Going through a divorce or planning your estate can feel overwhelming, especially when you're trying to understand your financial rights and obligations. But understanding one key principle of Texas law can bring much-needed clarity: Texas is a community property state.

This concept is the bedrock of how assets and debts are handled in a Texas marriage. In simple terms, most property acquired by you or your spouse from your wedding day forward is presumed to belong equally to both of you. It doesn't matter whose paycheck bought it or whose name is on the title. Knowing how this works is the first step toward protecting your financial future.

What Counts as Marital Property in Texas?

Texas is one of only nine states that follow community property rules. This legal framework has a massive impact on how your financial life is viewed by the courts, especially during a divorce or when a spouse passes away.

To get a handle on this, it helps to think of your marriage as creating a shared financial pot.

The "Community Presumption" in Texas

The Texas Family Code establishes a powerful starting point called the "community presumption." This rule assumes that nearly everything earned, bought, or acquired by either spouse during the marriage belongs to the community estate.

This shared pot typically includes:

- Income from Work: The paychecks you and your spouse earned while married.

- Property Bought During Marriage: That new car, the house, the furniture—if you bought it after saying "I do," it’s generally community property, even if only one of you is on the deed or loan.

- Retirement Funds Built Up During Marriage: The value that your 401(k), pension, or IRA gained during your marriage years is also considered part of the community.

Courts start with this assumption because Texas law recognizes that both spouses contribute to the marriage, whether by earning an income or by managing the household and raising a family. It’s all seen as a joint effort.

Of course, not everything automatically falls into this shared pot. The law makes a clear distinction for "separate property," which are assets that belong entirely to one spouse. Understanding this distinction is key, as we'll explore next. For a more detailed look, you can review these community property essentials for Texas divorces to build a solid foundation of knowledge.

Community vs. Separate Property in Texas at a Glance

This table provides a simple comparison of what typically qualifies as community versus separate property under Texas law, helping you quickly grasp the fundamental differences.

| Characteristic | Community Property (The Shared Pool) | Separate Property (Yours Alone) |

|---|---|---|

| When Acquired? | During the marriage | Before marriage or after legal separation |

| How Acquired? | Purchased with funds earned during the marriage | Received as an individual gift or inheritance |

| Common Examples | Income, houses/cars bought during marriage, retirement funds accrued during marriage | Property owned before the wedding, inherited assets, personal injury awards (for pain/suffering) |

| Legal Presumption | Presumed to be community property unless proven otherwise | Must be clearly proven as separate with "clear and convincing evidence" |

Understanding the character of each asset is the most important step in any Texas divorce or estate plan. Getting it wrong can have significant financial consequences.

Understanding the Community Property Presumption

When you're facing a Texas divorce or creating an estate plan, one core rule shapes everything: the community property presumption. Think of it as the default setting for all marital property. It’s the starting point for every conversation about who gets what, and understanding it is the first step toward protecting your assets.

In simple terms, Texas law presumes that anything you or your spouse acquired from your wedding day until the day you divorce belongs to the marital estate—to both of you. It doesn't matter whose paycheck bought it or whose name is on the title. A car bought with your salary but titled in your name? The court sees it as community property. A stock portfolio funded during the marriage? Community property.

The key word here is "presumed." The law automatically assumes everything is shared unless one spouse can prove otherwise. This puts the burden of proof entirely on the person trying to claim an asset as their separate, individual property.

Where Does This Rule Come From?

This isn't a new legal trend. Texas has been a community property state since 1840, and this principle has been a cornerstone of our legal system ever since, reflecting the view that marriage is a true partnership.

The rule is officially laid out in the Texas Family Code § 3.003(a), which states that any property in either spouse's possession during or at the end of a marriage is presumed to be community property. Texas courts have reinforced this idea time and again, making it one of the most solid principles in family law. You can dive deeper into the history of Texas marital property law to see how these concepts evolved.

This historical weight is significant because it shows how deeply Texas law values non-financial contributions to a marriage, like managing a home or raising children, placing them on equal footing with earning an income.

Key Takeaway: The court’s default position is that everything you own is community property. If you believe an asset is yours alone, it's your job to provide the evidence to prove it.

How the Presumption Plays Out in Real Life

Let’s walk through a common scenario to see how this works.

