When you lose someone you love, the last thing you want to deal with is a mountain of legal paperwork. It’s an incredibly difficult time, and the responsibilities that follow can feel completely overwhelming. At The Law Office of Bryan Fagan, PLLC, we understand the emotional weight you are carrying and believe in providing professional, empathetic guidance. This guide is designed to give you a clear, compassionate path forward on how to probate a will in Texas. The process, governed by the Texas Estates Code, ensures your loved one’s final wishes are honored, providing stability for your family during a period of uncertainty. Simply put, probating a will is the court’s official process for validating a will and appointing an executor to handle the deceased person’s final affairs. It’s a crucial step to make sure assets get to the right people.

Understanding the Texas Probate Process

Navigating the loss of a family member is an emotional journey, and taking on the duty of managing their final wishes can seem like an impossible task. The process to probate a will in Texas is the formal, court-supervised procedure that brings a loved one’s will to life. Think of it as the essential legal mechanism for identifying their assets, settling their final debts, and distributing their property to the people they chose.

For many families, the word “probate” conjures up images of long, drawn-out court battles and sky-high costs. The good news is that Texas law, mainly found in the Texas Estates Code, is actually set up to make this process as straightforward as possible for grieving families. The goal isn’t to create roadblocks but to ensure an orderly transfer of property that protects everyone involved, from creditors to beneficiaries.

The Core Purpose of Probate

At its heart, probate serves a few critical functions that bring legal closure and peace of mind. Without it, bank accounts could be frozen, real estate titles couldn’t be legally transferred, and family arguments could easily spiral out of control.

Here’s what probate really accomplishes:

- Validating the Will: The court confirms that the will is legally sound and truly was the final testament of the person who passed away. This is outlined in Chapter 256 of the Texas Estates Code.

- Appointing an Executor: The person named in the will is officially given the legal power to act on behalf of the estate.

- Resolving Debts and Taxes: Before anyone gets anything, all legitimate debts of the deceased are identified and paid using the estate’s assets.

- Distributing Assets: Finally, the remaining property is legally transferred to the beneficiaries listed in the will.

