If you’ve ever stood in the grocery aisle doing quiet math in your head—trying to stretch dollars, comparing prices, or wondering whether now is really the time to replace the car battery that died again—you know how quickly the everyday responsibilities of parenting can feel overwhelming. Add a divorce or custody order into the mix, and those ordinary stresses can collide with serious legal questions, including the one many Texans eventually face in moments of worry: what are the consequences of unpaid child support in Texas? For parents already carrying the emotional weight of a family transition, that question can stir fear, frustration, and uncertainty about what comes next.

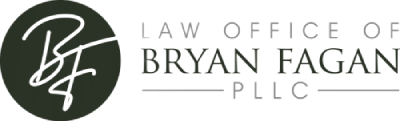

At The Law Office of Bryan Fagan, PLLC, we recognize that child support is much more than a financial obligation—it’s a lifeline that helps families maintain stability, consistency, and dignity during one of the hardest chapters of their lives. We’ve met countless parents who weren’t trying to avoid responsibility. They were simply struggling to keep up while navigating job shifts, rising expenses, or unexpected emergencies. And we’ve seen how quickly missed payments can escalate into court actions, strained relationships, and stress that affects the entire family.

Guided by our mission—our why—we aim to empower people to reclaim freedom and peace of mind during life’s most challenging transitions. Our how is through compassionate counsel, clear education, and innovative legal solutions that simplify complexity rather than add to it. And our what—the services we provide—is rooted in protecting what matters most: your children, your stability, and your future.

Led by Bryan Joseph Fagan, a South Texas College of Law graduate and trusted authority in Texas divorce and custody law, our firm leverages years of real-world experience to help families understand how the Texas Family Code approaches unpaid child support, how enforcement truly works in practice, and what parents can do to protect themselves before consequences intensify.

In the sections that follow, you’ll learn exactly how Texas handles unpaid child support, the legal and personal stakes involved, and the actionable steps you can take today to regain control of your situation. Most importantly, you’ll find reassurance that support, clarity, and solutions are within reach. Let’s begin.

Key Takeaways

- Unpaid child support in Texas can result in jail time up to 2 years, wage garnishment, and license suspension

- The Texas Attorney General enforces child support through multiple tools including property liens, tax refund interception, and credit reporting

- Support modifications under Texas Family Code §156.401 only apply going forward, never retroactively to reduce past-due amounts

- Unpaid child support continues to accrue interest and remains collectible even after the child reaches adulthood

- Early legal intervention can prevent costly enforcement actions and protect both parental rights and children’s financial security

Understanding the Serious Nature of Unpaid Child Support in Texas

Understanding What Are the Consequences of Unpaid Child Support in Texas requires more than a surface-level look at missed payments—it requires recognizing how quickly unpaid support can escalate into legal, financial, and even criminal repercussions under the Texas Family Code. When a parent falls behind, they are not simply accumulating a debt; they are violating a court order established under Texas Family Code Chapter 154, which outlines a parent’s financial duty to their child. These orders are designed to ensure a child’s basic needs are met, including food, housing, medical care, and other essential expenses. When support stops, the custodial parent often bears the full burden, and children can lose access to the stability and resources they depend on.

Texas courts and the Office of the Attorney General take enforcement extremely seriously. Under Texas Family Code §§ 157.001–157.009, the State may initiate enforcement actions that include wage garnishment, tax refund intercepts, liens against property and financial accounts, driver’s license and professional license suspensions, and contempt proceedings. Updated enforcement provisions also allow for the suspension of recreational licenses and reporting of arrears to credit bureaus. In more severe or willful cases, criminal nonsupport charges under Penal Code § 25.05 may apply, carrying the possibility of fines and state jail confinement. These tools aren’t meant simply to punish—they’re designed to compel compliance so children receive the support the law requires.

The range of consequences can be overwhelming. Administrative actions may interrupt employment, limit mobility, or restrict professional opportunities, while judicial actions may result in incarceration or long-term financial penalties. For parents navigating these challenges, the most important step is gaining clarity about their rights and obligations. Helpful resources such as the firm’s guide on What to Do If the Other Parent Stops Paying Child Support can provide immediate direction.

