Planning for what happens to your property after you’re gone is one of the most thoughtful and caring things you can do for your family. It can feel overwhelming, but you don't have to navigate it alone. In Texas, a powerful tool called a Transfer on Death Deed (TODD) lets you pass your real estate directly to your loved ones, often sidestepping the stress and cost of probate court. The best part? It's a simple instrument that keeps you in complete control of your property for your entire life.

Your Guide to the Texas Transfer on Death Deed

We understand that thinking about how your property will be handled can feel like a heavy weight. But it doesn't have to be a complex legal nightmare. This guide is here to walk you through every step, providing clear, actionable guidance to help you feel supported and understood.

A TODD lets you name a beneficiary who will automatically inherit your property the moment you pass away, bypassing the often long and drawn-out probate process. To better understand which assets usually have to go through the court system, it's helpful to know what in a will goes to probate in Texas.

As you begin your estate planning journey, it's also a smart move to look into other essential estate planning documents. When used alongside a TODD, these documents create a complete, solid plan that truly protects your family and preserves the legacy you've built.

How Does a Transfer on Death Deed Work in Texas?

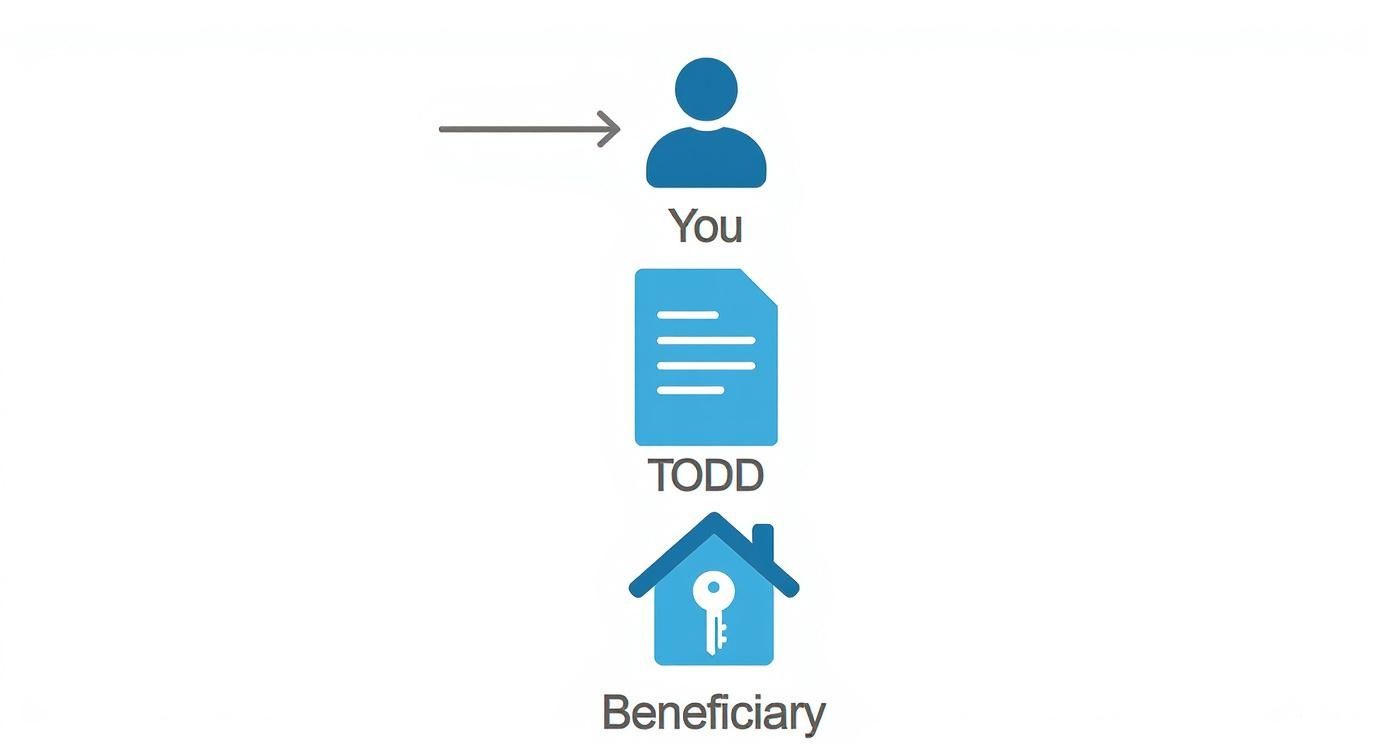

Think of a Transfer on Death Deed (often called a TODD) as a special instruction you leave for your property that only activates the moment you pass away. While you're alive, nothing changes. You retain 100% control—you can sell your home, take out a new mortgage, or rent it out just as you always have. The deed simply names the person who will inherit the real estate when you're gone.

This practical legal tool is governed by Chapter 114 of the Texas Estates Code. Since Texas introduced it in 2015, the TODD has become a go-to for many families seeking a straightforward way to pass on property. Before its creation, people often relied on informal property transfers that could cause significant title issues down the road. If you're curious about the history, the Texas Real Estate Research Center's website offers great insight into how the TODD cleaned up this process.

Here’s a simple, step-by-step breakdown of how it works:

- You Create and Sign the Deed: You prepare a valid TODD, clearly naming your beneficiary, and sign it in front of a notary.

- You Record the Deed: You file the notarized deed with the county clerk in the county where the property is located. This must be done while you are still alive.

- The Transfer Occurs Automatically: Upon your death, the property title transfers directly to your named beneficiary without any need for court intervention.

