforce the state’s commitment to the well-being of children by making support orders more realistic and responsive to today’s economic conditions. By applying the new percentages—20% for one child, 25% for two, 30% for three, 35% for four, and 40% for five or more children—courts can more accurately ensure that children’s needs are met, regardless of changes in household income levels.

For custodial and non-custodial parents alike, these changes carry significant financial and legal implications. Staying informed and proactive is essential, whether you’re planning to modify an existing order, negotiating support for the first time, or simply trying to understand how the cap affects your family. To explore a deeper breakdown of how these calculations work, see our detailed resource: Understanding the Child Support Formula in Texas.

At the Law Office of Bryan Fagan, PLLC, our attorneys understand that child support is not just about numbers on paper—it’s about protecting your child’s stability and future. We guide parents through these updates with compassion and clarity, ensuring your rights are respected and your children receive the support they deserve. To learn more about related issues, visit our Texas Child Support Resource Center

Updated Percentages for Child Support

The New Texas Child Support Guideline Cap and Percentages are carefully designed to ensure that children receive support proportionate to their parents’ financial resources. Under the updated law, 20% of a non-custodial parent’s net resources is allocated for one child, with percentages increasing as the number of children rises. Parents with two children are expected to contribute 25%, three children 30%, four children 35%, and five or more children at least 40%. These percentages, outlined in Texas Family Code §154.125, serve as a framework to promote fairness and consistency in child support determinations across the state.

Importantly, the Texas Family Code recognizes that every family’s circumstances are unique, which is why these guidelines function as a baseline rather than a rigid formula. Judges may adjust support obligations when there are extraordinary needs, such as medical care, specialized education, or other essential expenses that go beyond the standard guideline amounts. This flexibility ensures that children’s well-being remains the top priority.

For Texas families navigating these changes, understanding the percentages and how they apply to your financial situation is critical. Staying informed helps you anticipate future obligations, plan responsibly, and avoid unnecessary conflict. To learn more about legal strategies and practical solutions for support matters, see our dedicated guide: Top Legal Support for Texas Child Support Needs.

At times, these calculations can feel overwhelming, especially during divorce or custody disputes. That’s why so many parents turn to the family law team at the Law Office of Bryan Fagan, PLLC. With a commitment to educating families and protecting futures, our attorneys provide both the legal insight and the compassionate guidance you need to move forward with confidence. For additional resources, visit our Texas Child Support Resource Center.

Defining Net Resources

Net resources are crucial for child support calculations, representing income after allowable deductions. This includes:

- Salaries

- Wages

- Commissions

- Bonuses

- Retirement benefits

- Unemployment benefits

- Self-employment income.

To determine net resources, subtract allowable deductions from the total income, including:

- Taxes

- Social Security contributions

- Health insurance premiums for the child

- Medical or dental insurance premiums

Accurate accounting of these deductions provides a precise figure for net resources.

Calculating net resources is crucial for determining child support obligations. The non-custodial parent’s net resources percentage is used to calculate payments, varying by the number of children. This ensures fair support reflective of the parent’s financial capacity and the parent’s net resources.

Calculating Child Support Under the New Guidelines

Calculating child support under the New Texas Child Support Guideline Cap and Percentages requires a careful review of a parent’s financial situation. The process begins by determining gross monthly income and then subtracting allowable deductions such as federal income taxes, Social Security contributions, and health insurance premiums for the child. The result—known as net resources—becomes the basis for applying the guideline percentages under Texas Family Code §154.125.

Once net resources are established, the statutory percentages apply: 20% for one child, 25% for two children, 30% for three, 35% for four, and 40% for five or more children. These calculations ensure that child support reflects a parent’s ability to contribute while safeguarding the child’s financial well-being. Additional expenses, such as medical coverage under Texas Family Code §154.181 or childcare costs, may also be included to fully address the child’s needs. Documentation is critical—pay stubs, tax returns, and records of out-of-pocket expenses all play a vital role in accurate support determinations.

For example, under the new $11,700 income cap, a parent supporting one child would owe 20% of that amount—or $2,340 per month. This increase from the prior $1,840 maximum highlights the state’s recognition of inflation and the rising costs of raising children. For families, this means that support obligations are more in line with today’s realities, providing children with the stability they deserve.

If you’re a custodial parent navigating these updates, it’s important to understand how these changes apply to your specific case. Our attorneys provide clarity and guidance, ensuring every calculation is accurate and every child’s best interests are protected. For a deeper dive into these calculations, see our resource: Texas Child Support Calculation Guidelines for Custodial Parents.

At the Law Office of Bryan Fagan, our team is committed to educating families and protecting futures. Whether you’re seeking to establish, enforce, or modify a support order, we work alongside you to ensure your child’s needs are met under Texas law. You can also explore our Texas Child Support Resource Center for additional information tailored to parents just like you.