For families facing mounting arrears or uncertainty about next steps, speaking with an experienced Texas child support attorney can make all the difference. Practitioners at The Law Office of Bryan Fagan, PLLC, a trusted resource for Texas families, help parents understand their options, respond to enforcement actions, and pursue solutions that protect both their financial future and their children’s wellbeing. Whether a parent needs to explore modification, negotiate arrearage payments, or understand the implications of enforcement tools, compassionate legal guidance can restore stability and provide a path forward.

To explore related issues or learn how Texas handles nonpayment and enforcement, parents can also review this helpful internal resource: Child Support Information Center.

Criminal Consequences: Jail Time and Felony Charges

When parents fail to pay child support in Texas, they face two distinct types of criminal exposure that can result in serious jail time. The legal system treats unpaid support as both a civil violation and, in some cases, a criminal offense.

Contempt of court charges represent the most common path to incarceration for parents who refuse to pay child support. Under Texas Family Code, when a parent fails to comply with a support order, courts can hold them in contempt and impose up to six months in jail for violating court orders. This isn’t punishment in the traditional criminal sense—it’s considered “coercive” incarceration designed to motivate compliance. The parent can often “purge” the contempt by making payments or agreeing to a court-approved payment plan.

However, the stakes get much higher with criminal nonsupport charges under Texas Penal Code Section 25.05. When parents knowingly fail to provide court-ordered support for children under 18, prosecutors can file felony charges that carry much more severe penalties than contempt proceedings. This state jail felony offense can result in six months to two years imprisonment and fines up to $10,000.

The distinction matters enormously. While contempt focuses on getting parents to pay, criminal nonsupport creates a permanent criminal record that can affect employment, housing, professional licenses, and other opportunities for years to come. Prosecutors typically pursue these felony charges when parents have demonstrated a pattern of willful non-payment despite having the financial ability to pay.

Financial and Administrative Enforcement Actions

Texas offers one of the most comprehensive enforcement systems in the country, and understanding What Are the Consequences of Unpaid Child Support in Texas is essential for any parent facing arrears or enforcement action. Under the Texas Family Code—particularly §§ 157.001–157.327 and the updated income withholding provisions in Chapter 158—the State has broad authority to pursue nearly every source of a parent’s income or assets when support goes unpaid. These enforcement actions often begin automatically, making it critical for parents to act quickly when they fall behind.

One of the most powerful tools is income withholding. Texas Family Code Chapter 158 authorizes the Attorney General to issue an Income Withholding Order (IWO) directing employers to deduct support from a parent’s paycheck before the wages ever reach the parent. Employers are legally required to comply and may face penalties if they fail to do so. This ensures consistency and reduces the risk of accumulating arrears, but it also means enforcement can continue even if a parent is struggling financially. For those already dealing with past-due support, resources like this guide to handling child support arrears can be invaluable.

Texas may also intercept various forms of income beyond wages. Under state and federal law, tax refunds, lottery winnings, and certain government payments may be seized to satisfy unpaid support. The federal tax refund offset program, authorized by 42 U.S.C. § 664 and implemented in coordination with Texas Family Code enforcement procedures, frequently results in parents losing their entire refund when arrears exist. These measures reflect the State’s focus on ensuring children receive the support they are owed.

The enforcement authority extends further through liens filed under Texas Family Code § 157.3171. These liens can attach to bank accounts, real estate, vehicles, and even retirement accounts. Once a lien is in place, the parent cannot sell, refinance, or access the asset without addressing the past-due child support. Importantly, child support arrears cannot be discharged in bankruptcy under federal law, meaning these obligations follow parents long-term unless addressed directly. This is why families often turn to legal professionals at firms like the Texas Family Law Team at the Law Office of Bryan Fagan to understand their options and develop a strategic plan before enforcement intensifies.

Parents looking for additional guidance can explore related resources such as the Child Support Information Center for help navigating Texas child support obligations and enforcement tools.

License Suspensions and Professional Restrictions

License suspension represents one of the most disruptive enforcement tools available to Texas authorities, affecting everything from basic transportation to professional livelihoods. The state can suspend a wide range of licenses for parents who fall behind on support, creating cascading effects that touch every aspect of daily life.

Driver’s license suspension is perhaps the most immediate and visible consequence. When parents lose their driving privileges, they often struggle to maintain employment, especially in Texas where public transportation options may be limited. This creates a vicious cycle where license suspension leads to job loss, which makes it even harder to catch up on child support payments.

