When a loved one passes away, the last thing their family should have to deal with is a drawn-out, public court battle. Unfortunately, that’s often the reality of probate. To avoid probate in Texas, you can use several key estate planning tools, like creating a revocable living trust, setting up beneficiary designations, and using Transfer on Death Deeds for your real estate. These strategies are not just about financial efficiency; they are a profound act of care, designed to protect your family’s emotional and financial well-being during their most vulnerable moments. Taking these steps ensures your legacy is passed on with privacy, speed, and according to your precise wishes.

What Is Probate and Why Should You Avoid It in Texas

At its heart, probate is the court-supervised process used to wrap up a person’s financial life. As outlined in the Texas Estates Code, it’s how a Texas court validates a will, pays off any outstanding debts, and makes sure the remaining assets get to the right people. It’s the official system for settling an estate.

If someone dies without a will (known as dying “intestate”), the court must step in and follow a rigid legal formula under the Texas laws of intestate succession to decide who inherits. This statutory distribution often doesn’t align with what the person would have wanted, potentially leaving out close but unmarried partners or creating unintended consequences for children.

While the system is meant to be orderly, it frequently becomes a major headache for families already coping with grief. Once you understand the main drawbacks, you’ll see why a little planning now can make a world of difference later.

The Three Main Burdens of Probate

The probate process in Texas might be a legal necessity in some situations, but it brings a trio of challenges that can drain a family’s resources and patience.

- It Can Be Expensive: Probate isn’t free. There are court filing fees, mandatory notice publications, attorney’s fees, executor compensation, and appraisal costs to consider. These expenses come directly out of the estate, which means less is left for your loved ones.

- It Is Time-Consuming: Even a straightforward probate case can easily take six to nine months. If the estate is complex, involves business assets, or someone contests the will, it can drag on for a year or even longer. During that time, many assets are frozen, leaving your heirs unable to access funds they might desperately need.

- It Is a Public Process: This is a major concern for many families. Every document filed with the probate court, from the will to a detailed inventory of every single asset and its value, becomes public record. This lack of privacy can make families feel exposed and can even attract unwanted attention from creditors or solicitors.

At The Law Office of Bryan Fagan, PLLC, we see how the stress of a protracted court process can compound a family’s grief. Our experience shows that the uncertainty and delays can directly impact the stability and emotional well-being of surviving spouses and children, making a difficult time even harder.

The Impact on Your Children’s Well-Being

Consider this real-life scenario: a family loses its primary breadwinner. The surviving spouse and children are already dealing with immense emotional pain. Now, imagine their main bank accounts are frozen for six months because of probate.

This isn’t a hypothetical situation; it happens all the time. A delay like that creates immediate financial instability. It can put paying the mortgage, covering daily bills, or funding a child’s education at risk. That financial strain adds a whole new layer of anxiety to an already traumatic experience, disrupting a child’s academic focus and emotional stability. A child who is worried about whether they can stay in their home or if their activities will be paid for cannot thrive in school or social settings.

Probate vs Non-Probate Asset Transfer Comparison

Understanding how assets are transferred is key to effective estate planning. The table below breaks down the fundamental differences between the probate process and non-probate methods like a living trust.

| Characteristic | Probate Process | Non-Probate Transfer (e.g., Trust) |

|---|---|---|

| Court Involvement | Mandatory court supervision | None; managed by the trustee |

| Privacy | Public record | Completely private |

| Timeline | Months to over a year | Can be almost immediate |

| Cost | Court fees, attorney fees, executor fees | Typically lower administrative costs |

| Asset Access | Assets frozen until probate is complete | Immediate access for beneficiaries |

| Control | Court and executor control distribution | You dictate the terms in the trust |

As you can see, bypassing probate offers significant advantages in terms of privacy, speed, and cost, giving your family the security they need right when they need it most.

Taking Control of Your Legacy

Learning how to avoid probate in Texas isn’t about dodging legal responsibilities. It’s about choosing a smarter, more private, and more compassionate way to pass on what you’ve built. By taking deliberate steps now, you shield your family from unnecessary legal headaches down the road.

You ensure they have immediate access to the resources they need and the privacy to grieve without the world looking over their shoulder. To better grasp the fundamental concepts involved, you can refer to a comprehensive guide to understanding what probate is.

Protecting your family’s future starts with a conversation. If you are ready to explore personalized strategies to safeguard your legacy and shield your loved ones from the burdens of probate, we are here to help. Contact The Law Office of Bryan Fagan, PLLC, today to schedule a consultation with our experienced estate planning attorneys.