Special Cases and Deviations from Guidelines

Standard child support guidelines provide a framework, but certain situations require deviations. For example, if a child has exceptional medical needs or extraordinary educational expenses like private school tuition, courts may deviate from the guideline child support.

Courts may consider a non-custodial parent’s higher income for additional support beyond standard guidelines. If a child’s actual needs are demonstrated, courts prioritize those needs, allowing flexibility to address unique family circumstances, including those of the custodial parent.

To challenge the guideline amount, parents must provide proof of additional expenses and the child’s necessities. Demonstrating a material and substantial change in circumstances can also warrant modifications. Texas courts recognize each family’s uniqueness and accommodate these variations.

Impact on Higher-Income Parents

The increase under the New Texas Child Support Guideline Cap and Percentages from $9,200 to $11,700 has a significant impact on higher-income parents across Texas. By expanding the amount of income subject to calculation, courts can now base guideline support on a larger portion of net resources, as authorized by Texas Family Code §154.125. This update better reflects today’s economic realities and the rising costs of raising children, ensuring that support obligations align with the actual financial needs of families.

For parents whose earnings exceed the former $9,200 cap, this adjustment may result in several hundred dollars more in monthly payments. While this change can feel daunting, it also creates greater fairness for children who depend on that support. Courts now have a broader framework to make orders that more accurately meet children’s day-to-day and long-term expenses, from healthcare to extracurricular activities.

Higher-income parents are encouraged to take these changes into account when planning their financial strategies. Proactive steps—such as reviewing budgets, considering modifications, and consulting with experienced counsel—can help minimize surprises and ensure compliance. For an in-depth look at how maximum support obligations work in practice, visit our resource: Child Support in Texas: What Is the Most You Will Pay?.

At the Law Office of Bryan Fagan, our attorneys provide both the legal insight and compassionate guidance parents need to navigate these updates. We understand that financial obligations affect not just the paying parent, but the entire family’s sense of stability and security. If you have questions about whether your current order should be modified or how the new cap affects your unique situation, our team is here to help. For additional details, you can also explore our Texas Child Support Resource.

Modifying Existing Child Support Orders

The New Texas Child Support Guideline Cap and Percentages may give many custodial parents the opportunity to seek an increase in existing child support orders. Because the cap has risen from $9,200 to $11,700, courts now consider a greater portion of income when applying the percentages outlined in Texas Family Code §154.125. This change often justifies a modification, particularly when a parent’s income has increased or when the child’s needs have grown.

To successfully request a modification, parents must provide clear documentation. This may include proof of income changes, evidence of new or increased child-related responsibilities, or documentation of changes in medical coverage, as recognized under Texas Family Code §154.181. Courts require substantial proof to adjust support, and preparing a thorough request can prevent unnecessary delays. It’s also important to remember that informal agreements between parents are not legally binding. Only a court order or a formal Child Support Review Process can modify the official amount.

For parents considering a modification, accuracy is everything. Submitting pay stubs, tax returns, and records of self-employment income ensures the court has a complete picture of net resources. With the updated cap in place, these records may result in higher support amounts that better reflect the real costs of raising children.

The attorneys at the Law Office of Bryan Fagan, PLLC have guided countless families through these steps, ensuring that child support orders remain fair and consistent with current law. If you’re wondering how much support could be owed under the maximum amounts, you may find this guide helpful: Child Support in Texas: What Is the Most You Will Pay?. For additional insights, you can also explore our Texas Child Support Resource.

By staying informed and working with experienced legal counsel, parents can make sure support obligations are updated to reflect both today’s economic conditions and their child’s best interests.

Importance of Accurate Calculation and Legal Guidance

Accurate child support calculations are critical to ensuring children receive the financial stability they deserve. With the New Texas Child Support Guideline Cap and Percentages now in effect, parents must pay careful attention to how courts apply these rules under Texas Family Code §154.125. Even small errors in calculation—such as misapplying the cap or overlooking certain income sources—can result in unfair obligations or disputes that place unnecessary strain on families.

Working with an experienced family law attorney helps parents navigate these complexities. Legal guidance provides clarity on rights and responsibilities, ensures compliance with the latest updates to the Texas Family Code, and minimizes the risk of costly mistakes. Whether it involves reviewing custody and possession schedules, confirming that all income sources are properly disclosed, or identifying when additional child-related expenses may justify deviations from the guidelines, professional support can make the difference between uncertainty and peace of mind.

For families trying to understand what these numbers look like in practice, our resource on what is the average child support for one child in Texas offers practical examples and deeper insight into how courts apply the formula. Parents can also access our Texas Child Support Resource for guidance tailored to a wide range of support-related issues.