The reach extends far beyond driving privileges to encompass business licenses, professional licenses, hunting licenses, and even concealed weapon permits. Healthcare professionals can lose medical licenses, attorneys can lose their bar licenses, contractors can lose their trade licenses, and real estate agents can lose their ability to practice. The impact varies by profession, but for many parents, professional license suspension effectively eliminates their primary source of income.

Texas Family Code authorizes these suspensions specifically as child support enforcement tools, and licenses remain suspended until support obligations are current. Unlike some administrative penalties that might have appeal processes or time limits, license suspensions for unpaid support continue until the underlying debt is resolved. This gives the state enormous leverage over parents who depend on their licenses for their livelihood.

Credit and Financial Reputation Consequences

Unpaid child support can trigger a cascade of long-term financial and personal consequences, and understanding What Are the Consequences of Unpaid Child Support in Texas is essential for any parent facing arrears. Under the Texas Family Code—particularly §§ 157.001, 157.311, and 154.004—the State is authorized to pursue enforcement measures that affect nearly every area of a parent’s financial life. These consequences don’t stop once payments resume; they can follow a parent for years, shaping their creditworthiness, housing opportunities, and even their ability to travel.

One of the most significant impacts involves credit reporting. Delinquent child support is routinely reported to major credit bureaus as allowed under Texas Family Code § 157.3171. Unlike many debts that fall off a credit report after seven years, child support arrears can remain visible indefinitely until the balance is fully satisfied. This can make it difficult to qualify for mortgages, car loans, personal credit, or even rental housing. Parents grappling with these issues may find helpful guidance in resources like this article on jail and enforcement risks for unpaid support, which explores additional enforcement pathways and what parents should expect.

The consequences can also extend beyond state lines. Under federal law and supported by Texas enforcement procedures, parents who owe $2,500 or more in unpaid child support may be denied a U.S. passport. This restriction can derail work-related travel, interrupt international visitation plans, or prevent parents from seeing family abroad. For Texans employed in industries that require global mobility, this can have serious professional and emotional implications.

Texas also maintains a public “Child Support Evader” list through the Office of the Attorney General, which is authorized under Texas Family Code § 231.0011. Parents who meet certain criteria—such as owing substantial arrears and actively avoiding enforcement—may be featured on this public-facing platform. Beyond the financial consequences, this type of visibility can affect a parent’s reputation, employment prospects, and personal relationships. It is often one of the most painful consequences for families working to rebuild stability.

Parents seeking additional insight into handling arrears or preventing these long-term effects can explore supportive resources like the Texas Child Support Information Center. For those already experiencing enforcement actions, speaking with a knowledgeable attorney at The Law Office of Bryan Fagan, PLLC or “the Texas Family Law Team,” depending on the context of the article, can help restore control and provide a clear plan forward. Our mission remains the same: protecting your family’s future with clarity, compassion, and legally grounded solutions.

The Compounding Problem: Why Ignoring Unpaid Support Makes Everything Worse

When parents begin exploring What Are the Consequences of Unpaid Child Support in Texas, one of the most important realities to understand is how quickly a small problem can escalate into a long-term financial crisis. Under the Texas Family Code—particularly §§ 157.001, 157.263, and 157.265—the State is required to enforce unpaid child support aggressively, and these obligations grow with time rather than fading away. Many disputes arise simply because parents do not realize how fast arrears accumulate or how enforcement intensifies, a topic explored in this article on common reasons for Texas child support disputes.

One of the most challenging aspects of unpaid support is interest accrual. Texas law mandates a 6% annual interest rate on past-due child support (§157.265), meaning even a modest arrearage can expand significantly if left unaddressed. A parent who falls behind by $5,000 today could owe nearly double that amount a decade later, even without additional missed payments. This compounding effect often surprises parents and is a common source of confusion and conflict in enforcement cases.

As arrears continue to grow, enforcement measures become progressively more serious. At first, a parent may experience administrative actions like federal tax refund intercepts or financial institution data matches under §157.327. If unpaid support persists, the consequences escalate to driver’s license suspensions (§232.003), liens on property (§157.3171), and wage withholding. Continued nonpayment may eventually lead to contempt actions, fines, or even criminal nonsupport charges under Penal Code §25.05. Each step adds new financial and emotional strain, making the issue more difficult to resolve over time.