Using a Revocable Living Trust to Protect Your Heirs

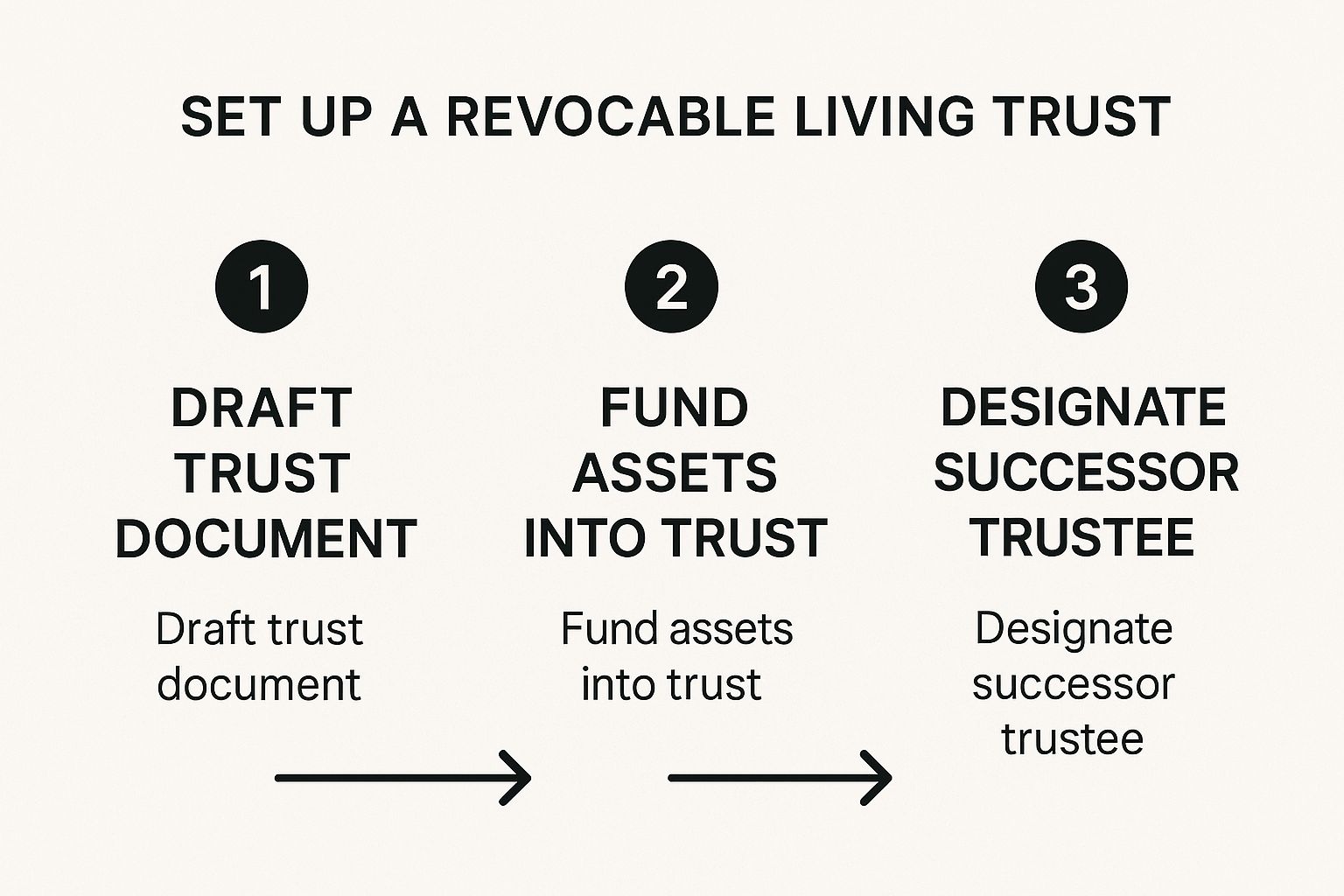

When Texas families are looking for the strongest way to sidestep probate, the revocable living trust often becomes the foundation of their estate plan. You can think of a trust as a private legal container you create to hold your most important assets. You then transfer ownership of property—like your house, bank accounts, and investments—from your name into the name of the trust.