This process completely sidesteps the lengthy and often expensive probate process. For a closer look at what court-supervised property transfers entail, check out our guide on probate and real estate in Texas.

Key Benefits of Using a Texas TODD

Let's be honest, no one wants their family to get tangled up in court proceedings while they are grieving. One of the biggest wins of a transfer on death deed in Texas is its power to completely bypass probate for the property it covers.

Probate is the court-supervised process of settling an estate, and it can be a real headache—often long, expensive, and emotionally draining. A TODD cuts through all that red tape, allowing for a direct and simple transfer.

Tax Advantages for Your Beneficiary

Beyond sidestepping probate, a TODD comes with a significant tax advantage for your beneficiary thanks to a "stepped-up basis."

Here’s a practical scenario: Imagine you bought your home years ago for $100,000. By the time you pass away, it's worth $400,000. With a TODD, your beneficiary’s tax basis becomes $400,000. This simple step can drastically reduce or even completely wipe out capital gains taxes if they decide to sell the property, saving them a significant amount of money.

Think of the TODD as a direct bridge between you and your beneficiary, ensuring the property goes straight to them without the detours of the court system.

Comparing Property Transfer Methods in Texas

When planning how to pass on your property, it's helpful to see how a TODD stacks up against other common tools like a will or joint ownership. Each has its own rules and implications for your family.

| Feature | Transfer on Death Deed (TODD) | Last Will and Testament | Adding a Joint Owner |

|---|---|---|---|

| Probate | Avoids probate entirely. | Goes through probate. | Avoids probate for that property. |

| Control | You keep 100% control during your life. | You keep 100% control during your life. | You give up partial ownership and control immediately. |

| Flexibility | Easy to change or revoke. | Can be changed or revoked, but requires a formal update. | Difficult to reverse; requires the other owner's consent. |

| Creditor Claims | Your beneficiary's creditors can't touch it until after your death. | Your beneficiary's creditors can't touch it during probate. | The property is immediately exposed to the new joint owner's debts. |

This table makes it clear that while options exist, the TODD offers a unique blend of control, simplicity, and protection that is hard to beat for straightforward property transfers in Texas. Unlike adding a joint owner, a TODD lets you maintain complete control over your property—you can sell it, mortgage it, or change your mind without needing anyone else's permission. To get a better sense of how these methods differ, it's worth exploring the pros and cons of using joint tenancy.