Another key factor is that unpaid child support never simply “expires.” Even though ongoing support obligations typically end when a child turns 18 or graduates high school (Texas Family Code §154.001), arrears do not. Past-due child support remains collectible indefinitely, and enforcement tools stay active until the balance is paid in full. Decades-old arrears can still result in wage garnishment, intercepts, and other compulsory collection efforts.

These escalating consequences are among the reasons disputes often arise between parents—some stemming from misunderstandings, others from financial hardship or lack of communication. Families seeking to understand why conflict occurs may find additional insight in the firm’s Texas Child Support Resource Center, which provides guidance to help parents avoid misunderstandings that lead to enforcement.

For parents already facing arrears, early legal intervention is essential. The team at the Texas Family Law Group at the Law Office of Bryan Fagan helps families navigate modification requests, negotiate arrearage payment plans, and address enforcement actions before they escalate. Support issues do not have to spiral—and with experienced legal guidance, families can often regain control long before penalties become overwhelming.

Legal Standards for Child Support Modification Under Texas Family Code §156.401

Texas law recognizes that parents’ financial circumstances can change, but the legal standards for modifying child support are specific and must be met before courts will consider changes to existing orders.

The three-year rule provides an automatic pathway for modification review. Either parent can request a modification if three years have passed since the current order was established, regardless of whether circumstances have changed. This gives both parents periodic opportunities to ensure that support amounts remain appropriate as children grow and circumstances evolve.

Before the three-year mark, parents must demonstrate a “material and substantial change” in circumstances to qualify for modification. The Texas Family Code requires that any proposed modification would result in either a 20% change in the support amount or a difference of at least $100 per month. Simply wanting to pay less or receive more isn’t sufficient—there must be concrete changes in income, child-related expenses, or family circumstances.

Common qualifying changes include job loss, disability, significant income increases or decreases, birth of additional children, changes in the child’s medical needs requiring additional medical and dental support, or modifications to custody arrangements that affect the amount of time each parent spends with the child. However, parents must act quickly when these changes occur, as delays can result in continued accumulation of support debt under the old order.

Critical Limitation: Modifications Apply Only Going Forward

One of the most misunderstood aspects of What Are the Consequences of Unpaid Child Support in Texas is the strict rule against retroactive modification. Under Texas Family Code §156.401, courts are prohibited from reducing or forgiving past-due child support, even when a parent later proves that a change in circumstances made payment impossible. This means that a modification—no matter how justified—can only change future child support obligations. Arrears that have already accumulated, along with the 6% annual interest required by §157.265, remain fully collectible until paid in full.

This rule creates a critical timing issue for Texas parents. If a parent loses a job in January but waits until June to file a modification request, the court cannot erase the five months of support that went unpaid. Those missed payments immediately become arrears, subject to wage withholding, license suspension, property liens, tax refund intercepts, and other enforcement tools outlined in Texas Family Code Chapters 157 and 232. These debts remain enforceable for life and do not disappear when a child turns 18. For parents hoping to explore whether any relief options exist, the firm’s guide on how child support arrears may be addressed in Texas offers helpful insight into limited exceptions and practical strategies.

The practical impact of delaying a modification is enormous. Even when a parent’s income drops dramatically—whether due to unemployment, illness, or an unforeseen emergency—the meter continues running until a petition is filed. A parent who believes their situation will quickly improve may unintentionally create thousands of dollars in arrears because Texas courts cannot retroactively adjust previous obligations. Once arrears exist, they are subject to every enforcement mechanism available under state law.

This is why attorneys at the Texas Family Law Team with the Law Office of Bryan Fagan emphasize the importance of filing for modification as soon as circumstances change. Acting quickly preserves legal rights, prevents unnecessary debt, and protects parents from enforcement actions that can jeopardize employment, transportation, credit, and housing. Even if a parent is uncertain whether their change in circumstances meets the statutory standard, filing early safeguards them against irreversible arrears.

Parents seeking guidance on modification, enforcement, or arrearage management can find additional support in the firm’s Texas Child Support Resource Center. With knowledgeable legal counsel and prompt action, families can prevent small challenges from growing into long-term financial burdens.