While you’re alive, you typically act as the trustee, which means you keep complete control over everything inside it. You can buy, sell, or manage the property just like you always have. And because it’s “revocable,” you have the freedom to change its terms or even dissolve it completely whenever you want, as permitted by the Texas Property Code.

The true benefit of a trust really shines after you pass away. Instead of your assets being frozen and tangled up in probate court, they are immediately managed by your designated successor trustee. This is someone you’ve hand-picked—often a trusted family member, a close friend, or even a financial institution—to step in and follow your instructions to the letter.

The Critical Process of Funding Your Trust

Just creating the trust document is only half the battle. For a trust to actually help you avoid probate in Texas, it has to be “funded.” This is just a formal way of saying you need to officially transfer the title of your assets into the trust’s name.

This is a step where people sometimes stumble, but it’s absolutely essential for the plan to work as intended.

- Real Estate: For your home or any other property, this means signing a new deed that moves the property from you as an individual to yourself as the trustee of your trust.

- Bank Accounts: You’ll need to sit down with your bank to retitle your checking, savings, and any money market accounts into the name of the trust.

- Investment Accounts: In the same way, your brokerage and other investment accounts must be formally moved over to the trust.

If you don’t fund the trust, you’ve essentially created an empty box. Any assets still in your individual name when you die will almost certainly have to go through probate, which defeats the whole purpose of setting up the trust in the first place.

This infographic breaks down the pretty straightforward process of setting up and funding a revocable living trust.

As you can see, creating a trust is a structured but completely manageable process that keeps your wishes private and your assets protected.

A Real-World Scenario: Protecting Minor Children

Let’s look at Mark and Sarah, a couple in their late 30s with two young children, ages 8 and 11. Their main goal is to make sure their kids are financially secure if something were to happen to both of them. A simple will could name a guardian, but it wouldn’t offer any sophisticated control over the kids’ inheritance.

If they only had wills, their entire estate would be dragged through probate. Even worse, if the children were to inherit a large sum of money, the court would likely appoint a financial guardian to manage the funds until each child turns 18. At that point, the child gets their entire inheritance in one lump sum—a situation that makes most parents very nervous. This sudden wealth can disrupt their focus on education and long-term goals.

By setting up a revocable living trust, Mark and Sarah can avoid all of these problems. They name Sarah’s responsible older sister as the successor trustee. Their trust document includes very specific instructions:

The trust will pay for the children’s health, education, and living expenses until they are older. At age 25, each child will receive one-third of their share. They will receive another third at age 30, and the final portion at age 35.

This structure shields the children’s inheritance from youthful mistakes and makes sure the money is there for their long-term well-being. It provides stability and guidance, protecting them from the emotional and financial chaos of a public probate battle, ensuring they can continue their schooling and development without disruption. This level of personalized protection just isn’t possible through the probate process.

To get a better sense of how trusts fit into the bigger picture of estate planning, it helps to compare a Living Trust vs. Will. This comparison really drives home how a trust offers far more privacy, control, and efficiency.

A trust is more than just a legal document; it’s a direct reflection of the care you have for your family’s future. By taking this step, you ensure your loved ones are protected on your terms, not the court’s. If creating this layer of security for your family is a priority, our team can help you design a plan that meets your specific needs. Schedule a consultation with The Law Office of Bryan Fagan, PLLC today to explore your options.

Using Deeds and Beneficiary Designations to Sidestep Probate

While a revocable living trust is a fantastic, comprehensive tool, it’s not always necessary for every family. For many Texans, a huge chunk of their assets can be shielded from probate using much simpler, more direct methods. These tools are powerful because they work like a contract, automatically transferring assets when you pass away and completely bypassing the probate court.

It’s all about being strategic. By using beneficiary designations and specialized deeds, you can make sure that specific, high-value assets—think your house, bank accounts, and retirement funds—go straight to your chosen heirs without any frustrating delays. These instruments are efficient, private, and an absolutely essential part of a smart plan to avoid probate in Texas.

POD and TOD Designations: The Easy Win for Financial Accounts

One of the most straightforward ways to keep your financial accounts out of a judge’s hands is by adding a Payable-on-Death (POD) or Transfer-on-Death (TOD) designation. These are just simple forms you can get from your bank or brokerage firm.

- A POD designation is what you’ll use for bank accounts—checking, savings, and certificates of deposit (CDs).

- A TOD designation is for investment and brokerage accounts, covering things like stocks, bonds, and mutual funds.

