Divorce can be one of life’s most difficult transitions, and when a business you've poured your life into is involved, the stakes feel impossibly high. The process of determining its value, known as business valuation, is one of the most important steps you’ll take to protect your financial future. This isn’t just about numbers on a page; it’s about your livelihood, and understanding your rights under Texas law can make the path forward less overwhelming.

Our goal is to cut through the confusion. We want to show you exactly how getting a fair and accurate valuation is the foundation for securing your financial stability after the divorce is final. We’ll break down key principles from the Texas Family Code in simple, straightforward terms so you can feel prepared, not powerless.

What Happens to a Business in a Texas Divorce

Going through a divorce is stressful enough. But when a business is on the table, it adds a layer of financial complexity that needs to be handled with care and real expertise. This is where a clear understanding of Texas law becomes your greatest asset.

The Financial Stakes of a Business-Owning Divorce

Divorce isn't just a personal matter; it's a major economic event, driving a huge demand for specialized legal and valuation services. In fact, the global market for these services was pegged at $4.35 billion in 2024, which shows just how many people are in the same boat.

That number tells a critical story: you aren't alone in this, and getting expert help is the norm, not the exception. For many couples, their business is the single most valuable asset they own. Getting the valuation right means the property division will be based on solid facts, not just feelings or guesswork. A comprehensive guide for business owners navigating divorce can shed more light on these unique challenges.

Of course, the business is just one piece of the puzzle. It's also vital to understand how major life changes like divorce impact your taxes, as this can have a huge effect on the final numbers. A proper valuation sets the stage for every financial negotiation to come, from splitting assets to figuring out spousal support. Think of it as the roadmap for untangling a shared financial life so you can both move forward with clarity.

