Divorce can be one of life’s most difficult transitions—but understanding your rights under Texas law can make it less overwhelming. When you're going through a divorce, retirement accounts like your 401(k) are often considered community property. This means the portion you earned while married is subject to a just and right division. To split a 401(k) without getting hit by massive tax penalties, you'll need a special court order known as a Qualified Domestic Relations Order (QDRO).

Protecting Your Retirement During a Texas Divorce

The idea of splitting the retirement savings you've spent years building can feel like another heavy blow in an already challenging time. For many Texans, a 401(k) is the largest financial asset they own, second only to their home. We want you to know that you don't have to navigate this alone. The first step toward securing your financial future is understanding your rights under Texas law. That knowledge is the key to protecting what you’ve worked so hard to build.

This guide is here to provide clear, calm answers. We will walk you through exactly how Texas community property laws apply to your retirement accounts and explain the crucial legal tool you'll need for a penalty-free split.

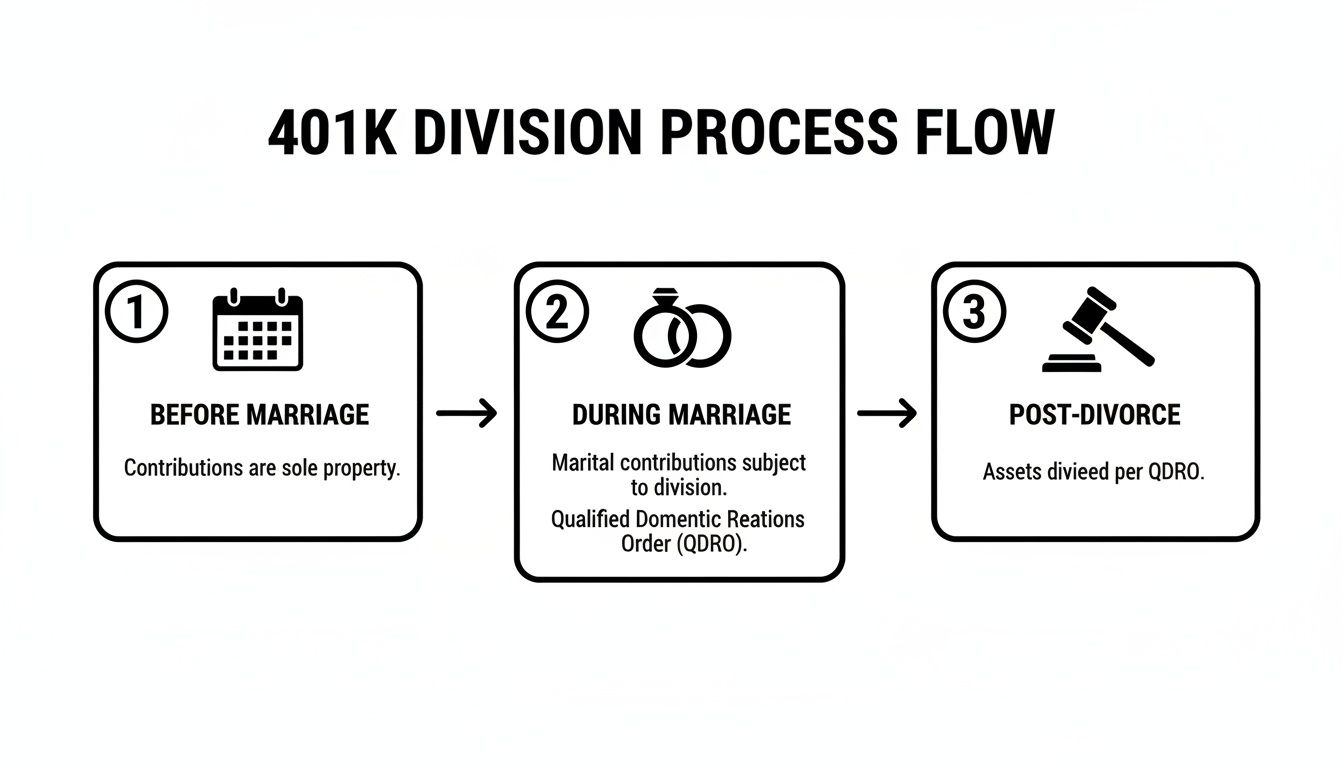

Your Roadmap to 401(k) Division

Splitting a 401(k) is a structured process with a clear path to follow. While every divorce is unique, the fundamental steps are consistent. Understanding this roadmap can help you feel more prepared and in control of what’s to come.