The process couldn’t be simpler. You fill out a form naming a person (or multiple people) as the beneficiary. During your lifetime, they have zero access to or control over those funds. Once you pass away, all your beneficiary has to do is present a death certificate to the institution, and they get immediate ownership of the account.

This transfer happens entirely outside of your will and the probate process. It’s clean, direct, and private—a perfect way to pass on liquid assets.

The Texas Transfer on Death Deed (TODD)

For most families, their home is their single most valuable asset. The Texas Transfer on Death Deed (TODD), governed by Chapter 114 of the Texas Estates Code, is a specific legal tool created to pass your home or other real estate directly to a beneficiary, letting them skip the headaches and costs of probate.

A TODD works a lot like a POD designation for a bank account. You sign and file a deed with the county clerk that names who will inherit the property upon your death. The crucial part? You keep full ownership and control of your property while you’re alive. You can still sell it, mortgage it, or even revoke the TODD and create a new one at any time.

A Transfer on Death Deed is a simple yet incredibly powerful way to provide immediate stability for your loved ones. By making sure the family home doesn’t get tangled up in court, you protect your children’s sense of security and continuity during an already difficult time.

Real-Life Example: Protecting the Family Home

Let me give you a real-world scenario we see all the time. Imagine a widower, David, whose only child, Emily, lives out of state. David’s main goal is to make sure Emily gets the family home without any legal drama. He’s worried that if the house goes through probate, Emily will be stuck dealing with court filings and delays from hundreds of miles away while she’s also grieving.

David works with an attorney to complete and file a Texas Transfer on Death Deed, naming Emily as the beneficiary. A few years later, when David passes, the process is seamless. Emily simply files an affidavit and a certified copy of David’s death certificate in the county property records. Just like that, ownership of the home transfers to her automatically—no court involvement whatsoever.

This one simple step saved Emily months of stress and thousands in potential legal fees. It let her focus on honoring her father instead of battling a bureaucratic process. The emotional relief of not having to worry about losing the family home allowed her and her own children to grieve in a stable environment.

The desire to avoid these legal hurdles is only growing. Our court systems are getting more and more bogged down. In fact, civil case filings in Texas have shot up by 22% since 2019. This trend really highlights the value of planning ahead to steer clear of potential legal logjams. You can read more about the trends in Texas court filings to see what we mean.

Taking these steps provides certainty and priceless peace of mind. If you want to explore how deeds and beneficiary designations can fit into your own estate plan, The Law Office of Bryan Fagan, PLLC is ready to help. Schedule a consultation with us today to start protecting your family’s future.

How Joint Ownership Can Bypass Probate

Another powerful tool for keeping property out of court comes down to how you title your assets. When you hold property jointly with someone else in a specific way, you can set up an automatic transfer of ownership when you pass away. This is a key strategy to avoid probate in Texas, and we see it most often with real estate and bank accounts shared between spouses.

The magic happens when you title the asset as “Joint Tenancy with Right of Survivorship” (JTWROS). That legal phrase is absolutely critical. It creates a direct path for the property to pass to the surviving owner, completely bypassing the need for a will or a probate judge’s approval.

So, when one joint owner dies, their share doesn’t get tangled up in their estate. It’s simply absorbed by the surviving owner, automatically. This seamless transfer is what makes JTWROS such an effective probate avoidance tool for certain kinds of assets.

Understanding Right of Survivorship

The “right of survivorship” is the legal engine that makes this all work. It means the surviving co-owner has an absolute right to the entire property. This right actually overrides any conflicting instructions you might have left in your will for that specific asset.

For example, let’s say you and your spouse own your home as joint tenants with right of survivorship. Your will can’t give your half of the house to your child from a previous marriage. By law, the moment you pass away, your spouse automatically becomes the sole owner. This provides immediate stability and keeps a critical family asset out of legal limbo.

This automatic transfer is a big deal, but it also shows why you have to use this strategy carefully. If it’s not coordinated with your overall estate plan, it can sometimes undermine your broader goals.

The Risks of Adding a Joint Owner

Adding a child to your deed or bank account might seem like a simple probate-avoidance hack, but it’s loaded with significant risks that could put your financial security in jeopardy. It’s an approach that demands a clear-eyed look at the potential downsides.

Before you add a non-spouse, like one of your adult kids, as a joint owner, you need to think about these potential problems:

- Creditor Exposure: Once you add someone to the title, that asset is legally theirs just as much as it is yours. If your child gets sued, files for bankruptcy, or racks up major debt, creditors could come after your property to settle their claims.