The Importance of Immediate Legal Action

When parents are trying to understand What Are the Consequences of Unpaid Child Support in Texas, one of the most important lessons is that timing matters. Texas has one of the strongest enforcement systems in the country, and under the Texas Family Code—particularly Chapters 154, 157, and 231—penalties can escalate quickly if arrears are ignored. Early action not only preserves more options but can also prevent long-term financial and legal harm. For parents facing the added stress of a job loss, health issue, or other crisis, it is reassuring to know that Texas law still provides pathways for relief if action is taken promptly.

Reaching out proactively to the Texas Attorney General’s Child Support Division often leads to better outcomes than waiting for formal enforcement. In many cases, the Attorney General can work with parents to establish payment arrangements or adjust withholding amounts before more serious measures take effect. Once an enforcement proceeding is filed under Texas Family Code § 157.002, however, options narrow significantly. Parents may also benefit from reviewing resources such as this guide on receiving child support after the paying parent dies to better understand how obligations continue and how the law protects a child’s right to support, even in difficult circumstances.

Legal representation becomes essential when enforcement is already looming. Attorneys at the Texas Family Law Team at the Law Office of Bryan Fagan regularly help parents negotiate with the Attorney General, request compliance hearings, and pursue a modification under Texas Family Code § 156.401 when there has been a material and substantial change in circumstances. Effective representation can help avoid criminal nonsupport charges, prevent unnecessary license suspensions, and stop arrears from growing due to interest, which continues at 6% annually until paid in full.

Ignoring the problem is almost always the most expensive path. License suspensions under Texas Family Code § 232.003 can affect employment and income. Contempt proceedings may lead to fines or jail time. Interest on arrears compounds, making repayment far more difficult the longer enforcement is delayed. For many families, consulting a knowledgeable attorney early not only prevents escalating penalties but also restores a sense of clarity and control during an otherwise overwhelming time.

Parents who need additional guidance can visit the firm’s Child Support Resource Center for educational articles, practical insights, and support in navigating Texas child support laws.

Our Mission: Ensuring Every Texas Child Receives Consistent Financial Support

At the Texas Family Advocacy Team at the Law Office of Bryan Fagan, our mission goes far beyond explaining What Are the Consequences of Unpaid Child Support in Texas. We believe every child deserves consistent financial support, and every parent deserves guidance rooted in compassion, clarity, and respect. Texas child support laws—primarily outlined in Texas Family Code Chapters 154 and 157—are built to ensure children receive the financial resources they need to grow, thrive, and enjoy stability, no matter the circumstances of their parents. When support is paid consistently, children benefit from secure housing, access to healthcare, proper nutrition, and opportunities that nurture their development.

Child support is not a punishment or a personal judgment—it is a reflection of Texas public policy that both parents share legal and financial responsibility for their children. Texas Family Code § 154.001 makes clear that support obligations exist to serve the best interests of the child, ensuring they receive the material and emotional stability they deserve. When payments lapse, consequences can be significant, but the underlying purpose remains focused on protecting a child’s wellbeing. Parents who want a deeper understanding of these obligations and enforcement tools can explore the firm’s comprehensive guide: Texas Child Support Overview & Resources.

We also recognize that many parents who fall behind are not unwilling—they are overwhelmed. Job losses, medical issues, rising costs of living, and unexpected emergencies can make it difficult to meet support obligations. The Texas Family Code provides legal mechanisms, including modification under § 156.401, that allow parents to request adjustments when circumstances materially change. Our attorneys help parents navigate these processes with practical solutions that support long-term stability rather than short-term panic.

At the same time, our firm remains deeply committed to enforcing orders that protect children’s financial security. Through comprehensive legal representation, we help parents understand their obligations, evaluate whether modification is appropriate, and respond to enforcement actions under § 157.001 that may threaten wages, licenses, or liberty. We focus not only on legal strategy but on the real-life challenges families face during these stressful periods.

Ultimately, our goal is to achieve outcomes that honor the best interests of children while preserving dignity, parental relationships, and long-term financial stability. Whether a family is requesting enforcement, defending against it, or seeking modification, we guide them with empathy and clarity at every step. Parents seeking more information about Texas child support laws, enforcement options, or modification rights can visit the firm’s Texas Child Support Resource Center for additional support and education.