At the Law Office of Bryan Fagan, PLLC, we believe that protecting a child’s future starts with making sure support orders are both fair and accurate. Our attorneys are dedicated to educating families, easing the stress of complex financial calculations, and ensuring every child has the resources they need to thrive.

How Bryan Fagan’s Attorneys Can Help

Bryan Fagan’s attorneys are well-versed in the new Texas child support guideline cap and percentages. They guide families through these changes, ensuring child support orders reflect current law and prioritize children’s best interests, ensuring legal compliance and protecting all parties’ rights.

Families should schedule a consultation with Bryan Fagan’s attorneys for tailored advice on how the new guidelines impact families in their specific case. This personalized approach helps parents navigate the updated child support framework and make informed decisions for their children.

Leveraging the expertise of Bryan Fagan’s attorneys allows parents to confidently handle child support modifications, ensuring fair obligations that reflect current economic realities, starting from the effective date.

Case Studies and Testimonials

Real-life experiences often bring clarity to what legal updates mean in practice. With the New Texas Child Support Guideline Cap and Percentages, families across Texas are seeing firsthand how these changes affect their financial responsibilities and, more importantly, their children’s stability. Under Texas Family Code §154.125, courts now apply the updated $11,700 cap when calculating obligations, which can result in higher support amounts that better reflect today’s cost of raising children.

Anonymized case studies from our clients illustrate these shifts clearly. For example, parents who once contributed under the old $9,200 cap now find their obligations recalculated to align with the new guidelines. While this adjustment may initially seem daunting, many parents have expressed relief knowing that the increased support ensures their children’s needs—from healthcare to extracurricular activities—are better covered. These stories underscore that with the right legal guidance, navigating the new framework is not only manageable but can lead to positive outcomes for children and parents alike.

Client testimonials consistently reflect the reassurance parents feel when working with our attorneys. Whether it’s helping a custodial parent secure a modification or guiding a higher-earning parent through financial planning, families value the clarity, advocacy, and compassion our team provides. For those who want to better understand their own rights and responsibilities, our dedicated resource on Texas Child Support offers detailed insights into how these laws apply.

At the Law Office of Bryan Fagan, PLLC, we take pride in educating families and protecting futures. By combining our legal expertise with a client-focused approach, we help parents adapt to new child support laws in ways that foster security, fairness, and peace of mind. For additional information on navigating these updates, visit our Texas Child Support Resource.

Conclusion:

Change can feel overwhelming—especially when it involves money, court orders, and the future of your children. But the heart of the New Texas Child Support Guideline Cap and Percentages isn’t just about numbers on paper; it’s about making sure kids have what they need to grow, feel secure, and thrive. For parents, that means you don’t have to navigate these changes alone, and for children, it means a stronger foundation for their everyday lives.

If you’ve been wondering how these updates might play out in your own family—whether through higher obligations, modifications to existing orders, or just a need for clarity—now is the time to get answers. At The Law Office of Bryan Fagan, PLLC, we take pride in helping Texas families understand not just the law, but the very real ways it impacts their daily lives. Our attorneys can walk you through the changes, advocate for your child’s best interests, and give you peace of mind knowing you have a trusted team in your corner.

So as you think about what this new cap means for your family, ask yourself: wouldn’t it feel better to face it with the right plan, rather than guesswork? We’re here to help you do just that—because protecting your child’s future isn’t just our job, it’s our calling.

Frequently Asked Questions

As of September 1, 2025, the new Texas child support cap is $11,700 in monthly net resources. Courts use this figure when applying the guideline percentages under the Texas Family Code.

The 2025 update raises the income cap from $9,200 to $11,700. Guideline percentages remain the same: 20% for one child, 25% for two, 30% for three, 35% for four, and 40% for five or more children.

Typically, no. Texas law caps withholding at 50% of disposable income, though arrears or multiple orders can push obligations close to that limit.

Yes. The statutory cap is now $11,700 in monthly net resources. Guideline percentages apply up to that amount, though courts may go beyond it if a child’s proven needs require more support.

For one child, the maximum guideline support is 20% of $11,700, or $2,340 per month. For five or more children, the maximum guideline amount is 40%, or $4,680 monthly.

Not automatically. Child support may increase if a parent’s income rises, but only through a formal modification process. Courts don’t consider income above the $11,700 cap unless the child’s needs justify higher support.

The highest guideline percentage is 40% of net resources for five or more children. Courts can deviate upward for extraordinary needs, such as medical or educational expenses.

This occurs when courts order support higher than the standard percentages, usually because the child has extraordinary medical, educational, or other needs that exceed the cap.