The goal isn't just to divide an asset; it's to do so strategically, in a way that protects both you and your spouse from unnecessary financial penalties and builds a solid foundation for your future. This requires careful legal and financial planning from the very beginning. As we cover in our guide on dividing retirement benefits upon divorce, a proactive approach makes all the difference.

Texas Family Code § 7.001 requires a "just and right" division of community property. While this doesn't automatically mean a 50/50 split, that is often the starting point for negotiations involving retirement funds.

To give you a clear roadmap of the 401(k) division process from start to finish, here's a quick overview of the essential stages.

Key Stages for Dividing a 401(k) in Texas

| Stage | Primary Goal | Why It's Critical |

|---|---|---|

| Characterization | Determine what portion of the 401(k) is community property (earned during marriage) versus separate property (earned before marriage). | This step ensures only the marital share is divided, protecting the assets that are legally yours alone. |

| Valuation | Establish an accurate, agreed-upon value for the community portion of the 401(k) as of a specific date. | The market fluctuates daily. Locking in a valuation date is essential for a fair and equitable division. |

| Negotiation | Decide how the 401(k) will be divided—whether through a direct split, an asset offset, or another settlement strategy. | This is where you and your attorney strategize to achieve an outcome that aligns with your long-term financial goals. |

| QDRO Execution | Draft, obtain court approval, and submit a Qualified Domestic Relations Order (QDRO) to the plan administrator. | A QDRO is the only legal instrument that allows you to divide a 401(k) without triggering early withdrawal penalties and immediate income taxes. |

Think of these stages as guideposts on your journey. Knowing what’s next helps you prepare, ask the right questions, and make informed decisions every step of the way.

How Community Property Law Affects Your 401(k)

When you're facing a divorce in Texas, one of the first questions you might have is, "Is my spouse actually entitled to my 401(k)?" The answer is rooted in a core legal principle called community property, and understanding this concept is the first step toward a fair division of the assets you've both worked to build.

Simply put, Texas is a community property state. This means that most property, assets, and debts acquired by either spouse during the marriage are presumed to belong to both of you jointly. This includes your income, the house you bought together, and yes, the contributions made to a 401(k) from the day you were married until the day of your divorce.

Differentiating Community vs. Separate Property

The key to a fair division of a 401(k) is to accurately distinguish the "community" portion from the "separate" portion. Not every dollar in your retirement account is automatically subject to division.

Under the Texas Family Code § 3.001, separate property includes assets that were:

- Owned by a spouse before the marriage.

- Acquired by a spouse during the marriage as a gift.

- Received by a spouse through inheritance.

This is critically important for your 401(k). Any funds you contributed before you were married, plus any market growth on those specific funds, remain your separate property. Only the value of the account that accumulated during the marriage is considered part of the community estate to be divided.

The Power of Tracing Your Assets

Here’s where it gets tricky: the law places the burden of proving that a portion of your 401(k) is separate property squarely on your shoulders. This legal process is called "tracing," and it requires clear and convincing evidence. You can't just tell the judge you had money in the account before the wedding; you have to prove it.

For example, imagine you worked for your company for five years before a ten-year marriage. The contributions and growth from those first five years are yours alone. To prove this, you'll need to gather specific documents.

You cannot just state that part of your 401(k) is separate property; you must prove it with documentation. A Texas court will presume the entire account is community property unless you provide clear evidence to the contrary.

Effective tracing is not just a suggestion; it's a necessity. It often requires:

- Pre-marital account statements: The statement from the month of your marriage is invaluable, as it establishes the starting value of your separate property.

- Account statements throughout the marriage: These show the complete history of contributions, employer matches, and market fluctuations.

- A clear calculation: An experienced attorney or a financial expert, like a forensic accountant, can create a detailed report showing precisely how the separate property portion grew over time, independent of community contributions.

Failing to properly trace your separate property can be a costly mistake. If you cannot prove it, the court may treat the entire 401(k) as community property, potentially costing you a significant portion of your pre-marital savings.

The Growing Concern of "Gray Divorce"

Correctly characterizing and dividing retirement assets is especially critical for couples divorcing later in life. We're seeing a rise in what's known as "gray divorce"—divorces among adults aged 65 and older. For these individuals, there is simply less time to rebuild retirement savings after a split.

In community property states like Texas, where retirement accounts are often divided, a fair and accurate division is paramount to securing a stable financial future. You can discover more insights about how divorce can impact retirement plans for older Americans.