Actionable Steps for Parents with Unpaid Child Support in Texas

When parents begin researching What Are the Consequences of Unpaid Child Support in Texas, one of the most important lessons is that early action can prevent serious, long-term consequences. Texas enforcement laws—especially those in Texas Family Code Chapters 154, 157, and 231—move quickly once arrears begin to accumulate. Delays can lead to escalating penalties, financial hardship, or even risks similar to situations described in this cautionary story about a father who lost his home. Taking proactive steps is essential to protecting both your rights and your financial stability.

A strong first step is documenting your situation thoroughly. Families should gather pay stubs, tax returns, bank records, termination notices, medical documentation, or anything else that shows why payments were missed. This evidence becomes critical when requesting modification under Texas Family Code § 156.401, which requires proof of a “material and substantial change” in circumstances before a court can adjust ongoing support.

Parents should also contact the Texas Attorney General’s Child Support Division as early as possible. Reaching out before enforcement begins often leads to more manageable payment plans, temporary arrangements, or other solutions that reduce the risk of harsh penalties like license suspension or property liens under Texas Family Code § 232.003 and § 157.3171. Waiting for a formal enforcement notice can narrow your options considerably.

If your income has decreased or your circumstances have changed significantly, filing for a modification immediately is essential. Texas law does not allow retroactive modification, meaning courts cannot reduce past-due amounts regardless of your hardship. Every month you wait adds to your arrears, and those arrears continue to accrue interest under Texas Family Code § 157.265 until fully paid.

Legal representation is often the key to avoiding the most severe consequences. Attorneys at the Texas family law team at the Law Office of Bryan Fagan help parents negotiate payment arrangements, defend against enforcement actions, pursue modifications, and navigate contempt hearings under Texas Family Code § 157.166. Early legal guidance can mean the difference between a manageable plan and overwhelming penalties that threaten employment, property, and financial security.

Finally, parents should create a realistic and sustainable plan for meeting current and future support obligations. Demonstrating good faith—through partial payments, communication, and clear budgeting—can influence how courts and the Attorney General respond. Families looking for additional support can explore helpful resources like the firm’s Texas Child Support Resource Center for guidance tailored to Texas parents working to regain stability and protect their future.

Protecting Your Future: Understanding Consequences Prevents Severe Penalties

Understanding what are the consequences of unpaid child support in Texas empowers parents to make informed decisions that protect both their future and their children’s wellbeing. Knowledge of the state’s enforcement tools enables proactive planning that can prevent devastating outcomes like criminal charges, license suspensions, and long-term financial damage.

The key insight is that Texas’s child support enforcement system is designed to escalate consequences over time, making early action exponentially more valuable than delayed response. Parents who address problems immediately often find cooperative solutions that preserve their ability to work, maintain professional licenses, and avoid criminal exposure. Those who wait typically face much more limited and expensive options.

Proper legal guidance makes the difference between resolution and escalation. An experienced child support attorney understands how enforcement procedures work, knows what options are available at different stages of the process, and can often negotiate outcomes that protect both parental rights and children’s financial security.

Schedule Your Free Consultation with the Law Office of Bryan Fagan PLLC

Don’t wait for the situation to escalate before learning What Are the Consequences of Unpaid Child Support in Texas or understanding how to protect yourself from the most serious enforcement actions. The longer arrears go unaddressed, the more aggressively the State may proceed under the Texas Family Code—including wage withholding (§158.001), license suspension (§232.003), property liens (§157.3171), and even contempt hearings (§157.166). Early action gives you options, and speaking with a knowledgeable child support attorney can prevent consequences that become harder to reverse over time.

At this stage, personalized legal guidance matters. The team at the Texas Family Law Group at the Law Office of Bryan Fagan has extensive experience helping parents navigate enforcement proceedings, negotiate payment plans, pursue modification under §156.401, and defend against criminal nonsupport allegations. Each case is unique, but the pattern is clear: parents who seek help early almost always secure better outcomes than those who wait for enforcement to begin. You can learn more about what strong legal advocacy looks like by reviewing this resource on securing an experienced Texas child support enforcement lawyer.

When you schedule a consultation, our attorneys take the time to review your financial situation, identify whether a modification may be appropriate, and outline a plan that protects your rights while addressing the needs of your child. We understand the stress that child support issues create for the entire family, and our goal is to provide clarity, direction, and practical strategies that support long-term stability. For many parents, simply knowing what steps to take next brings a sense of relief and control that has been missing for far too long.

