Thinking about the future can be a heavy task, but creating a last will and testament is one of the most profound acts of care you can offer your family. It provides them with clarity and protection during a time they will need it most. While a last will and testament template for Texas can be a useful starting point, understanding why this document is so essential is the first step toward achieving genuine peace of mind for yourself and your loved ones.

Why Every Texan Needs a Will

Confronting what happens after you are gone is never easy. But putting off this important planning can saddle your loved ones with an even heavier legal and emotional burden. A will is far more than a legal document—it is your voice, ensuring your final wishes are heard and respected by the law.

If you pass away without a will, the State of Texas makes all the critical decisions for you.

When someone dies without a will, they are considered "intestate." In that situation, the Texas Estates Code dictates exactly how your property is divided based on a rigid legal formula. This process, known as intestate succession, does not account for your personal relationships or your family's unique needs.

The Risks of Dying Without a Will

The state’s one-size-fits-all formula can create unintended, and often heartbreaking, consequences. For example, in a blended family, assets you intended for your stepchildren could be completely shut out. An unmarried partner would have no legal claim to the property you shared together.

Even the rich and famous have left their families in disarray. You can read about the chaos it created for celebrities who died without a will to see how significant the impact can be.

Dying intestate also drags your family into a more complicated, expensive, and public probate process. The court must appoint an administrator to manage your estate, and that role may not go to the person you would have trusted most. This can easily ignite family arguments during an already painful time.

A will is your opportunity to take control. It allows you to protect your loved ones, decide who receives your property, and provide clear instructions to prevent conflict and confusion.

It's surprising how many people skip this crucial step. A 2024 Wills and Estate Planning Study from Caring.com revealed that only about one-third of Americans have a will. This lack of preparation can have serious consequences here in Texas, where our probate system has strict deadlines and procedures.

To understand the difference, let’s look at how things play out with and without a will in Texas.

What Happens in Texas With a Will vs Without a Will

| Scenario | With a Valid Texas Will (Testate) | Without a Will (Intestate) |

|---|---|---|

| Asset Distribution | Your property is distributed exactly as you specified to your chosen beneficiaries. You control who gets what. | The state divides your property according to a strict legal formula (intestate succession), which may not align with your wishes. |

| Executor of Estate | You appoint a trusted person or institution (Executor) to manage your estate, pay debts, and carry out your instructions. | The court appoints an administrator, who may not be someone you would have chosen. This can lead to delays and family conflict. |

| Guardianship for Minors | You name a guardian to care for your minor children, ensuring they are raised by someone you trust completely. | The court decides who will be the guardian of your children, a decision that might not reflect your preference. |

| Probate Process | The probate process is generally simpler, faster, and less expensive because your wishes are clearly documented. | Probate is more complex, public, and costly. The court must determine heirs, which can be a lengthy process. |

| Special Gifts | You can leave specific items, heirlooms, or amounts of money to specific people, friends, or charities. | You have no ability to make specific gifts. All assets are divided based on the legal formula. |

| Unmarried Partners | You can provide for an unmarried partner by naming them as a beneficiary in your will. | An unmarried partner has no legal right to inherit any of your property under Texas intestate succession laws. |

| Blended Families | You can ensure stepchildren or other relatives are included and provided for according to your wishes. | Stepchildren are typically not considered legal heirs and would likely inherit nothing. |

As you can see, a will empowers you to make these critical decisions yourself, rather than leaving them to the state.

The Peace of Mind a Will Provides

A thoughtfully prepared will does more than just distribute assets. It gives you the power to:

- Appoint an Executor: You choose a trusted person or institution to manage your estate, pay off any debts, and ensure your instructions are followed precisely.

- Name a Guardian: For parents with young children, this is arguably the most important reason to have a will. You decide who will step in to raise your kids if the unthinkable happens.

- Provide for Loved Ones: You can make specific gifts, set up trusts for beneficiaries who might need extra guidance, and make sure everyone you care about is provided for, including friends or charitable organizations.

Taking these steps is an invaluable gift to your family: the gift of certainty and support during a difficult time.