- Divorce Complications: If your child goes through a divorce, their share in your joint property could be classified as a marital asset. A judge could order your property to be divided as part of the divorce settlement, dragging your life savings into their family law drama.

- Loss of Control: As a joint owner, your child has equal rights to the asset. For a bank account, that means they could withdraw every last penny without your permission. You essentially surrender exclusive control over your own money.

At The Law Office of Bryan Fagan, PLLC, our expertise in family law gives us a unique perspective on these risks. We urge clients to be extremely cautious about using joint ownership with children as their main probate avoidance strategy. The unintended fallout can spark family conflict and financial devastation that far outweigh the initial convenience.

A Hypothetical Scenario: Unintended Consequences

Imagine Maria, an elderly widow who wants to make things easy for her son, Alex, after she’s gone. She adds him as a joint owner with right of survivorship to her savings account, which holds her life savings of $150,000. Her only goal is to keep that account out of probate.

A year later, Alex causes a serious car accident and is found at fault. The other driver sues and wins a judgment for $200,000—far more than his auto insurance covers. The judgment creditor discovers the joint bank account and can legally garnish it to help pay off the debt.

Just like that, Maria’s entire life savings is at risk because of something that had nothing to do with her. The very tool she used to protect her legacy ended up exposing it to a total loss, causing immense stress and financial hardship for her. This story is a painful illustration of how joint ownership can backfire, wrecking a family’s emotional and financial well-being. It could force a family into financial crisis, impacting the educational and developmental opportunities of grandchildren.

While joint ownership is a legitimate tool, especially for married couples, it requires a serious conversation with an experienced attorney. We can help you weigh the pros and cons to see if it’s the right move for your family. Contact The Law Office of Bryan Fagan, PLLC for a consultation to build a plan that truly protects you.

Easier Paths for Small Texas Estates

Life happens, and sometimes a person passes away without a neat and tidy estate plan in place. For the family left behind, the idea of getting tangled up in a formal probate process is the last thing they want to deal with.

The good news is, Texas law understands this. There are simpler, faster alternatives for smaller estates that can save a ton of time and money. These options are a critical part of the puzzle when you’re figuring out how to avoid probate in Texas, especially when you’re already dealing with a loss.

These streamlined procedures exist because not every estate needs a judge watching over every single step. For grieving families, they are a huge relief, offering a way to settle a loved one’s affairs without adding a mountain of legal stress.

The Small Estate Affidavit: A Quick Solution

One of the most practical tools in the Texas probate toolbox is the Small Estate Affidavit (SEA). Think of it as an express lane for settling an estate. It’s a sworn legal document that lets heirs collect property and assets without ever stepping into a courtroom for a full probate hearing.

Of course, there are some firm rules to qualify, as laid out in Chapter 205 of the Texas Estates Code. An SEA is only an option if:

- The estate’s total value (not counting the homestead and certain other exempt property) is $75,000 or less.

- The person died without a will (this is known as dying “intestate”).

- The estate’s assets are worth more than what it owes in debts.

- All the heirs are on the same page about how the property should be split up and are willing to sign the affidavit.

Once the affidavit is approved by the court, the heirs can take that court order straight to the bank or any other institution holding the assets. It’s their green light to release the property directly to the family, completely bypassing the need for an executor and formal court proceedings.

Muniment of Title: A Uniquely Texan Process

Texas offers another simplified path called Muniment of Title. This one is a bit different because it’s used when there is a valid will. It works beautifully for estates that don’t have any outstanding debts, other than something secured by real estate, like a home mortgage.

With a Muniment of Title, you’re essentially asking the court to just officially recognize the will as the true and final transfer of ownership. It’s a one-and-done deal.

Once the court gives its stamp of approval, the will itself acts like a deed, legally transferring title of the assets to the beneficiaries. You don’t have to appoint an executor or file a detailed inventory of assets with the court, which keeps things private and incredibly straightforward.

Muniment of Title really showcases the practical, common-sense side of the Texas legal system. It respects the wishes laid out in a will but ditches all the formal administrative steps when they just aren’t needed to protect creditors.

A Real-World Scenario: Maria’s Inheritance

Let’s imagine an elderly woman named Maria passes away. She lived a simple life in a rental apartment and had a single savings account with $30,000. She didn’t have a will and had no debts.