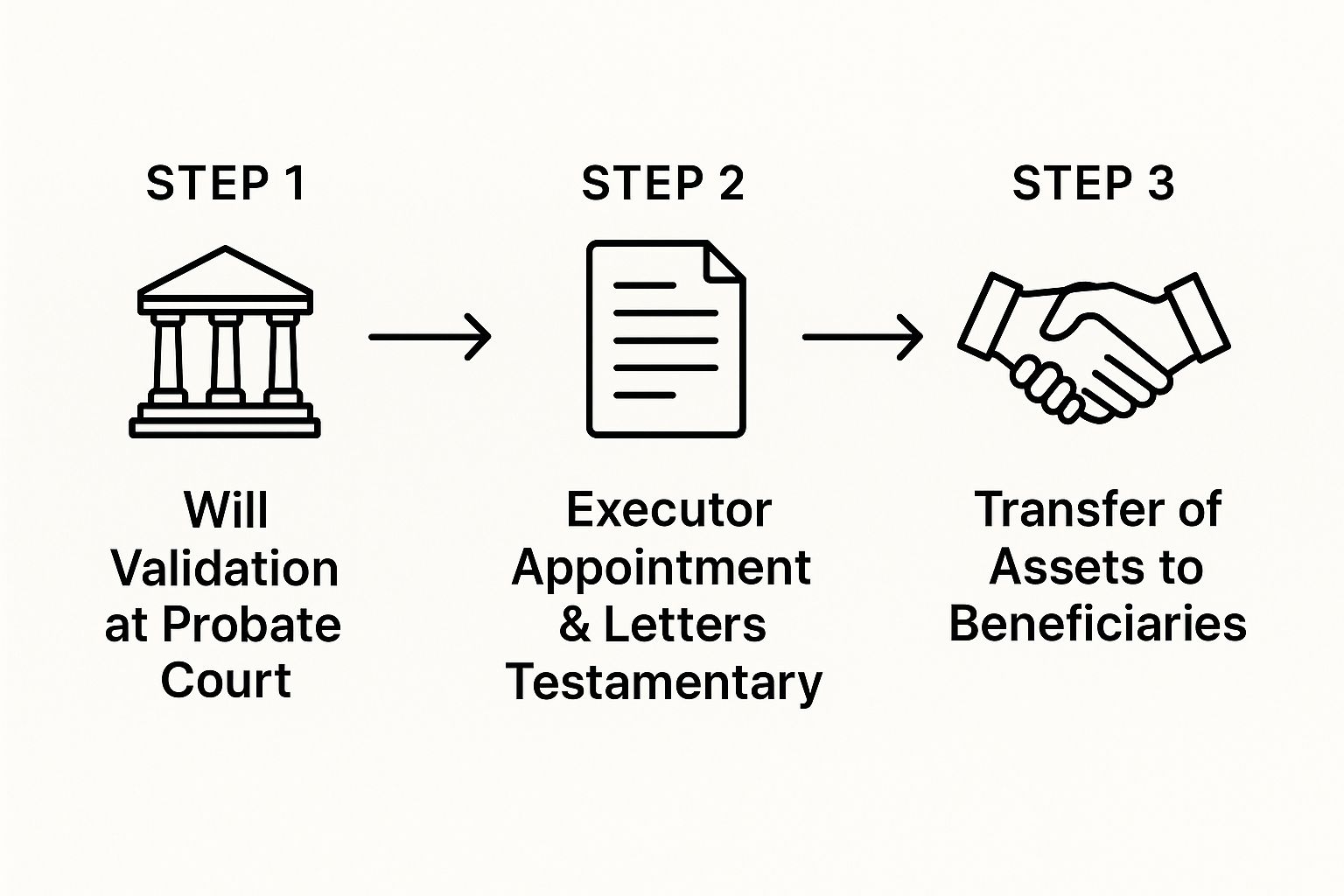

This infographic gives a simple visual breakdown of the main stages you’ll go through.

As you can see, probate is a structured journey from getting the court’s stamp of approval to the final transfer of assets, providing a clear and organized framework.

Why Probate Matters for Your Family

Let’s look at a real-life scenario. Imagine a father, Mark, passes away. His will names his oldest daughter, Emily, as the executor. It clearly states that his home should go to Emily and his savings account should go to his younger son, David, who is still in high school.

Without probate, Emily has zero legal authority to sell the house or even touch Mark’s bank accounts to pay the final utility bills. This legal limbo can create incredible stress and uncertainty for both children, adding financial instability to an already heartbreaking time. For David, the emotional turmoil of losing his father is compounded by financial worries that could disrupt his academic and emotional well-being. The stability probate provides is crucial for children navigating grief.

By going through probate, Emily receives what are called “Letters Testamentary” from the court. This document is her golden ticket—it grants her the legal power to manage the estate, making sure her father’s wishes are honored and providing a stable transition for her and her brother.

For a bigger picture of how a will fits into your family’s future, learning more about comprehensive estate planning can be incredibly helpful.

At The Law Office of Bryan Fagan, PLLC, our expertise in Texas family and probate law demonstrates our authority and trustworthiness in these sensitive matters. Our compassionate attorneys are here to walk you through every step, ensuring the process is handled with dignity and precision. If you’re facing the responsibility of probating a will, schedule a consultation with us today.

Filing the Application to Start Probate

The formal journey of probating a will in Texas kicks off with one critical document: the ‘Application to Probate Will and for Issuance of Letters Testamentary.’ This is the official request you make to a Texas court, asking it to legally recognize the will as valid and to appoint the executor named inside it. It’s the first real legal step you’ll take, shifting from a period of grief toward the concrete task of carrying out your loved one’s final wishes.

You can’t just file this application anywhere. It has to be submitted to the proper court, which is almost always in the county where the person who passed away (the “decedent”) lived. For instance, if your loved one was a resident of Harris County, the probate process would unfold there. This rule exists to keep the case local and accessible for the family, handled by a court that knows the specific local procedures.

When you probate a will in Texas, the clock is ticking. The state has a strict four-year statute of limitations for filing a will for probate, as stipulated in Texas Estates Code § 256.003, and that countdown begins on the date of death. If you miss this window, the court will almost certainly refuse to probate the will. The estate would then be treated as if no will ever existed. This can throw a family into chaos, as state intestacy laws—not the decedent’s wishes—would decide who gets what.

The application itself is the foundation of the entire probate case, so getting the details right is non-negotiable. You’ll need to provide some very specific information:

- Decedent’s Information: The full name, date of death, and the county where they lived.

- Executor’s Details: The application needs to identify the person named in the will as the executor, along with their current name and address.

