When you lose someone you care about, the last thing you want to deal with is a mountain of complicated legal paperwork. The grieving process is difficult enough without the added stress of a complex legal system. Many families assume that formal probate is the only way to settle an estate, but in Texas, that’s not always the case. For smaller estates, there’s a much simpler, more direct path called the Small Estate Affidavit.

This guide is designed to walk you through that process with the clarity and compassion you deserve. We understand what you’re going through, and our goal is to help you feel supported and understood every step of the way.

Settling an Estate Without the Legal Headache

When a person passes away without a will (known as dying “intestate”), their estate usually has to go through a formal court process known as probate. This is how assets are legally transferred to their rightful heirs. But probate can be long, expensive, and emotionally draining at a time when your family is already navigating a profound loss.

Thankfully, the Texas Estates Code provides a better alternative for qualifying families, one that avoids the time and expense of full probate.

Think of the Small Estate Affidavit (or SEA) as a legal shortcut. It’s a sworn statement filed with the court that, once a judge approves it, allows the heirs to collect the deceased’s assets directly. There’s no need to appoint a formal estate administrator. For many families, this approach saves a significant amount of time, money, and stress, helping you settle your loved one’s affairs much more quickly and peacefully.

Why Should You Consider a Small Estate Affidavit?

For families managing a modest estate, the benefits of using a small estate affidavit texas form are immediate and impactful. Here’s what makes it such a valuable tool:

- It Costs a Lot Less: The filing fees for an SEA are a fraction of the court costs and attorney fees you’d face with a full probate.

- It’s Much Faster: The whole process usually takes a matter of weeks, not the months—or even years—that probate can drag on. This means heirs get access to property and necessary funds sooner.

- It’s Simpler: While you definitely need to be careful and pay attention to the details, filling out and filing an SEA is far less complex than navigating a formal probate proceeding.

In this guide, we’ll take you through every part of the process. We will cover who qualifies, what paperwork you’ll need, how to fill out the form correctly, and what happens after you file it. Our goal is to give you practical, actionable guidance to help you through this difficult transition.

Is a Small Estate Affidavit Right for Your Family?

Before you jump into filling out forms, the very first step is making sure this simplified process is an option for your family. The Texas Estates Code is very clear about who can and can’t use a Small Estate Affidavit (SEA), and figuring this out now will save you a world of headache later.

The whole point of the SEA is to offer a faster, less expensive route for families dealing with a modest estate. Think of it as an alternative path that helps many people sidestep the complexities of a full-blown probate process. If that sounds appealing, learning how to avoid probate court can give you a clearer picture of whether an SEA is the best tool for the job.

The Estate Value Threshold

The biggest gatekeeper for using a Texas SEA is the total value of the estate. The magic number is $75,000. If the estate’s qualifying assets are at or below this amount, you can generally bypass the formal probate system.

But here’s where it gets interesting, and frankly, quite helpful. The law is designed with real families in mind, so the $75,000 cap excludes the value of the decedent’s homestead and other exempt property, as outlined in the Texas Estates Code.

So, what does that actually mean? Exempt property typically covers essential assets a family needs, such as:

- One vehicle for each family member who has a driver’s license

- Home furnishings and treasured family heirlooms

- Certain livestock

- Tools of a trade or profession

- A limited amount of jewelry

This distinction is a game-changer for many families. For example, let’s say a parent passes away, leaving behind a home worth $250,000, a car valued at $15,000, and a bank account with $40,000. At first glance, the total value is way over the limit. But when you subtract the $250,000 homestead, the remaining non-exempt assets only total $55,000. In this real-world scenario, the estate would absolutely qualify for a Small Estate Affidavit.

To make it even clearer, we’ve put together a quick checklist to help you see if an SEA is a good fit.