Her only heirs are her two adult children. They’re grieving and feel completely overwhelmed by the thought of hiring lawyers and going to court.

For them, the Small Estate Affidavit is a perfect fit. The siblings can work together on the affidavit, listing their mother’s savings account and confirming she had no debts. After filing it with the court, they get a certified copy of the order, which they take to the bank. The bank releases the funds to them, and that’s it—the entire process is wrapped up for a fraction of what a standard probate would have cost.

This simple process lifts a massive weight off their shoulders, both financially and emotionally. It lets them focus on their family instead of a drawn-out legal process and ensures their mother’s legacy, no matter how modest, goes directly to them without delay, which is critical for their own families’ financial stability.

Navigating these options can still feel complicated, and it’s crucial to make sure every box is ticked correctly. If you think your loved one’s estate might qualify for one of these simpler paths, our team is here to offer compassionate, clear-headed guidance. Contact The Law Office of Bryan Fagan, PLLC for a consultation to find the most efficient way forward for your family.

Pulling It All Together to Protect Your Family’s Future

After walking through the different strategies, from trusts to deeds, the goal is always the same: avoid probate in Texas and protect the people you care about most. This kind of thoughtful estate planning is so much more than just numbers on a page or the legal title to a house. It’s a genuine act of care, designed to give your spouse and kids stability, privacy, and peace of mind when they’ll need it most.

By planning ahead, you’re essentially building a shield. You’re protecting your family from the stress and public nature of a long, drawn-out court process. You’re making sure they can immediately get to the resources they need to move forward without financial stress. But most importantly, you’re preserving your legacy while looking out for their emotional well-being.

It’s About More Than Assets; It’s About Stability for Your Kids

The link between a solid estate plan and a child’s well-being is incredibly direct and powerful. When a parent passes away, a kid’s entire world is turned upside down. The absolute last thing they need is for that emotional chaos to be made worse by financial instability or family fighting over assets.

A well-designed plan that sidesteps probate creates a seamless transition. It keeps their home secure and makes sure money is available for their education and day-to-day needs without any hiccups. This continuity is a critical anchor for a grieving child, letting them focus on healing instead of worrying about what’s next. It ensures their academic progress isn’t derailed by financial uncertainty or family turmoil.

At The Law Office of Bryan Fagan, PLLC, we believe the best estate plans are built on a foundation of empathy. We leverage our extensive experience in Texas family law to get that you aren’t just transferring property—you’re protecting futures and providing comfort for the next generation.

Finding Your Personalized Path Forward

There’s no single magic bullet for Texas families. The right mix of tools—whether that’s a revocable living trust, a Transfer on Death Deed, or just being smart with beneficiary designations—depends completely on your unique family dynamics and financial picture.

- For young families with minor children, a trust is often essential to manage inheritances responsibly until they’re older.

- For someone whose main asset is their home, a Transfer on Death Deed might be the most straightforward and effective solution.

- For blended families, a carefully structured plan is absolutely crucial to head off disputes and make sure everyone is provided for exactly as you intend.

The most important thing is simply taking that first step. Putting it off is the single biggest threat to any family’s security. A conversation with an experienced attorney can help clarify your goals and map out a clear, actionable path to protect what matters most to you.

A Real-Life Example: Protecting a Family Legacy

Let’s look at a real-world scenario. Consider Michael and Jessica, who owned a successful small business and had two teenagers. Their biggest fear was that if something happened to them, the business would get tangled up in probate, threatening its very survival and their kids’ inheritance.

Working with their attorney, they put a comprehensive plan in place. They placed their business interests and their home into a revocable living trust, naming a trusted business partner as a co-trustee to step in and manage the company if needed. They also double-checked and updated the beneficiary designations on all their life insurance and retirement accounts.

When Michael passed away unexpectedly, the plan worked just as they’d hoped. As the surviving trustee, Jessica had immediate, seamless control over all their assets. The business kept running without a single interruption, providing financial stability for her and the kids. They were able to grieve together as a family, shielded from the stress and public eye of probate court. This is the exact peace of mind that proactive planning delivers. This stability was crucial for their teenagers’ emotional health, allowing them to remain in their home and school without disruption.

At The Law Office of Bryan Fagan, PLLC, our commitment is to the families of Texas. We have the experience and authority to help you build a personalized plan that reflects your values and protects your loved ones. Don’t leave their future to chance.

Schedule a consultation with our dedicated estate planning attorneys today and take the definitive step toward safeguarding your family’s future.