Imagine Sarah and Tom are married. A few years in, Sarah takes money from her paycheck—earned during the marriage—and buys a classic car. She puts the title exclusively in her name. When they later file for divorce, Sarah insists the car is hers because she bought it and her name is on the title.

The court will almost certainly see it differently. Here’s why:

- The salary Sarah earned during the marriage is community property.

- Because she used community funds (her salary) to buy the car, the car is also community property.

- The name on the title is irrelevant in determining whether the asset is community or separate.

To keep the car as her own, Sarah would need to show clear and convincing evidence that she bought it with separate funds—perhaps money from an inheritance she received and kept in a totally separate bank account. Without that solid proof, the car is considered part of the marital estate and is subject to division.

This presumption isn't just for divorce; it’s also a huge factor in estate planning, dictating which assets a surviving spouse has a claim to and which can be passed to heirs through a will. It truly is the foundation upon which all other property rules are built.

How to Define Your Separate Property

While Texas law starts with a strong presumption that everything acquired during your marriage is a shared asset, it also draws a clear line around what belongs to you and you alone. This is called separate property.

Identifying what qualifies as your separate property is just as crucial as understanding the community pot. It’s the key to protecting the assets you brought into the marriage and anything you received personally along the way. Think of it as building a legal fence around what is yours.

According to Texas Family Code § 3.001, the definition is designed to keep your individual assets from being divided in a divorce.

What Qualifies as Separate Property in Texas

The law points to three main categories of separate property. But remember the catch: the spouse claiming an asset as separate must prove it with clear and convincing evidence—a high legal bar.

Here’s what typically qualifies:

- Property You Owned Before Marriage: This is the most straightforward category. Anything you owned before you were married is yours. That could be a house you bought, a savings account you’ve had since college, or an investment portfolio. If it existed before the wedding, it’s yours.

- Property Acquired by Gift: If someone gives you a gift meant only for you, it remains your separate property. For example, if your parents give you $10,000 for your birthday and make it clear the money is for you alone, those funds are yours, not part of the marital pot.

- Property Acquired by Inheritance: Anything you inherit from a loved one's estate is yours. If your grandmother leaves you her antique jewelry collection in her will, that jewelry belongs to you, not the community estate.

A Crucial Distinction: Here's something that surprises many people. The income generated from your separate property—like rent from a house you owned before the marriage or dividends from inherited stocks—is also considered your separate property. This is a big departure from your regular paycheck, which is always community property.

This specific rule has deep roots in Texas history. A major update to the law in 1917 declared that rents and profits from a spouse's separate property would also remain separate, a significant shift from older legal traditions. This evolution, with roots in statutes from as early as 1848, helped create the firm boundaries we have today. To dig deeper, you can explore the historical context of Texas marital property statutes and their evolution.

Proving Your Separate Property Claim

Because the law defaults to assuming everything is community property, just saying an asset is yours isn't enough. You must be able to trace it back to its source and prove its origins. This is where meticulous record-keeping becomes your best friend.

For instance, if you inherited $50,000, the smartest move is to deposit it into a brand-new bank account opened in your name only. If you drop it into the joint checking account you and your spouse use for daily expenses, those funds get "commingled" and risk being treated as community property.

Keeping things separate is the most critical step, and you can learn more about how separate property is defined in our detailed guide.

Your best defense is a solid paper trail. Start gathering documents like:

- Bank Statements: These can show an account existed before you got married or prove that inherited funds went into a separate account.

- Property Deeds: A deed dated before the marriage is powerful proof.

- Gift Letters or Wills: Any document that clearly states a gift or inheritance was intended for you alone is invaluable.

Without this evidence, a valuable separate asset could easily get swept into the community estate and divided. Taking the time to organize these documents now can save you a world of stress and protect what is rightfully yours.

In an ideal world, every asset would be neatly labeled "yours," "mine," or "ours." But real life, and especially real marriages, are more complex. This is where the concept of commingling becomes incredibly important.

Commingling happens when you mix separate property with community property, blurring the lines of ownership until they’re almost impossible to distinguish.

For example, let's say you inherit $20,000. That's your separate property. But if you deposit it into the joint checking account you share with your spouse, from which you pay the mortgage, buy groceries, and fund family vacations, you've just commingled the funds. That inheritance is no longer a distinct, separate asset; it has been absorbed into the community pot.