Ultimately, understanding how community property law applies to your 401(k) empowers you to advocate for a fair outcome. It transforms an emotional and often confusing process into a clear, fact-based exercise. By diligently gathering your financial records and working with a knowledgeable Texas family law attorney, you can protect what's rightfully yours while ensuring the community portion is divided in a just and right manner.

Using a QDRO to Divide Your 401(k) Correctly

Here’s one of the most common—and costly—mistakes we see people make: simply stating in their divorce decree that a 401(k) will be split. While a Texas judge can order the division, the company that manages the 401(k) plan will not act without a very specific, separate court order.

That essential legal tool is called a Qualified Domestic Relations Order, or QDRO.

A QDRO is a highly technical legal document that provides the 401(k) plan administrator with legally binding instructions on how to divide the account. It spells out exactly who gets what, how much, and how the payout should occur. Without a valid QDRO, any attempt to move money from one spouse's 401(k) to the other can trigger immediate income taxes and a painful 10% early withdrawal penalty, potentially erasing a significant portion of your retirement funds.

This chart illustrates how a 401(k) moves through marriage and divorce, highlighting just how critical the QDRO is in that final stage.

As you can see, the process flows from identifying separate and marital funds to the legal division after the divorce is final—a step made possible only by a correctly executed QDRO.

The QDRO Drafting and Approval Process

Let us be clear: drafting a QDRO is not a do-it-yourself project. Every retirement plan has its own unique set of rules and required language. Using a generic template from the internet almost guarantees that the plan administrator will reject your order, leading to long delays and additional legal fees. You need an experienced family law attorney to handle this correctly.

The typical process for getting a QDRO in place involves a few key checkpoints:

- Drafting the Order: Your attorney will draft the QDRO based on the terms agreed upon in your divorce decree. The language must be precise, covering details like the exact percentage or dollar amount and how to handle market gains or losses between the divorce date and the actual payout.

- Pre-Approval from the Plan Administrator: This is a crucial step that is often skipped. Before presenting the QDRO to a judge, we send the draft to the 401(k) plan administrator for their review. They will confirm if it meets their internal requirements and federal law. Obtaining this pre-approval helps prevent the frustrating scenario of having a signed court order rejected later.

- Getting the Judge’s Signature: Once the plan administrator gives the green light, the QDRO is presented to the judge to be signed, making it an official court order.

- Final Submission and Execution: The signed order is sent back to the plan administrator, who will then "qualify" the order and finally execute the division of the account according to its terms.

This multi-step process demands patience and precision. Having a knowledgeable QDRO lawyer in Texas in your corner can make all the difference.

Common Pitfalls to Avoid with Your QDRO

Even with an attorney, there are common mistakes that can complicate the process. Being aware of them helps you advocate for your own financial future.

For instance, one of the biggest disputes we see is over how to handle market fluctuations. If your divorce decree awards your spouse a flat dollar amount—say, $100,000—but the market declines before the QDRO is finalized, you could end up paying out far more than 50% of the account's current value.

A well-drafted QDRO should almost always specify a percentage, not a fixed dollar amount. This ensures both spouses share equally in any market gains or losses that occur between the date of divorce and the date of distribution.

Another common landmine is failing to account for outstanding 401(k) loans. If the account holder took out a loan against their 401(k) during the marriage, that loan is considered a community debt. The QDRO must specify how that loan will be handled in the division to ensure the receiving spouse gets their fair share of the net account value.

To protect yourself, make sure your legal team addresses these critical details:

- Market Gains and Losses: The QDRO should clearly state that the receiving spouse's share will be adjusted for any investment gains or losses up until the day the funds are moved into their own account.

- Outstanding Loans: Any loans against the 401(k) must be accounted for. The outstanding loan balance is typically deducted from the total account value before the division is calculated.

- Vesting Schedules: If the employee spouse isn't fully vested in their employer's matching contributions, the QDRO needs to be crystal clear about how that unvested portion will be treated.

Getting the QDRO process right is a technical but manageable part of splitting a 401(k). It requires careful attention to detail and proactive communication. With the right legal guidance, you can ensure the division is done correctly and fairly—without being hit by avoidable penalties—setting you up for a more secure future.

Strategic Approaches to Valuing and Negotiating Your 401(k)

When you look at a 401(k) statement during a divorce, that large number is just a snapshot in time. The stock market is in constant motion, and these fluctuations can significantly alter an account’s value between the day you agree on a settlement and the day the funds are actually divided. This is precisely why the valuation date becomes such a crucial point of negotiation in any Texas divorce.