How Texas Law Defines Your Business Assets

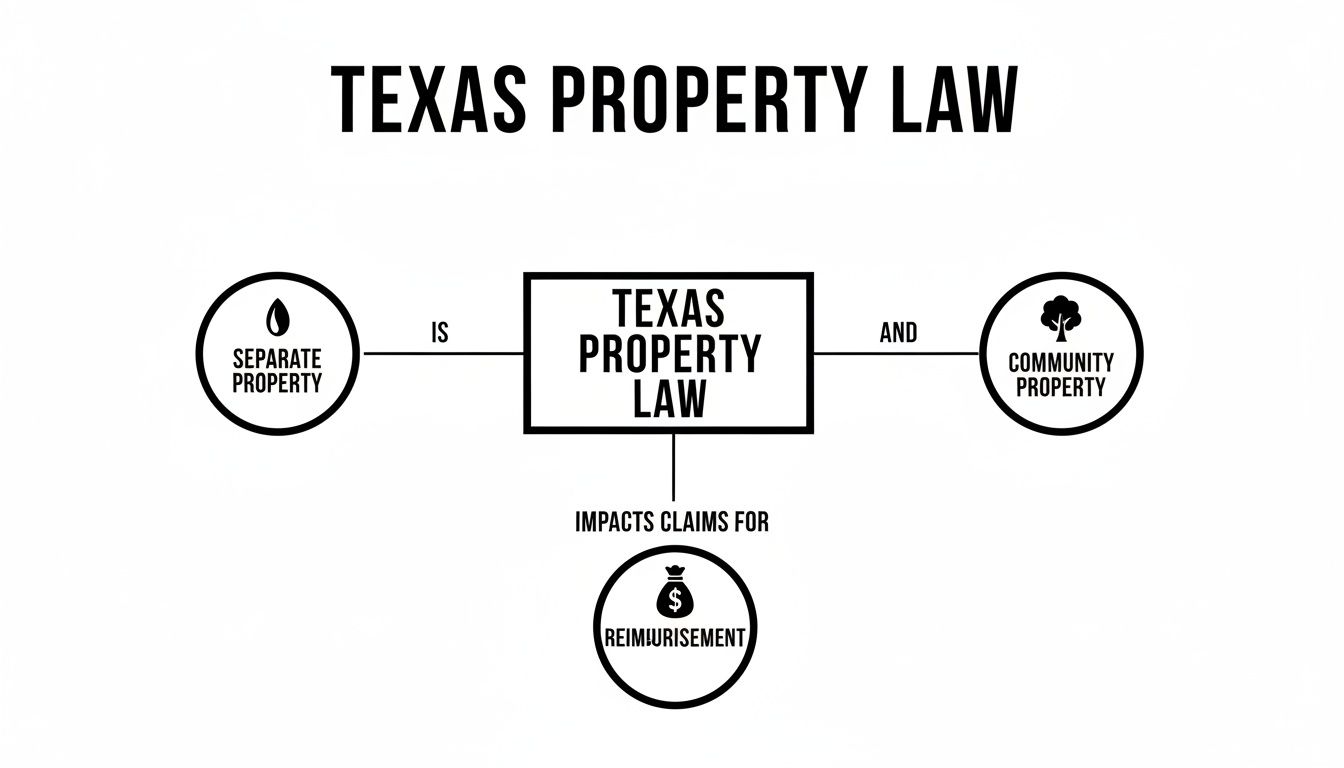

When you're trying to figure out how a business gets handled in a divorce, the first place to look is Texas's community property laws. These rules are the bedrock for every decision made about your assets—including the business you've poured your life into. The entire journey of a divorce and business valuation really kicks off with one powerful legal concept.

Under the Texas Family Code § 3.003, anything acquired by you or your spouse during the marriage is presumed to be community property. In plain English, the law starts by assuming that your business, or at least the value it gained while you were married, belongs to both of you. From there, the court's task is to divide this marital estate in a way that is "just and right," which doesn't always mean a clean 50/50 split.

Separate vs. Community Property: The Tree Analogy

One of the easiest ways to get your head around this is to think of your business as a tree.

- Separate Property (The Seed): If you started your business before the wedding, that original company is like a seed you planted. That seed is legally yours—your separate property.

- Community Property (The Growth and Fruit): Here's the catch. Any growth that tree experiences during the marriage is considered community property. All the new branches, leaves, and fruit it produces represent the increase in the business's value, the profits it generated, and the assets it bought while you were married.

This distinction is absolutely critical. Even if the business was 100% yours before you said "I do," the value it built up during the marriage is part of the marital estate that has to be divided. This is exactly why getting a professional valuation isn't just a smart move; it's a legal necessity for a fair result.

Key Legal Concepts You Need to Know

A couple of specific legal doctrines often come up when a business is on the table in a Texas divorce: the "inception of title" rule and "reimbursement" claims. Understanding these will show you why the lines between separate and community property can get surprisingly fuzzy.

1. Inception of Title

The "inception of title" rule is all about pinpointing when an asset was officially acquired. For a business, this is usually the date it was legally formed or purchased. Texas law says that the character of the property—whether it's separate or community—is locked in at that moment. If the business was started during the marriage, it’s presumed to be community property right from the start. If you started it before the marriage, it begins as your separate property. But that's where things can get more complicated.

2. Reimbursement Claims

What if community money—cash from a joint bank account, for example—was used to support or grow that separate property business? Perhaps you used a joint savings account to buy new equipment or pay down a business loan that existed before the marriage.

In situations like this, the marital estate may have a reimbursement claim against the separate property business. This is a legal demand for the community estate to be paid back for the money it funneled into growing the value of one spouse's separate asset.

These claims are not simple and require a deep dive into your financial history to prove. A forensic accountant often has to comb through years of bank statements, loan paperwork, and business records to trace where community funds were used to benefit the separate business. This analysis is a huge part of making sure the final division of your assets is truly "just and right."

At the end of the day, these Texas-specific rules make one thing clear: you can't afford to guess what your business is worth or what its legal status is. A precise, impartial, and legally defensible divorce and business valuation is the only path to ensuring your property division is fair and reflects the true nature of everything you've built.

The Three Main Approaches to Valuing a Business

Figuring out what a business is actually worth during a divorce isn't just about pulling a number out of thin air. It's a structured process that relies on established, court-accepted methods. Understanding these approaches helps demystify how an expert lands on a final valuation, giving you clarity during what is often a very uncertain time.

Ultimately, a professional valuation makes sure the division of your marital estate is based on a fair and defensible figure. The method an expert chooses can seriously impact the final number, which is why courts and valuation professionals typically rely on three main approaches: the income approach, the market approach, and the asset approach. Often, they'll use a mix of these to paint the most accurate picture.

This entire process is built on the foundation of Texas community property law, which dictates what's considered marital property versus separate property. This distinction is the starting point for everything that follows.

As you can see, understanding how Texas separates property is the first step before any valuation method can even be applied. It determines exactly what part of the business is on the table for division.

So, let's break down the three main ways a business's value is calculated.