Quick Eligibility Checklist for Texas SEA

This table is a great starting point. Just run through each requirement to see if your situation lines up with what the law requires.

| Requirement | What It Means | Does Your Situation Qualify? |

|---|---|---|

| Asset Value Limit | Non-exempt assets are $75,000 or less. | Yes / No |

| Homestead Exclusion | The value of the primary residence is not counted toward the limit. | Yes / No |

| Died Without a Will | The deceased person did not have a valid, written will. | Yes / No |

| 30-Day Wait | At least 30 days must have passed since the date of death. | Yes / No |

| No Pending Probate | No one has already started a formal probate application for the estate. | Yes / No |

| Debts vs. Assets | The estate’s debts (excluding the homestead mortgage) do not exceed its assets. | Yes / No |

This table doesn’t cover every nuance, but if you can check “Yes” to these key points, you’re likely on the right track.

Other Critical Conditions for Eligibility

Getting the asset value right is huge, but there are a few other non-negotiable conditions for using a small estate affidavit texas form. If you miss even one of these, the court will almost certainly reject your filing, and you’ll be sent back to square one.

Key Takeaway: The SEA is designed for straightforward situations. Any legal complexities, such as a contested will or disputes among heirs, will likely require a formal probate proceeding to resolve.

Let’s quickly walk through the other must-haves:

- No Will: The person who passed away must have died “intestate,” which is just the legal term for dying without a valid will. If there’s a will, it has to go through the standard probate process.

- 30-Day Waiting Period: You can’t file the affidavit until at least 30 days have passed since the date of death. This gives creditors a chance to make claims and allows the family time to gather all the necessary information.

- No Pending Probate Application: You need to be sure that no one else has already started a formal probate process for the estate.

- Debts Cannot Exceed Assets: The estate’s total debts (not counting any mortgage on the homestead) can’t be more than the value of its non-exempt assets. In other words, there must be enough money to pay off all known bills.

By carefully working through these requirements, you can feel confident about whether this simpler, faster path is the right one for settling your loved one’s affairs.

Gathering Your Essential Information and Documents

Once you’ve confirmed that a Small Estate Affidavit is the right path for your family, the next step is preparation. A smooth filing process hinges on having all your ducks in a row before you start filling out the small estate affidavit texas form. Think of this as building the foundation; the more accurate and complete it is, the stronger your affidavit will be in the eyes of the court.

Approaching this step with care and attention to detail is non-negotiable. Any missing information or incorrect values can lead to frustrating delays or even an outright rejection from the probate court clerk.

Creating a Complete Asset Inventory

The heart of the affidavit is a detailed list of the decedent’s assets. Your goal here is to create a clear snapshot of everything your loved one owned on the day they passed away, focusing specifically on the non-exempt property that counts toward that $75,000 limit.

You’ll need to gather documents that prove ownership and establish the fair market value for each item. This isn’t a guessing game; it requires concrete evidence.

- Bank Accounts: Get your hands on the most recent statements for all checking, savings, and money market accounts. The statement needs to clearly show the balance as of the date of death.

- Vehicles: Find the title for any cars, trucks, or motorcycles. You can use online resources like Kelley Blue Book or NADAguides to nail down the fair market value.

- Stocks and Bonds: If your loved one owned investments, you’ll need the statements from their brokerage account showing the value on their date of death.

- Other Personal Property: For valuable items like furniture, jewelry, or collectibles, you might need to get an appraisal to establish an accurate, defensible value.

This list must be exhaustive. Forgetting even a small account can cause significant problems down the road.

Identifying All Debts and Liabilities

Just as important as listing assets is compiling a thorough list of all known debts. The court needs to see that the estate’s assets are sufficient to cover its liabilities before anything is distributed to heirs.

Start gathering final bills and statements for any outstanding obligations. These could include:

- Credit card balances

- Medical bills from a final illness

- Utility bills

- Personal loans

Remember, a mortgage secured by the homestead generally isn’t counted against the estate in this calculation, but you need to be upfront about all other debts.

A Critical Step: The law requires the affidavit to state that, to the best of your knowledge, the estate’s assets (excluding the homestead and exempt property) exceed its known liabilities. Getting this right protects you and the other heirs.

The Role of Disinterested Witnesses

Finally, the affidavit must be signed by two disinterested witnesses. This is a specific legal term with a very clear meaning. These witnesses must meet two key criteria: they cannot be heirs to the estate, and they must have personal knowledge of the decedent’s family history and marital status.