If you are already facing enforcement, or fear you might soon, this is the moment to act. The consequences outlined in the Texas Family Code are serious, but they are not inevitable. With timely legal support, parents can often avoid the harshest penalties and regain financial footing before the situation becomes overwhelming. Additional guidance is available through helpful firm resources like the Texas Child Support Information Center, which provides education and support for families navigating complex child support challenges.

The attorneys at The Law Office of Bryan Fagan, PLLC are here to help you understand your options, safeguard your rights, and move forward with confidence. Reach out today to schedule your free consultation. Taking that first step now can prevent significantly more serious consequences in the future and help you build a stable path forward for yourself and your child.

Conclusion:

When you’re dealing with unpaid child support—or any challenge tied to a family transition—it’s easy to feel like the legal system is just one more thing stacked against you. But understanding your rights and options is powerful. It turns uncertainty into clarity and stress into a plan. And if there’s one takeaway from this conversation, it’s that you don’t have to navigate these moments alone or guess your way forward.

Every family’s situation is different, and the right guidance can make all the difference in protecting your wellbeing and restoring stability. Working with an experienced Texas family law attorney gives you the support, strategy, and confidence needed to address problems before they grow and to protect the future you’re building for yourself and your children. At The Law Office of Bryan Fagan, PLLC, that’s exactly why we do what we do—to empower families with peace of mind during life’s hardest transitions.

If reading this has stirred a few new questions or even a sense of relief that there are solutions, that’s a good sign. It means you’re already moving toward clarity. And if you’re ready to take the next step, our team is here to listen, guide, and stand with you every step of the way.

Life doesn’t pause when legal issues rise up—but the right help can make the road ahead feel a whole lot smoother. When you’re ready, we’re here.

Frequently Asked Questions About Unpaid Child Support in Texas

When child support goes unpaid, the amount owed becomes a legal debt called arrears, and Texas can use several enforcement tools to collect it. These include wage garnishment, tax refund interception, bank account levies, license suspension, and contempt of court. In more serious cases—especially when a parent intentionally refuses to pay—criminal charges may follow. Interest continues to grow until the balance is paid in full, and the debt never goes away, even after the child becomes an adult.

Texas does not set a specific number of missed payments that triggers a warrant. Instead, a warrant (called a capias) is usually issued after an enforcement action is filed, the parent fails to attend a hearing, or the court finds a willful failure to follow its orders. Being even a few months behind can lead to a hearing, and ignoring the court can lead to arrest.

There is no minimum dollar threshold for felony nonsupport. A felony charge occurs when a parent intentionally or knowingly fails to pay court-ordered support over time, despite having the ability to do so. Criminal nonsupport is a state jail felony punishable by 180 days to 2 years in jail and fines up to $10,000.

Although Texas has no statute formally called the “deadbeat dad law,” the term refers to Texas’s strict enforcement system for unpaid support. This system allows the state to suspend licenses, seize tax refunds, place liens on property, report delinquencies to credit bureaus, hold parents in contempt, and—when necessary—pursue criminal nonsupport charges. The law applies to all parents, not just fathers.

Texas periodically updates its child support guidelines and enforcement tools. Recent changes have focused on adjusting the income cap used for guideline calculations and refining enforcement rules to reflect modern financial realities. Because laws evolve, it’s important to speak with a Texas family law attorney to understand how current statutes may affect your case.

Not automatically. Failure to pay child support becomes a felony when the state can prove that the parent intentionally or knowingly refused to provide support as ordered. Many cases remain civil, but felony prosecution is possible when nonpayment is severe, repeated, and willful.

A purge payment is an amount set by the judge during a contempt case to give the parent an opportunity to avoid jail or secure release after being held in contempt. It’s essentially a court-ordered payment toward the arrears that must be made immediately or within a short timeframe. Purge payments are based on the parent’s ability to pay and are designed to encourage compliance with existing support orders.

Yes. Texas courts can issue a capias warrant when a parent fails to appear in court for a child support enforcement hearing or fails to comply with the court’s instructions regarding payment. Being arrested on a child support warrant can lead to jail time, additional court fees, and tougher enforcement measures. Importantly, paying something toward support and staying in communication with the court or the Attorney General can often prevent a warrant from being issued.