Simply agreeing to a 50/50 split is just the beginning. The real strategy lies in how you value the account and what you negotiate in exchange for that value. This is where you can find a creative solution that fits your long-term financial picture, rather than settling for a one-size-fits-all approach.

Beyond the 50/50 Split: The Power of an Asset Offset

One of the most effective negotiation tools is a technique called "asset offsetting," sometimes known as a buyout. Instead of physically dividing the 401(k) with a QDRO, one spouse keeps the entire retirement account. In return, the other spouse receives different community property assets of equal value.

This practical approach offers several real-world advantages:

- It's faster and simpler. You can avoid the QDRO process, which can often take months to complete.

- It preserves retirement funds. The spouse keeping the 401(k) maintains their retirement savings in one place without disruption.

- It provides immediate access to other assets. The other spouse might receive assets they need right now, such as the family home or liquid funds.

Let’s look at a practical scenario. Imagine Sarah and Tom are divorcing. The community property portion of Tom's 401(k) is worth $200,000, and they also have $200,000 in equity in their home. Sarah’s priority is to stay in the home with their children and avoid uprooting them.

Instead of splitting both assets, they can agree that Tom will keep his retirement account intact. In exchange, Sarah receives all the equity in the home, allowing her to refinance the mortgage in her name without needing cash to buy out Tom's share. This is a thoughtful solution that addresses both of their primary needs.

Taming the Beast: Negotiating Valuation Dates and Market Risk

Because a 401(k)’s value can fluctuate significantly with the market, agreeing to a fixed dollar amount is a considerable gamble. For instance, you agree that your spouse will receive $150,000 from your $300,000 401(k). Before the QDRO is finalized, the market drops 10%, and the account is now only worth $270,000. Paying out the fixed $150,000 now leaves you with only $120,000—far from an equal division.

The smartest way to shield both of you from market volatility is to define the division as a percentage, not a fixed dollar amount. This ensures that you and your ex-spouse share equally in any market gains or losses that happen before the funds are officially separated.

By agreeing to a 50% split of the community portion, you are both in the same position, riding the market waves together. This simple change in language can prevent a major financial headache and future disagreements.

Exploring Your Options: Buyouts and Rollovers

Another strategy, particularly in high-net-worth divorces, is a direct buyout. This is where one spouse uses cash or other non-retirement funds to pay the other for their share of the 401(k). This keeps the retirement account whole but requires careful consideration of the tax consequences of liquidating other assets to fund the buyout.

If a direct split is the chosen path, the receiving spouse has options once the QDRO is approved:

- Roll the funds into an IRA: This is the most common choice. It keeps the money growing in a tax-advantaged retirement account, avoiding immediate taxes and penalties, and gives the recipient full control over investment decisions.

- Leave the funds in the original 401(k): Some plans allow an ex-spouse to maintain a separate account within the existing plan.

- Take a cash distribution: This provides immediate access to cash, but be aware: it will be treated as ordinary income and taxed accordingly.

Each of these paths has different financial implications. Smart negotiation isn't just about deciding if you will split the 401(k), but about determining how that division can best support your financial future. A skilled divorce attorney can help you model these scenarios so you can make a clear-headed decision at the mediation table.

Avoiding Costly Tax and Early Withdrawal Penalties

Getting the 401(k) split wrong during a divorce can lead to some truly devastating—and completely avoidable—financial consequences. A single misstep could trigger a massive income tax bill and the painful 10% early withdrawal penalty from the IRS.

Fortunately, a properly handled Qualified Domestic Relations Order (QDRO) is your shield against these financial landmines. It is the key to ensuring that retirement assets move from one spouse to the other smoothly and, most importantly, without penalties.

Understanding how a QDRO protects you is absolutely essential. It’s the difference between preserving your nest egg and watching a significant portion of it disappear to taxes before you ever have a chance to use it.

The Rollover: Your Safest Path Forward

For the spouse receiving the funds—known in legal terms as the "alternate payee"—the most common and almost always the wisest move is a direct rollover. Once the 401(k) plan administrator approves the QDRO, the awarded funds can be moved directly into an Individual Retirement Account (IRA) established in the receiving spouse's name.

This is a non-taxable event. You are essentially moving money from one qualified retirement plan to another, which means you defer all income taxes and sidestep any early withdrawal penalties. The money remains invested for your future, continuing to grow tax-deferred until you reach retirement age.

With a QDRO facilitating a direct rollover into an IRA, you can transfer your share of a 401(k) with $0 in immediate taxes and $0 in penalties. This is, hands down, the most effective way to protect the full value of the retirement assets you were awarded.