These individuals aren’t just signing a piece of paper; they’re swearing under oath that the family information presented in the affidavit is true. This could be a longtime family friend, a neighbor, or even a clergy member. Their signatures provide a crucial layer of validation that the court really relies on.

How to Complete the Texas Small Estate Affidavit Form

Looking at a legal document after losing someone you love can feel overwhelming, but the Texas small estate affidavit form is usually more straightforward than it first appears. The trick is to be incredibly meticulous, accurate, and completely honest with every single piece of information you put down.

Think of it less like a scary legal battle and more like a detailed checklist. You’re simply helping the court get a clear, final financial picture of your loved one’s estate.

Let’s walk through this with a real-world example. Imagine ‘John Smith,’ a widower, has just passed away. His only heirs are his two adult children, Sarah and Michael. John owned his home outright (his homestead), drove a 2018 Toyota Camry, and had a checking account with $25,000. The only debt he left behind was a final hospital bill for $500. In this scenario, Sarah and Michael are perfect candidates to use an SEA because his non-exempt assets—the car and the cash—are well under the $75,000 Texas limit.

Detailing the Assets and Liabilities

The form will ask you to list every single asset, along with its fair market value on the day your loved one died. This has to be precise.

For John’s estate, Sarah and Michael would need to list:

- Checking Account: They’ll need the bank statement from the day he passed. This will show the exact balance of $25,000.

- 2018 Toyota Camry: They can use an online valuation tool like Kelley Blue Book to find its market value, which might be around $18,000.

After listing the assets, they have to list all known liabilities. This part is absolutely crucial because you are swearing to the court that the estate is solvent (meaning it has more assets than debts). In this case, they would just list the $500 hospital bill. It’s clear the assets far exceed the debts.