To reclaim those funds as separate property in a divorce, you would have to perform a meticulous process called tracing. This isn't easy and often requires hiring financial experts to painstakingly follow the paper trail and prove which dollars came from where.

The Challenge of Commingled Property

Once you mix assets, Texas law presumes the entire mixture is community property. The burden of proof is on you to provide clear and convincing evidence that a portion of it was originally yours alone. This is a high bar to clear, which is why keeping separate assets truly separate is so critical.

Here are a few common ways people unintentionally convert their separate property into community property:

- Depositing an Inheritance into a Joint Account: This is the most common mistake. The inherited money gets spent on joint bills and loses its separate identity.

- Paying Down a Joint Debt with Separate Money: Using funds from a pre-marital savings account to make a large payment on the mortgage for the house you bought together.

- Improving a Separate Asset with Community Funds: Let's say you owned a house before you got married (your separate property). If you then use income earned during the marriage (community funds) to remodel the kitchen, the community now has a financial interest in your separate property house.

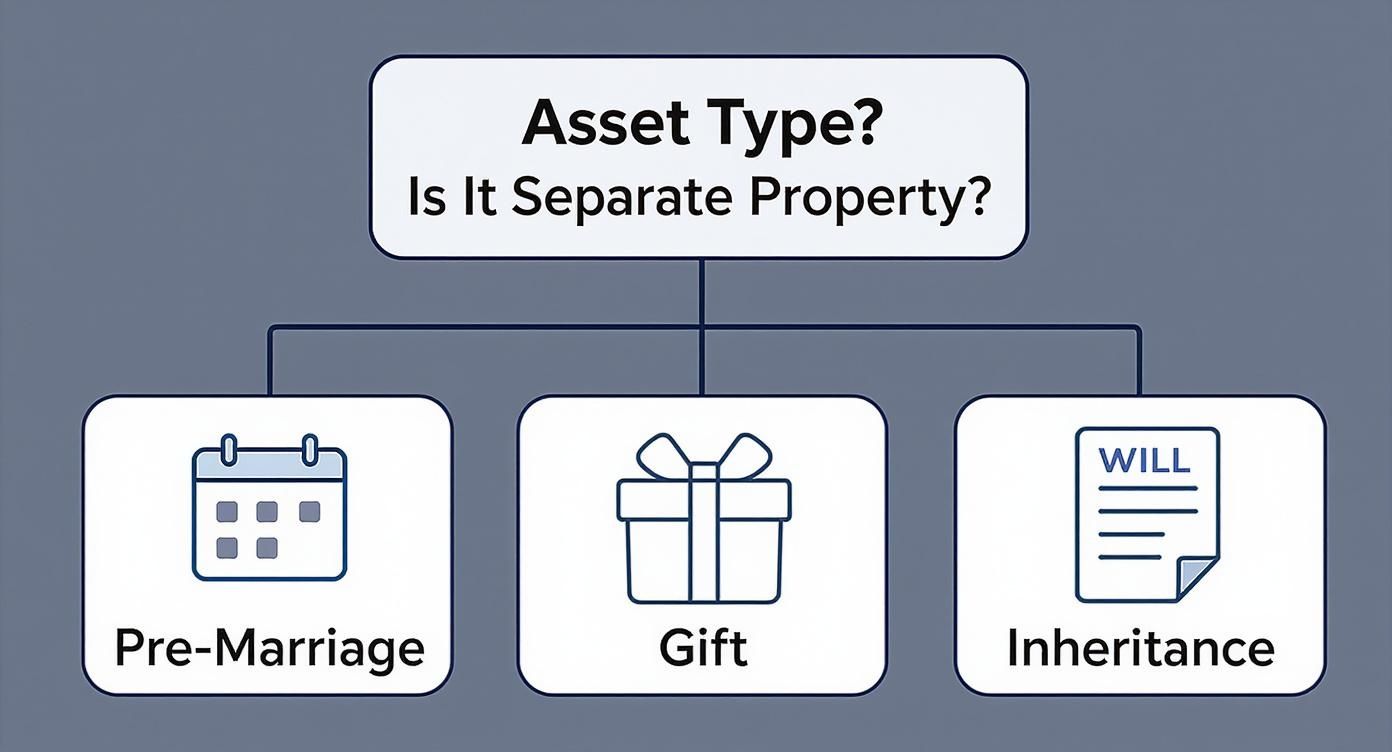

This simple flowchart shows the three main starting points for separate property.