To ensure you're navigating all tax implications correctly, it is wise to consult with specialized tax accountants. They can offer advice tailored to your specific financial situation.

A Unique Exception: The QDRO Cash-Out Option

There is a special rule that applies only to 401(k) divisions under a QDRO. While we almost always advise clients to roll the funds over, we understand that life happens and sometimes you need access to cash.

The IRS allows an alternate payee to take a cash distribution directly from their ex-spouse's 401(k) as part of a QDRO without being subject to the usual 10% early withdrawal penalty, even if they are under age 59½.

This is a significant distinction. However—and this is a big however—it's crucial to remember this exception only waives the penalty. It does not waive the income tax. Any amount you take out as cash will be treated as ordinary income for that tax year, and you will have to pay taxes on it.

For example, if you take a $50,000 cash distribution, the good news is you avoid the $5,000 early withdrawal penalty. The bad news is you still have to report the entire $50,000 as income, which could easily push you into a higher tax bracket. You can learn more about how to prepare for the financial side of a split in our article covering common tax mistakes to avoid in a divorce.

When a 401(k) is divided, the receiving spouse must think carefully about when they might need the funds and whether waiting until retirement is feasible. Unlike IRAs, which can be divided through a "transfer incident to divorce" without immediate tax consequences, 401(k) divisions are far more complex and demand strict adherence to IRS rules to avoid costly mistakes.

Common Questions About Splitting a 401(k) in a Texas Divorce

When it comes to splitting a 401(k), the big picture can feel overwhelming, but it’s often the small, practical questions that cause the most stress. The process is technical and full of jargon, and it's easy to feel like you're one misstep away from a costly error.

To help provide clarity, we’ve gathered answers to the questions we hear most often from clients who are navigating the process of splitting a 401(k) in a divorce.

What Happens to an Outstanding 401(k) Loan?

This question comes up frequently. If the spouse with the 401(k) took out a loan against it during the marriage, that loan is almost always treated as a community debt. This means it belongs to both of you, not just the person whose name is on the account.

When it comes time to divide the account, the outstanding loan balance is subtracted from the total account value before the marital portion is calculated. A properly drafted QDRO must spell this out clearly to ensure the division of the net assets is fair. If the loan is not accounted for, one spouse could receive significantly less than they are actually entitled to.

How Long Does the QDRO Process Take?

Patience is essential when it comes to a QDRO. From start to finish, the process can take anywhere from a few months to over a year. There is no single, simple answer because the timeline depends on several key factors:

- Plan Complexity: Some 401(k) plans have straightforward rules, while others are complex and require significant back-and-forth to get right.

- Administrator Response Time: The plan administrator acts as the gatekeeper. Their response time for reviewing and pre-approving the draft QDRO is a major variable. Large companies often have a lengthy queue.

- Court Schedules: Simply getting a judge's signature on the final order is subject to the court's busy docket.

Because this is not an overnight process, it’s critical to begin drafting the QDRO as soon as you have an agreement. The longer you wait, the longer your financial future remains in limbo.

Can My Spouse Get My 401(k) if We Were Only Married a Short Time?

Yes. Even in a short marriage, Texas law states your spouse is entitled to a "just and right" share of the community property portion of your 401(k). The key here is the community portion—the value that was built up from the date of marriage to the date of divorce.

For example, if you were married for two years, your spouse would have a claim to a share of the contributions, any employer matches, and the market gains or losses that occurred only during that specific two-year period. Everything you had in the account before the marriage remains your separate property, but you will need the records to prove it.

A common misconception is that you must be married for ten years for a spouse to have a claim to your retirement. That is not true for 401(k) division in Texas. The ten-year rule people often hear about is usually related to claiming certain Social Security benefits, which is a completely different matter.

What if My Ex-Spouse Refuses to Cooperate?

Unfortunately, this can happen. If your finalized divorce decree orders the 401(k) to be divided but your ex-spouse is dragging their feet or refusing to sign the necessary paperwork, you are not without options.

Your attorney can return to court and file an enforcement action. A judge has the authority to compel your ex-spouse to comply with the decree's terms. In some cases, the court can even appoint someone to sign the QDRO on their behalf or order them to pay the attorney's fees you incurred to enforce the order. Your divorce decree is a legally binding court order, and there are mechanisms to ensure it is followed.

If you need help navigating divorce, custody, or estate planning in Texas, contact The Law Office of Bryan Fagan, PLLC today for a free consultation.