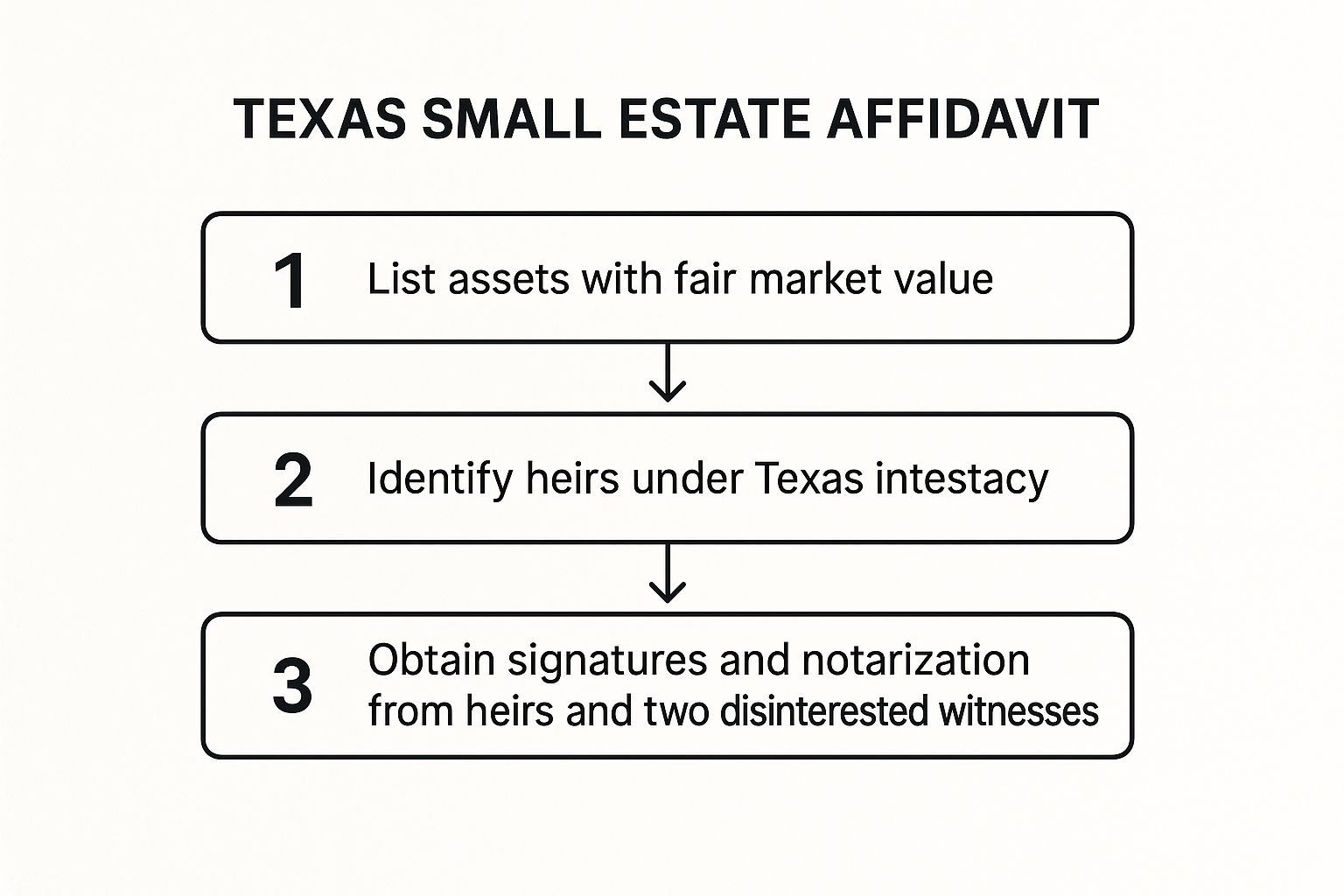

This infographic gives you a bird’s-eye view of the whole process, from listing assets all the way to getting the form notarized.

As you can see, it’s a logical flow of steps designed to make sure everything is legally sound before the court will sign off on it.

Identifying Heirs and Securing Signatures

A big chunk of the affidavit is dedicated to identifying the “distributees”—the legal term for heirs. Since John Smith didn’t have a will, Texas intestacy laws kick in. His heirs are simply his two children, Sarah and Michael, and they will each inherit 50% of his estate.

The form requires a surprisingly complete family history. You’ll need information about the deceased’s parents, siblings, and even any children who may have passed away before them. This is to ensure every single potential heir has been identified.

Expert Insight: I can’t stress this enough: failing to list a single rightful heir is one of the most common reasons courts reject an SEA. It doesn’t matter if they’re estranged or you don’t know where they are. You have to be thorough.

While you’re working on the Texas Small Estate Affidavit, an AI legal assistant can be a good resource for double-checking complex requirements and making sure you haven’t missed a key detail. These tools can help explain legal jargon and ensure your information is accurate.

The last hurdle is getting all the signatures, and this is arguably the most important step. Everything must be signed in front of a notary public.

- All Heirs (Distributees): Both Sarah and Michael have to sign. If there were five heirs, all five would need to sign. No exceptions.

- Two Disinterested Witnesses: You’ll also need two people who knew the deceased but will not inherit anything from the estate. These witnesses are swearing under oath that the family history you’ve laid out in the affidavit is true to the best of their knowledge.

Once every signature is on the page and notarized, the form is officially complete. Each signature validates the truthfulness of the information, turning it from a simple document into a sworn statement ready for the court’s review.

Filing the Affidavit and Getting Access to Estate Assets

You’ve done the hard work of gathering information, filling out the small estate affidavit texas form, and getting all the necessary signatures notarized. Now it’s time for the final steps—the ones that turn that stack of paper into a powerful legal tool for settling your loved one’s affairs.

The process from here is pretty straightforward, but you have to follow the court’s procedures to the letter.

Your first move is to file the affidavit with the probate court clerk in the county where the person who passed away lived. This is a critical detail; you can’t just file it in any county. It must be the one where the decedent had their legal residence. This officially submits your request to the court.

The Court’s Review and Approval

Once filed, a probate judge will review the affidavit. The judge’s job is to make sure you’ve checked all the boxes required by the Texas Estates Code. They’ll confirm the estate actually qualifies, that all assets and debts are listed correctly, and that every single heir has been identified and has signed off.