- Beneficiary Information: You’ll have to list out all the beneficiaries named in the will, including their names, ages, and where they live.

- Estate Details: The court also needs a general description of the estate’s property and a ballpark estimate of its value.

Getting this information together accurately is vital. Even small errors or omissions can cause frustrating delays, forcing you to file amendments and make extra court appearances—adding more stress to an already tough time.

The Waiting Period and Public Notice

Once the application is filed, things don’t happen overnight. Texas law mandates a public notice period. The county clerk is required to post a notice at the courthouse announcing that an application to probate a will has been submitted.

This posting is a formal heads-up to the public, including any potential creditors or unknown heirs. It must stay up for at least 10 days before any court hearing can be scheduled. Think of it as a built-in safeguard to ensure the process is transparent and gives anyone with a valid interest a chance to step forward.

The evolution of Texas probate law really underscores why these rules matter. That four-year deadline is a big deal; missing it can completely upend a person’s final wishes and spark disputes among family. It’s a powerful reason to act promptly. On the other hand, Texas law also tries to make things easier, which is why independent administration is used in about 80% of cases—it’s a faster, less burdensome path for families. You can discover more insights about ongoing efforts to refine Texas probate laws and how they impact families today.

A Hypothetical Example: Sarah’s First Steps

Let’s look at a hypothetical scenario. Sarah, whose mother recently passed away in Houston, finds herself named as the sole executor in the will. Overwhelmed and not knowing where to start, she reaches out to The Law Office of Bryan Fagan, PLLC for experienced guidance.

We immediately helped her track down the necessary documents, like the original will and her mother’s death certificate. We worked together to prepare the Application to Probate Will, double-checking every detail about her mother, the beneficiaries, and the estate. We then filed it with the Harris County probate court, and the 10-day public notice period officially began. This proactive support prevented delays that could have created financial instability for the family, particularly for any minor beneficiaries whose well-being depends on a smooth transition of assets.

For Sarah, this guidance was a huge relief. Instead of losing sleep over procedural mistakes, she could focus on being there for her family. Her attorney took care of all the court communications, making sure the process moved smoothly toward the hearing where she would be officially appointed as executor. This kind of proactive support provides stability when a family needs it most.

If you’re in a situation like Sarah’s, feeling lost in the early stages of probate, we’re here to guide you. Schedule a consultation with The Law Office of Bryan Fagan, PLLC, today to make sure the process is handled with the care and professionalism your family deserves.

The Executor’s Fiduciary Duties and Responsibilities

Once the judge signs the order and you’ve taken your oath, you are officially the executor of the estate. It’s a significant moment, but it also marks the beginning of a serious legal and ethical obligation known as a fiduciary duty.

This isn’t just a fancy legal term; it’s a promise. It means you must act with the highest degree of honesty, always putting the estate’s best interests ahead of your own, or anyone else’s.

Your first move is to get what are called “Letters Testamentary” from the court clerk. Think of this document as your official hall pass. It’s the legal proof you need to show banks, financial institutions, and anyone else that you have the authority to manage the decedent’s assets. With these Letters in hand, the real work begins.

Core Responsibilities of an Executor

As the executor, you’ve essentially become the temporary steward of your loved one’s legacy. This job is far more than just shuffling paperwork; it’s about carrying out their wishes with integrity. The Texas Estates Code lays out the rules of the road, which are designed to protect everyone involved—from creditors to the beneficiaries themselves.

Here’s what your main duties will look like:

- Round Up and Secure All Assets: Your first job is to find, gather, and protect everything the estate owns. This can be as simple as consolidating bank accounts or as hands-on as changing the locks on the decedent’s home.

- Give Notice to Creditors: You’re required to let potential creditors know about the death. This is usually done by publishing a notice in a local newspaper, which starts the clock for them to submit any claims they might have.

- Settle Up Debts and Final Taxes: Using funds from the estate, you’ll pay off any legitimate debts. You’re also responsible for filing and paying the decedent’s final income tax return and handling any potential estate taxes.

- File an Inventory with the Court: Within 90 days of your appointment, you must file a detailed report called an “Inventory, Appraisement, and List of Claims.” This is a transparent breakdown of all estate assets and their values for the court and beneficiaries to see.

Meticulous record-keeping is non-negotiable. It’s your single best defense against any future disputes or legal challenges. Every dollar in and every penny out needs to be tracked perfectly.