As the visual shows, identifying separate property at the outset is straightforward. The real challenge is keeping it that way throughout a marriage.

Handling High-Value and Specialized Assets

Beyond commingling, some assets have their own complex rules, especially in a Texas divorce. These are often the most valuable parts of a marital estate and require a seasoned hand to divide correctly.

Retirement Accounts (401(k)s, IRAs, Pensions)

Any money contributed to or earned by a retirement account during the marriage is community property. For instance, if you had $50,000 in your 401(k) on your wedding day and it grew to $200,000 by the time of your divorce, that $150,000 growth is part of the community estate to be divided. Splitting these accounts isn't as simple as writing a check; it requires a special court order known as a Qualified Domestic Relations Order (QDRO) to avoid significant tax penalties.

Business Interests

If a business was launched during the marriage, Texas law generally treats it as community property—even if only one spouse was the "face" of the company. If the business existed before the marriage, it remains separate property, but any increase in its value during the marriage could be subject to a community claim. Valuing a private business is a complex process, often demanding the expertise of forensic accountants.

Military Divorce Considerations

Military families navigate a unique set of rules. Under the Uniformed Services Former Spouses’ Protection Act (USFSPA), military retirement pay earned during the marriage is divisible as community property. There are also specific regulations for dividing other benefits and handling custody when relocations are common.

A Note on High-Net-Worth Divorce: When the marital estate includes stock options, real estate portfolios, family trusts, or valuable collections, the complexity skyrockets. These cases require a high degree of financial acumen to properly identify, value, and divide every asset in a "just and right" manner.

Trying to sort through these complicated financial webs on your own is a recipe for disaster. The stakes are too high, and a single misstep can have financial repercussions that last a lifetime. Protecting what's yours requires sharp, strategic legal guidance.

If you need help navigating divorce, custody, or estate planning in Texas, contact The Law Office of Bryan Fagan today for a free consultation.

How Texas Courts Divide Community Property

One of the biggest myths we have to bust for clients is the idea that "community property" means everything gets split 50/50. It seems logical, but it’s not how Texas law works. The truth is much more nuanced and is designed to create a fair outcome, not just a mathematically equal one.

Going through a divorce is hard enough; not knowing what your financial future looks like makes it even harder. Understanding how Texas courts approach this process can give you some much-needed clarity and a sense of control.

The guiding principle comes from the Texas Family Code, Section 7.001, which directs the court to divide the community estate in a way that is “just and right.” This flexible standard gives judges the power to look at the unique, real-life circumstances of each family.

So, What Does "Just and Right" Actually Mean?

If it’s not always a 50/50 split, what factors does a judge consider? Think of the court as putting together a puzzle of your marriage and family life. They look at all the pieces to see the whole picture, allowing for a division that truly reflects your reality.

Here are some of the key factors that can tilt the scales away from an even split:

- Fault in the Breakup: If one spouse's actions, like adultery or cruelty, are the reason the marriage is ending, the court can award a larger share of the property to the wronged spouse.

- Disparity in Earning Capacity: The judge will look at each person's ability to support themselves after the divorce. If one spouse gave up a career to raise children and now has a much lower earning potential, they may receive more of the assets to help them get back on their feet.

- Health of the Spouses: Chronic health problems or a disability can be a major factor. A spouse who needs more financial support for medical care may be awarded a larger portion of the estate.

- Custody of the Children: The court always prioritizes the children's best interests. The parent who has primary custody will often get a larger share, and sometimes the family home, to ensure a stable environment.

- Benefits the Innocent Spouse Would Have Received: The court might consider what the non-fault spouse lost out on. If the marriage had continued, they would have kept benefiting from the ongoing growth of assets, and a judge can factor that lost opportunity into the division.

A Real-World Example of an Unequal Split

Let's look at a common scenario. Imagine Mark and Lisa are divorcing after 20 years. Lisa left her teaching job years ago to be a stay-at-home mom to their three kids, which allowed Mark to focus on building his successful business. Now, Lisa has a significant gap in her resume and a much lower earning capacity.

A judge looking at this situation would likely decide that a 50/50 split isn't "just and right." Instead, the court might award Lisa 60% of the community estate. This could mean she gets the family home to provide stability for the kids, plus a larger portion of Mark's retirement funds to compensate for the years she wasn't earning her own. This outcome recognizes her critical, non-financial contributions to the marriage and addresses her financial needs moving forward.