If everything looks good, the judge will issue a court order approving the Small Estate Affidavit. This order is your golden ticket—it’s the legal validation you need to move forward. Make sure you request several certified copies of both the affidavit and the judge’s order from the clerk. You’ll need to hand these out to banks, the DMV, and anyone else holding the estate’s assets.

One of the biggest reasons people use a Small Estate Affidavit in Texas is to avoid the high costs of formal probate. Filing fees are usually between $25 to $300, depending on the county. That’s a world away from the thousands of dollars you might spend on a full probate case. Plus, the whole process can often be wrapped up in just a few weeks. You can learn more about the benefits of this approach on thlg.law.

Using the Approved Affidavit to Collect Assets

With those certified, court-approved documents in your hands, you can finally start collecting the estate’s assets. This is where all your careful preparation pays off.

You are now legally empowered to present the certified copy of the affidavit and court order to any person or institution holding the decedent’s property. They are required by law to release the assets to the heirs listed in the affidavit.

This means you can start tackling the final to-do list, which often includes things like:

- Closing bank accounts and getting the funds disbursed to the heirs.

- Transferring the title of a car or truck at the DMV.

- Gaining access to a safe deposit box.

- Claiming a final paycheck from an employer.

Each heir gets their share of the property exactly as laid out in the affidavit. At this point, you’ve successfully used the SEA to bypass formal probate, allowing you to settle the estate efficiently and with respect.

Common Questions About the SEA Process

Even with the best guide in hand, stepping into the legal world after losing a loved one can feel disorienting. It’s completely normal for specific questions to pop up as you try to apply these rules to your family’s unique situation. We’ve walked countless families through this, and over time, we’ve noticed the same concerns come up again and again.

This section is dedicated to answering those questions head-on. Our goal is to give you clear, practical answers so you can keep moving forward with confidence and sidestep common hurdles.

What if My Loved One Owned a House?

This is a big one, and for good reason—real estate can complicate things quickly. A Small Estate Affidavit can be used to transfer the title to a house, but only under very specific circumstances. It must be the decedent’s homestead, and it must be the only piece of real property in the estate.

Even then, the homestead can only pass to a surviving spouse or minor children, as spelled out in the Texas Estates Code. If the property wasn’t their main residence, or if it’s supposed to go to adult children or other relatives, the SEA isn’t the right tool for the job. You’ll likely need to look at other options, like an Affidavit of Heirship or a more formal probate.

What if a Bank Rejects the Affidavit?

This happens more often than you’d think. While a court-approved SEA is a legally binding document, some banks and credit unions have their own rigid, internal policies that can cause frustrating delays.

If you run into this, the first step is to stay calm and politely present them with a certified copy of the affidavit and the court order that approves it. Seeing the official, court-stamped paperwork is often enough to get things moving.

If the bank still won’t budge, it’s probably time to get some legal backup. A firm letter from an attorney that spells out the bank’s legal duty to comply with the court order is usually all it takes to break the stalemate.

Can I Use an SEA if There Is a Will?

Simply put, no. The Small Estate Affidavit was created specifically for “intestate” situations, which is the legal term for when someone passes away without a valid will. The entire SEA process is built on Texas’s intestate succession laws, which provide a default roadmap for who inherits property.

If there’s a will, that document is the final word on how the property should be distributed. It must be filed with the probate court, and its instructions will always override the state’s default inheritance rules that an SEA relies on.

What Are My Legal Duties After Approval?

Getting the affidavit approved by the court isn’t the final step. As an heir receiving property, you now have legal responsibilities. Your very first duty is to use the estate’s assets to pay any of the decedent’s known debts. This has to happen before anyone gets their inheritance.

After debts are settled, you must distribute the remaining property to the other heirs exactly as detailed in the affidavit. Be careful here—failing to handle these duties properly can make you personally liable to creditors or other family members.

If you need help navigating divorce, custody, or estate planning in Texas, contact The Law Office of Bryan Fagan today for a free consultation.