How to Create and File a TODD in Texas

Let's walk through the practical steps to create a valid transfer on death deed in Texas. You have to follow these steps precisely to ensure the deed holds up and accomplishes your goals.

- Use the Correct Form: Texas law provides a specific statutory form. You cannot simply write something up from scratch.

- Provide a Legal Description: You'll need the full legal description of your property, which you can find on your current deed.

- Name Your Beneficiary: Clearly state the full legal name of your beneficiary (or beneficiaries). Accuracy is key here.

- Sign Before a Notary: You must sign the deed in front of a notary public. This is a legal requirement.

- File the Deed: The completed and notarized deed must be filed with the county clerk in the county where your property is located, and it must be done before your death.

An unrecorded TODD is legally invalid under Texas law. This final step is absolutely essential for your estate plan to succeed and to avoid your property ending up in probate court.

Common Mistakes and Potential Pitfalls to Avoid

While a transfer on death deed in Texas is a fantastic estate planning tool, it's not foolproof. A few simple yet common mistakes can create a world of headaches for the family you’re trying to protect. Knowing these potential pitfalls is the best way to ensure your wishes are carried out.

The single most critical error we see is failing to record the deed with the county clerk before passing away. If it’s not officially on file with the county, it legally doesn’t exist. An unrecorded TODD is completely invalid, meaning your property will almost certainly get tangled up in probate court.

Another tricky spot is naming multiple beneficiaries. When they inherit the property together, they become co-owners. For example, if you leave your home to your three children, they must all agree on what to do with it—sell, rent, or have one buy out the others. This can easily lead to arguments. It's also vital to plan for what happens if one of your beneficiaries dies before you. If you haven't named an alternate, their share might not go where you'd expect. These details are why careful planning can prevent major family conflicts.

How to Change or Revoke a Transfer on Death Deed

Life is unpredictable, and a good estate plan needs to be flexible. One of the greatest advantages of a transfer on death deed in Texas is that you’re never locked in. You can change your mind and revoke it anytime, ensuring your plans always match your current wishes.

Here’s how you can make a change:

- File a Revocation: You can file a formal document called a "Revocation of Transfer on Death Deed" with the county clerk where the property is located. It’s a clean and clear way to undo the deed.

- File a New TODD: Alternatively, you can simply file a brand-new TODD that names a different beneficiary. The law is set up so that the most recently filed deed automatically cancels out any previous ones for that same property.

The popularity of these deeds has exploded—one study found that filings in major Texas counties jumped by over 500% in just five years. You can see how these deeds are impacting Texas families for a deeper look at the trend.

It is critical to remember this: your will cannot change or cancel a recorded TODD. No matter what your will says, the transfer on death deed always takes precedence for that specific piece of property.

Got Questions About Texas TODDs? Let's Talk.

When you're sorting out your estate plan, questions are a good thing—it means you're being thorough. Getting straightforward answers is how you build a plan you can feel confident in. Here are a few common questions we hear about using a transfer on death deed in Texas.

Can I Leave Property to a Minor with a Texas TODD?

Legally, yes, you can. However, in practice, it’s often not the best approach. If a minor inherits your property directly, a court will likely have to appoint a legal guardian to manage that property for them until they turn 18. This can create the exact kind of legal headaches and expenses you were hoping to avoid in the first place.

Does a TODD Protect My House from My Creditors?

No, a TODD does not shield your property from creditors. While you're alive, the house is still your asset and can be subject to your debts. After you pass away, your beneficiary inherits the property, but they also inherit any liens or mortgages attached to it. The debts don't simply disappear.

What if My Beneficiary Dies Before I Do?

This is a critical point. Under Texas law, if your primary beneficiary passes away before you do, the transfer fails. It's null and void. The property doesn't automatically pass to their children or spouse. Instead, it falls back into your estate and is likely headed for probate court—unless you have named an alternate beneficiary on the deed itself. This is a practical step that can save your family from unnecessary court involvement.

If you need help navigating divorce, custody, or estate planning in Texas, contact The Law Office of Bryan Fagan today for a free consultation.