The Emotional Weight of Fiduciary Duty

Let’s make this real. Imagine Robert is named the executor for his father’s will. His sister, Jessica, is a beneficiary and is going through a tough financial time. She pleads with Robert to give her an “advance” on her inheritance to cover some urgent bills. The problem? Their father left behind a sizable amount of credit card debt.

As the executor, Robert’s fiduciary duty is crystal clear: he must pay all valid debts before distributing a single dollar to the beneficiaries. Giving Jessica that money now would be a direct violation of this duty. If the estate came up short for creditors, Robert could be held personally liable for the difference. This situation could easily cause a rift in the family, creating an unstable environment for any children involved, impacting their emotional security.

This is where the human element hits hard. An executor’s duties don’t happen in a legal bubble; they unfold within the messy, complicated world of family relationships. Having an attorney isn’t just about procedure—it’s about creating a buffer. It allows the executor to make the right legal calls that protect the estate and, by extension, the entire family.

Navigating these responsibilities without a misstep is paramount. Even an honest mistake can lead to personal financial liability or ignite family conflicts that smolder for years. The process to probate a will in Texas is structured, but that doesn’t make it simple.

At The Law Office of Bryan Fagan, PLLC, we get the immense pressure you’re under. Our experience handling complex estate matters establishes our expertise and trustworthiness. We provide the steady, experienced guidance you need to fulfill your fiduciary duties correctly and with compassion. If you’ve been named an executor and aren’t sure where to start, schedule a consultation with our experienced legal team today.

Managing Estate Assets and Settling Debts

Once the court hands you your Letters Testamentary, your job title officially changes from applicant to active estate manager. This is where the real work begins—handling money, property, and, yes, debts. Your primary duty now is to take control of, protect, and wisely manage everything your loved one left behind until it’s time to distribute it to the beneficiaries.

This part of the journey requires serious organization and a solid grasp of your financial duties under the Texas Estates Code. Every step you take from here on out directly impacts the inheritance and helps prevent legal headaches for your family down the road.

Consolidating and Safeguarding Estate Property

First things first: you need to round up all the estate’s assets and get them under your control. The easiest way to do this is by opening a new bank account specifically for the estate. Any cash—from old checking accounts to cashed-out investment dividends—goes into this account.

This estate account is non-negotiable for a few key reasons:

- It Creates a Clean Financial Trail: Every dollar that comes in or goes out is clearly documented. You’ll need this for the final accounting you present to the court and the heirs.

- It Keeps Funds Separate: Mixing your personal money with the estate’s is a huge no-no and a breach of your legal duty. A dedicated account prevents this entirely.

- It Makes Paying Bills Simple: You’ll have one central, trackable source for paying the estate’s debts and other expenses.

Your responsibilities extend to physical property, too. This could mean changing the locks on the house, making sure the homeowner’s insurance is up to date, or getting a property ready to sell. You might find yourself managing everything on an ultimate estate cleanout checklist to get a home ready for sale or distribution.

A Real-World Scenario Involving Estate Debts

Let’s look at a common situation. David was just named executor of his dad’s will. On top of grieving, he finds out his father left behind the family home, a mortgage, and a pile of credit card bills. Before long, letters from credit card companies start pouring in, all demanding payment. This financial pressure can create significant stress, impacting not only David but also his children, who may sense the instability and worry.

Feeling overwhelmed, David calls his attorney at The Law Office of Bryan Fagan, PLLC. He quickly learns that he shouldn’t just start paying every bill that shows up. His first move is to publish a formal “Notice to Creditors” in a local newspaper. This legal notice officially announces the death and gives any creditors a set window of time to file a formal claim against the estate.

A critical piece of advice for any executor: you are only obligated to pay valid claims that are filed on time. Just because a bill arrives in the mail doesn’t mean it’s a legitimate debt the estate must pay.

With his attorney’s help, David goes through each claim one by one. He discovers one credit card company is claiming a much higher balance than his father’s records indicate. After some digging, they find billing errors and are able to negotiate the debt down significantly. He then uses money from the estate account to cover the mortgage and the legitimate, settled credit card debts. By being diligent, he protected as much of the inheritance as possible for himself and his siblings.

Notifying Creditors and Handling Claims

The process David followed isn’t optional; it’s a required part of probating a will in Texas. You have to take specific steps to let creditors know what’s going on.

- Secured Creditors: For debts attached to property, like a mortgage or car loan, you have to send a notice by certified mail.