Key Insight: The goal of the court is equity, not necessarily equality. The division is tailored to the specific facts of your life, your marriage, and your family's needs.

Don't Forget About the Debts

Property division isn’t just about who gets the house and the savings account. It’s also about who gets the debt.

Any liabilities incurred during the marriage—the mortgage, car loans, credit card balances—are also considered community property. Just like assets, these debts will be divided in a "just and right" manner. The court looks at the entire financial picture, both positive and negative, before making a final decision.

If you need help navigating divorce, custody, or estate planning in Texas, contact The Law Office of Bryan Fagan today for a free consultation.

Protecting Your Separate Assets With Legal Tools

Taking charge of your financial future is a smart move, whether you're about to walk down the aisle or have been married for years. While Texas has its default community property rules, you are not stuck with them. You have the power to create your own financial map using powerful legal tools.

Think of these agreements not as a sign of mistrust, but as a form of financial insurance. It’s about being prepared and creating clarity. These documents let you and your partner set your own terms, rather than leaving it up to a court in the middle of a crisis.

Using Prenuptial and Postnuptial Agreements

The most direct way to protect your separate property is with a marital agreement. These are legally binding contracts that allow you and your spouse to opt out of the standard community property rules, clearly defining what belongs to whom.

- Prenuptial Agreements: Signed before the marriage, these are ideal if you're coming into the marriage with significant personal assets, a business, or the expectation of a future inheritance.

- Postnuptial Agreements: Drafted during the marriage, a postnup can be a great tool if, for example, you receive a large inheritance and want to formally keep it separate, or if you simply decide you want to get your financial house in order.

These agreements provide peace of mind by ensuring both partners know where they stand, which can prevent conflict and confusion down the road. Our guide goes into more detail on how to retain your separate property in divorce.

Practical Steps for Maintaining Separate Property

Legal agreements are just one piece of the puzzle. How you manage your assets day-to-day is equally important. The golden rule is to avoid commingling—mixing separate and community funds together until they become indistinguishable.

Actionable Tip: If you inherit money or receive a large cash gift, open a brand-new bank account in your name only and deposit it there. Do not put that money into the joint checking account you use for groceries and bills.

Keep meticulous records of everything. This means holding onto deeds, titles, bank statements from before the marriage, and any gift letters or trust documents that prove an asset was intended only for you. For a deeper dive into how property ownership fits into the bigger picture, you can find helpful information on the legal and financial considerations of property division. Taking these steps now is how you secure your financial footing, whatever the future holds.

Common Questions About Texas Community Property

Even when you grasp the basics, Texas property law can feel like a maze. Let's tackle some of the most frequent questions we hear, clearing up the confusion that often surrounds divorce and property.

What Happens to Debt in a Texas Divorce?

Debts are treated just like assets—they get divided, too. Any debt incurred during the marriage is typically considered community debt. That means it belongs to both of you and will be split in a way the court finds "just and right."

This includes mortgages, car loans, and personal credit card balances, even if only one name is on the account. A judge will look at the whole financial picture, including each spouse's ability to pay, before deciding who is responsible for what.

Does a Spouse Have a Claim on My Inheritance?

The short answer is usually no. Under Texas Family Code § 3.001, anything you inherit is legally considered your separate property. It belongs to you alone.

However, you must keep it separate. If you deposit that inheritance into a joint bank account and use it for shared expenses, the lines get blurry. It can quickly become "commingled," losing its protected status and turning into community property that can be divided.

How Does Adultery Affect Property Division?

While Texas is a "no-fault" divorce state, this doesn't mean misconduct is ignored. If one spouse's affair caused the marriage to fail, a judge has the discretion to award the other spouse a larger share of the community property.

This is a key reason why a "just and right" division often doesn't mean a 50/50 split. The court can—and often does—factor in fault when deciding what is fair.

A classic example is when one spouse spends community funds on an affair (e.g., gifts, trips). A court can "reconstitute" the estate by adding back the value of the wasted money and awarding that amount to the innocent spouse before dividing the rest.

Getting these details right is absolutely essential for protecting your financial future.

If you need help navigating divorce, custody, or estate planning in Texas, contact The Law Office of Bryan Fagan today for a free consultation.