Comparing Business Valuation Approaches

To make sense of these complex methods, it helps to see them side-by-side. Each one looks at the business through a different lens, and the right one—or a combination of them—depends entirely on the type of business we're talking about.

| Valuation Method | How It Works (Simple Analogy) | Best Suited For |

|---|---|---|

| The Asset Approach | Tallying up the value of a car's parts (engine, tires, frame) and subtracting the car loan. | Asset-heavy businesses like manufacturing, real estate holding companies, or investment firms. |

| The Market Approach | Pricing your house by looking at what similar homes in the neighborhood recently sold for. | Businesses in industries with plenty of recent, comparable sales data available (e.g., restaurants, retail stores). |

| The Income Approach | Valuing a rental property based on how much income it’s expected to generate over time. | Service-based businesses where value is tied to future earnings, like law firms, consulting agencies, or medical practices. |

While this table gives you a quick snapshot, a skilled expert rarely just picks one. The real art is in blending them to arrive at a value that truly reflects the business's unique circumstances.

The Asset Approach

Think of the Asset Approach as taking inventory. You add up the value of everything the business owns—cash in the bank, equipment, real estate, accounts receivable—and then you subtract everything it owes, like loans and outstanding bills. What’s left is the net asset value. This method gives you a solid, tangible baseline value. It’s particularly useful for businesses that are heavy on physical assets, like a construction company with a lot of machinery or a real estate holding firm. The downside? It doesn't really account for the business's ability to make money in the future, which is often where the real value lies.

The Market Approach

The Market Approach is a lot like selling a house. A real estate agent doesn't just guess a price; they look at "comps"—what similar houses in your area have sold for recently. It’s the same idea here. A valuation expert will search for data on similar businesses in the same industry that have recently been sold. This method is incredibly powerful when good "comps" are available, as it reflects what the real-world market is willing to pay. The major challenge, however, is finding truly comparable businesses, especially for niche or highly specialized companies.

The Income Approach

Finally, we have the Income Approach. This one treats the business like an investment. Its value isn't based on what its assets are worth today, but on its power to generate profits and cash flow down the road. It’s all about future potential. Experts use sophisticated techniques like Discounted Cash Flow (DCF) or Capitalization of Earnings to project the business's future income and then translate that back into a present-day value. This is often the go-to method for service-based businesses—think medical practices, law firms, or consulting agencies—where the primary value comes from consistent revenue streams, not a warehouse full of equipment. The nuances are especially critical when https://www.bryanfagan.com/2024/06/valuing-a-medical-practice-during-divorce-in-tex/, where intangible assets like goodwill can be a huge factor.

None of these valuation methods can work their magic without clean, accurate financial records. Following financial reporting best practices isn't just good for business—it's absolutely essential for ensuring the data given to an expert is reliable and paints a true picture of the company's health. Good preparation here is vital for a fair outcome.

Choosing the Right Financial Expert for Your Valuation

When it comes to putting a number on your business during a divorce, trying to do it yourself is a recipe for disaster. The value of your business isn’t just some figure you can pull from a spreadsheet. It’s a complex financial conclusion that absolutely must hold up under the intense scrutiny of a Texas courtroom.

This is exactly why getting the right credentialed professional isn't just a good idea—it’s a non-negotiable part of your legal strategy. An expert's report gives the judge the objective, third-party analysis they need to make a "just and right" division of your community estate. Without it, you're just guessing, and a guess could lead to a devastatingly unfair settlement that costs you for years to come.

Who Should Be on Your Team?

Picking the right professional is critical, and different financial puzzles require different experts. While your legal team at The Law Office of Bryan Fagan will guide you through this, it’s helpful to understand the key players you might encounter.

- Certified Valuation Analyst (CVA): This is your specialist. A CVA lives and breathes business valuation. They hold specific credentials proving their deep expertise in the very methodologies we’ve been talking about, and they know how to produce comprehensive reports designed to withstand a legal challenge.

- Forensic Accountant: Think of this professional as a financial detective. A forensic accountant is absolutely essential when the books are disorganized, records are missing, or you suspect your spouse might be hiding assets or intentionally lowering the company’s income to reduce its value. They are masters at tracing money and uncovering the real financial story.

- Certified Public Accountant (CPA) with Valuation Experience: Not all CPAs are created equal for this task. While many are brilliant at taxes and general accounting, you need one who specializes in valuation for divorce. Look for extra credentials like an ABV (Accredited in Business Valuation). This tells you they understand the unique pressures and rules of a litigation environment.