- Unsecured Creditors: For things like credit cards and medical bills, publishing a notice in a local paper usually does the trick.

After a creditor files a claim, you have the power to either accept and pay it or reject it. If you reject the claim, the creditor can then sue the estate to try and prove it’s valid. This system is designed to shield the estate from fraudulent or inaccurate debt claims.

Managing the estate’s assets and debts is often the most demanding part of being an executor. It takes a careful hand and a clear head. If you’re facing these duties, reach out to The Law Office of Bryan Fagan, PLLC, for a consultation to make sure every financial detail is handled correctly.

Distributing Assets and Closing the Estate

You’ve navigated the maze of gathering assets and settling debts. Now, you’re at the final, and frankly, most rewarding part of being an executor: distributing your loved one’s property and officially closing the estate. Getting these last steps right is about more than just checking boxes; it brings legal finality and some much-needed emotional closure for everyone involved.

This last phase is all about precision and being completely transparent. The goal here is to make sure every beneficiary gets exactly what the will says they should, leaving no gray areas for arguments down the road. When you wrap this up correctly, the family can finally start to move forward, confident that everything was handled with the care it deserved.

Preparing the Final Accounting

Before you hand over a single asset, you need to create a final accounting. Think of this as the comprehensive financial report card for your time as executor. It needs to meticulously detail every single transaction.

This report should include:

- Any income the estate earned, like interest from a bank account or stock dividends.

- Every single bill you paid to creditors.

- All the administrative costs, like court filing fees or what you paid the attorney.

- A clear, final list of the assets left over that are ready to be distributed.

This document gives the beneficiaries a crystal-clear picture of how you managed the estate’s money. It’s your proof that you upheld your fiduciary duty and handled everything responsibly.

Distributing Property to Beneficiaries

Once the final accounting is done and you’ve settled all the debts and taxes, it’s time to start distributing what’s left. You’ll follow the will’s instructions to the letter. But it’s not as simple as just handing things over. Every type of asset needs to be formally and legally transferred.

For instance, if the will leaves a car to a nephew, you have to officially transfer the vehicle’s title into his name. If a home is willed to a daughter, a new deed must be drafted, signed, and filed with the county to legally make her the new owner. For cash gifts, you’ll write checks straight from the estate’s bank account.

Here’s a critical tip: Get a signed receipt from every single beneficiary for every item or dollar they receive. These receipts are your legal proof that you followed the will’s directions. You’ll need them to close the estate with the court.

A Hypothetical Example of Why These Final Steps Matter

Let’s imagine a client, Maria, who was the executor for her mom’s estate. The will was simple: Maria got the house, her brother got their mom’s classic car, and the cash was split between them. After months of paying bills and dealing with paperwork, Maria was just exhausted and wanted it to be over.

So, she gave her brother the keys to the car and wired half the remaining bank balance into his account. A few weeks later, her brother called, completely frustrated. He couldn’t register the car because the title was still in their mom’s name. This one oversight created a huge headache and strained their relationship. This conflict created tension in the family, which ultimately affected the emotional well-being of their children, who were already struggling with the loss of their grandmother.

This story really drives home how crucial those formal steps are. If Maria had just taken the time to properly transfer the car title and file a new deed for the house, it would have saved them a lot of stress and conflict.

Formally Closing the Estate

After all the property is distributed and you have a signed receipt from every beneficiary, you can finally petition the court to close the estate. In Texas, most estates are handled through an independent administration, which simplifies this last step. You’ll likely just need to file a “Notice of Closing Estate” or a similar affidavit to wrap up your duties.

This final document officially releases you from your role as executor. It’s your declaration to the court that you’ve done everything you were supposed to do—paid all the debts you knew about and distributed the property as the will directed. Once the court accepts your filing, the probate process is officially complete.

Making it through these last steps requires a sharp eye for detail. The team at the Law Office of Bryan Fagan, PLLC, can make sure your loved one’s estate is closed out correctly and without unnecessary delays. Schedule a consultation with us today to get the peace of mind that comes from knowing the probate process is handled right.

Don’t Need Full Probate? Texas Offers Simpler Alternatives

The idea of going through a full, formal probate process in Texas can feel overwhelming, especially when you’re also dealing with the emotional weight of losing someone. It often sounds like a long, complicated road. But what if there was a shortcut?

Luckily, Texas law recognizes that not every estate needs the full court-supervised treatment. For many families dealing with smaller or less complicated estates, there are simpler, faster, and cheaper alternatives that can save a tremendous amount of time and money.