What to Look for in a Valuation Expert

When you and your attorney start vetting potential experts, you're looking for more than just a fancy title. You need a strategic partner for your case.

The single most important quality in a valuation expert is their ability to communicate complex financial information clearly and persuasively, both in a written report and on the witness stand. A brilliant analysis is useless if a judge cannot understand it.

You’ll want an expert with a proven track record in Texas divorce courts. Don't be shy about asking about their experience with businesses in your specific industry—whether it's a dental practice, a construction firm, or a software startup. Their familiarity with your market can make a huge difference. You can learn more about the role of expert witnesses and how they fit into the legal discovery process in our guide on divorce discovery and subpoenas.

Finally, be prepared for a deep dive. Your expert will need a mountain of documents to build a credible valuation. We're talking at least 3-5 years of business tax returns, profit-and-loss statements, balance sheets, and bank records. The more organized and complete you are from the beginning, the smoother—and more cost-effective—the entire process will be.

Cracking the Code on Valuation Costs and Timelines

When you're facing a divorce that involves a business, two questions almost always come to mind: "How much is this going to cost?" and "How long is this going to take?"

Getting a handle on the financial and time commitments for a divorce and business valuation is absolutely essential. It helps you manage expectations and plan your next moves. Think of this process not as just another expense, but as a critical investment in securing a fair and just outcome for your future. The price tag for a business valuation isn't a simple, flat fee. It's completely tied to the specific, unique circumstances of your business and, frankly, your divorce.

What Drives the Cost of a Valuation

The single biggest factor is the complexity of the business itself. Valuing a small, single-location coffee shop with clean books is a world away from untangling a multi-entity construction company with messy records and international suppliers. The more moving parts, the more time it takes.

The state of your financial records is another huge piece of the puzzle. If your bookkeeping is organized, transparent, and up-to-date, the process will be much smoother and less expensive. But if the records are disorganized, incomplete, or hint that money might be hidden, a forensic accountant will need to dig much deeper. That kind of investigative work takes time and increases the cost.

Finally, the level of conflict between you and your spouse plays a major role. If you can both agree to use a single, neutral valuation expert, you'll often share the cost, keeping it much more manageable. But if things are contentious and both sides hire their own experts who then have to battle it out in court, the legal and professional fees can climb dramatically.

Setting Realistic Financial Expectations

Business valuation is a highly specialized field, and the experts who do this work have years of training and experience. Their fees reflect that. Forensic accountants typically charge anywhere from $200 to $600 per hour. For a straightforward small business, you can expect a valuation to land somewhere in the $5,000 to $15,000 range. However, for more complicated scenarios—think multiple companies, suspected fraud, or drawn-out court battles with dueling experts—the total fees can easily exceed $50,000. You can get a better sense of what's involved by checking out this detailed overview of forensic accountants in divorce on nsktglobal.com.

While the upfront cost can feel overwhelming, a cheap or inaccurate valuation can cost you so much more in the long run. A thorough, defensible valuation is your best defense against walking away with an unfair settlement.

The Timeline for Completing a Valuation

Just like the cost, the timeline is not one-size-fits-all. A professional business valuation is a meticulous, detail-oriented process that simply can't be rushed. It involves a deep dive into documents, intense financial analysis, industry research, and ultimately, drafting a comprehensive report that will hold up under scrutiny in a Texas courtroom. At a bare minimum, you should expect the process to take several weeks. For more complex businesses or highly contested cases, it's not at all unusual for a valuation to take several months from the day you hire the expert to the moment you get the final report. Your attorney will factor this timeline into the overall legal strategy for your divorce.

Actionable Steps to Protect Your Business During a Divorce

When you're facing a divorce, the pressure can feel immense, especially when the future of your business hangs in the balance. Taking calm, deliberate action is your best defense. Knowing what to do—and just as importantly, what not to do—is the key to safeguarding the company you’ve poured your life into.

Think of this period as a critical holding pattern. The main goal is to preserve the business’s value and stability until a final agreement is reached. The steps you take right now will directly impact the divorce and business valuation process and, ultimately, your final property division. Following a clear, proactive strategy is absolutely essential to protecting your livelihood.

Your Immediate Business Protection Checklist

The moment a divorce appears on the horizon, it’s time to shift from long-term growth strategy to immediate preservation. These are crucial actions to protect your business's integrity and value.

-

Gather All Essential Financial Documents: Don't put this off. Immediately start collecting and organizing every key financial record you can get your hands on. This creates a transparent, undeniable baseline for the valuation process. Your list must include:

- At least three to five years of business tax returns.

- Profit and loss (P&L) statements and balance sheets.

- Bank and credit card statements.

- Loan documents and shareholder agreements.

- A comprehensive list of all business assets and liabilities.

-

Avoid Sudden, Significant Business Decisions: This is not the time to make any drastic moves. Any sudden changes could easily be misinterpreted as attempts to devalue the business or hide assets. Without first consulting your attorney, you must avoid:

- Selling off major assets.

- Taking on significant new debt.

- Making large, uncharacteristic purchases.

- Changing the business's legal structure.

A judge will almost certainly view these actions with suspicion, which could seriously damage your credibility and the outcome of your case. Maintaining the status quo is your safest and most strategic move right now.

Maintain Professionalism and Communication

It is absolutely essential to keep your marital conflicts separate from your professional life. Your employees, clients, and partners are looking to you for stability. Bringing divorce-related stress into the workplace can harm morale, productivity, and ultimately the business’s bottom line—the very thing the valuation is trying to measure.

It’s just as important to maintain open and honest communication with your legal and financial team. Be completely transparent about your business operations and financial situation. Your attorney and valuation expert are your advocates; the more information they have, the better they can protect your interests. Following these clear, proactive steps will help you move through this process with confidence, ensuring you protect the business you've dedicated yourself to building.

Frequently Asked Questions About Business Valuations in Texas

When you're facing a divorce and a business valuation, it's natural to have a million questions running through your head. You're not alone in wondering about the "what ifs" or worrying about worst-case scenarios. Let's tackle some of the most common questions we hear from clients to help replace some of that uncertainty with clarity.

What If My Spouse and I Disagree on the Business Value?

This happens all the time. In fact, it's more common for spouses to disagree on the value than to agree right away. When you can't see eye to eye, it’s not a dead end. The standard process is for each of you to hire your own qualified valuation expert. These experts will analyze the financials independently and produce their own detailed reports. If those reports are far apart, your attorneys will usually try to negotiate a settlement, perhaps by splitting the difference or finding another creative solution. If negotiations fail, the issue will likely be decided in the courtroom. Both experts will have to testify, explaining their methods and justifying their conclusions to the judge. The judge then acts as the ultimate referee, weighing the evidence and deciding which valuation is more credible.

Yes, and this is often the cleanest and most practical solution. A buyout allows the spouse running the company to keep it, while the other spouse receives different marital assets equal to their share of the business's value.

For example, let's say the community property portion of your business is valued at $500,000. Your spouse’s half would be $250,000. You could "buy out" that interest by giving them $250,000 worth of assets from somewhere else—perhaps the equity in your house, a portion of your 401(k), or other investment accounts. This lets the business continue operating without interruption.

What Is Personal Goodwill and How Does It Affect My Business Valuation?

"Goodwill" is an intangible concept that can have a huge impact on your final numbers. It’s the value of your business's reputation and customer loyalty. But Texas law makes a very important distinction here:

- Enterprise Goodwill: This is the value attached to the business itself—its brand name, location, customer lists, and established processes. Think of it as the value that would remain even if you walked away tomorrow. This is a community asset and is subject to division.

- Personal Goodwill: This value is tied directly to one spouse’s unique skills, personal reputation, and relationships. Under Texas law, your personal goodwill is considered your separate property. It is not subject to division in the divorce.

This is exactly why you need an experienced valuation expert. Separating personal goodwill from enterprise goodwill is critical, especially for professionals like doctors, lawyers, or consultants whose businesses are built almost entirely on their personal reputation.

My Business Isn't Profitable—Does It Still Have Value?

Absolutely. Profitability is just one piece of the puzzle. A business can hold significant value even if it's currently losing money or just breaking even. This is where the Asset Approach comes in. An expert using this method will look past the profit-and-loss statement and focus on what the business owns. This includes tangible assets like real estate, vehicles, expensive equipment, inventory, and even cash in the bank. A company might also have valuable intellectual property (like patents or trademarks), a solid customer list, or machinery worth a fortune. So, even if your business is operating in the red, it must go through a formal valuation to determine its net asset value for a fair and just division of property.

If you need help navigating divorce, custody, or estate planning in Texas, contact The Law Office of Bryan Fagan today for a free consultation.