These streamlined procedures are a lifeline. They help families access essential assets and transfer property without the endless hearings and administrative hoops of formal probate. For a surviving spouse or children, these options can be a game-changer, easing financial stress during an already difficult time.

The Small Estate Affidavit: A Powerful Tool for Small Estates

One of the most useful alternatives is the Small Estate Affidavit (SEA). This is a legal tool that allows heirs to collect a deceased person’s property without ever having to go through a formal probate hearing in a courtroom. It’s designed specifically for families with straightforward estates.

Of course, there are strict rules to qualify under Texas Estates Code Chapter 205:

- The total value of the estate’s assets (not counting the homestead and other exempt property) can’t be more than $75,000.

- The person must have died without a will (this is known as dying intestate).

- The estate’s assets must be worth more than its debts.

- Every heir has to agree on how the property will be divided and sign the affidavit.

If you meet these requirements, the heirs can sign the affidavit, get it approved by the court, and then present it to banks, financial institutions, or anyone else holding the deceased’s assets. This allows them to release the property directly to the heirs, completely bypassing the need to appoint an executor and deal with formal court supervision.

Probate as a Muniment of Title: When a Will Exists but Debts Don’t

Another excellent option, this one for situations where there is a will, is called Probate as a Muniment of Title. It sounds a bit strange, but it describes a very practical process. Essentially, you’re just asking the court to legally recognize the will as the official document that transfers ownership of property.

Think of it as using the will itself as a deed to transfer title. This method is perfect when the main goal is to transfer real estate or other titled property, and the estate has no outstanding debts (other than something secured by real estate, like a mortgage).

The biggest advantage here is that no executor is appointed, and no formal estate administration is necessary. Once the court approves the will as a muniment of title, you can file a certified copy of the court order and the will in the county’s property records to make the title transfer official.

This process is worlds faster and more affordable than traditional probate, offering a direct path to transferring assets when the deceased’s financial affairs were already in good order.

Comparing Your Options to Full Probate

Knowing when these alternatives are on the table is key. The Texas probate system is actually designed to be efficient, which is why it sets a $75,000 threshold for what it considers a small estate. If an estate falls below this value, simplified procedures like the Small Estate Affidavit or a muniment of title are often the best path forward.

These options can often settle an estate in just 30 to 60 days—a huge difference from the months or even years a complex probate case can take. With independent administration already used in about 80% of Texas probate cases, the law clearly favors efficiency and keeping things out of the courtroom whenever possible. You can learn more about how the threshold for probate in Texas shapes the process for families.

Here’s a quick look at how they stack up:

| Feature | Formal Probate | Small Estate Affidavit (SEA) | Muniment of Title |

|---|---|---|---|

| Will Required? | Yes | No (Intestate Only) | Yes |

| Executor Appointed? | Yes | No | No |

| Court Hearings? | Multiple | Typically none | One |

| Best For | Larger or complex estates with debts. | Small estates under $75,000 with no will. | Estates with a will but no debts. |

A Hypothetical Scenario: The Jackson Siblings

Let’s look at a final hypothetical scenario with the Jackson siblings. Their mother passed away without a will, leaving behind a modest savings account and her paid-off car. The total value was around $40,000. The thought of a drawn-out probate process was overwhelming, especially since they needed the funds to help cover her funeral expenses and ensure the financial stability of a younger sibling still in college. A prolonged legal battle would undoubtedly affect the younger sibling’s academic performance and emotional health.

After a quick consultation with an attorney, they learned they were perfect candidates for a Small Estate Affidavit. They worked together to gather the needed information, signed the affidavit, and submitted it to the court for approval.

Within a few weeks, they had the approved document in hand. They took it to the bank and the DMV and were able to transfer the assets without the stress and high cost of a full probate. This alternative gave them quick access to the money they needed and allowed them to focus on what really mattered—grieving and supporting each other.

The path through probate doesn’t have to be a one-size-fits-all ordeal. Understanding these alternatives can bring incredible relief and clarity. At The Law Office of Bryan Fagan, PLLC, we have extensive experience guiding families through these exact situations, demonstrating our expertise and earning our clients’ trust. We’re here to help you find the most compassionate and efficient way forward. If you’re tasked with settling a loved one’s estate, schedule a consultation with our experienced team to explore all your options. Visit us online to get started.