The Essential Elements of a Valid Texas Will

Putting your wishes in writing is a major step, but for those wishes to be honored by a Texas court, the document must follow specific rules laid out in the Texas Estates Code. Think of these as the legal building blocks for your will. If even one is missing, the entire structure could be at risk, which is why it's so critical to get them right from the start.

Many people mistakenly believe a will is just a letter explaining who gets what. Texas law, however, is much more precise. For a will to be valid, it must be in writing. While there are extremely rare exceptions for oral wills (such as a soldier in active service), they are not a reliable tool for estate planning.

The Core Requirements for Validity

For your will to be upheld in probate court, it must meet three non-negotiable conditions. These form the legal foundation of the entire document.

- In Writing: The will must be a physical document—not a voice recording or a verbal promise.

- Signed by You (the Testator): You must personally sign the will. Alternatively, another person can sign it on your behalf, but they must do so in your presence and under your direct instruction. Your signature makes it official.

- Attested by Two Credible Witnesses: Two witnesses must watch you sign (or acknowledge your signature) and then sign the will themselves in your presence. In Texas, these witnesses must be at least 14 years old and, crucially, cannot be beneficiaries in your will.

This last point about witnesses is a common pitfall. It may seem convenient to ask a family member who is also a beneficiary to witness your signature, but doing so can create a legal mess.

The Problem with Interested Witnesses

Let's consider a scenario. Imagine Sarah is drafting her will and wants to leave her prized classic car to her nephew, Tom. When it is time to sign the document, she asks Tom and a neighbor to be her two witnesses. While her intentions were good, she created a significant legal problem.

Under Texas law, if a beneficiary acts as a witness (making them an "interested witness"), the gift to that person could be voided. Unless Tom's testimony can be corroborated by a neutral third party or the will can be proven by other means, he may have to forfeit the very car Sarah wanted him to have. It's a simple mistake with serious consequences.

Our advice is to always use witnesses who have no financial interest in your will. To learn more about other potential issues, check out our guide on what makes a will null and void.

Simplifying Probate with a Self-Proving Affidavit

Beyond these core requirements, there’s one more component that every solid last will and testament template for Texas should include: a self-proving affidavit. While not technically required for the will to be valid, it is an incredibly powerful tool for making the probate process faster and easier for your family.

A self-proving affidavit is a separate statement attached to your will. You and your witnesses sign this part in front of a notary public, swearing under oath that all legal formalities were followed during the signing.

Years later, when your will goes through probate, this affidavit serves as proof for the court. Without it, your executor might have to track down the original witnesses—who could have moved, passed away, or forgotten the event—and bring them to court to testify. The affidavit eliminates that stressful and time-consuming step, saving your loved ones money and grief during an already difficult time.

Building Your Texas Will Clause by Clause

This is where your intentions become legally binding instructions. A last will and testament template for Texas is a collection of different sections, or "clauses," each performing a specific job. Getting these clauses right is key to ensuring your will does exactly what you want it to, from deciding who manages your affairs to who gets your most cherished possessions.

Think of your will as a blueprint for your legacy. If one part is shaky or missing, the whole structure could be at risk. Let's walk through these core components so you can feel confident about what your will says and does.

Appointing Your Executor

One of the first and most important decisions is naming an executor. This is the person (or an institution, like a bank's trust department) you trust to take charge of your estate. Their job is to follow your will's instructions: gather your assets, pay final debts and taxes, and distribute what's left to the people you have named.

Choosing an executor is a significant responsibility. You need someone honest, organized, and capable of handling financial details, all while likely grieving. That is why it is absolutely critical to also name an alternate, or successor, executor.

Life is unpredictable. If your first choice cannot or does not want to serve, having a backup prevents the court from having to appoint someone for you. This saves time and money and ensures your estate remains in the hands of someone you trust.

Making Specific Gifts of Property

Once your executor is designated, you can begin spelling out who gets what. This often starts with "specific bequests," which are gifts of particular items to specific people.

- Sentimental Items: This is your chance to give your grandfather's watch to your son or your collection of family photos to your niece. Designating these items can prevent family arguments.

- High-Value Assets: You might want to leave a classic car, a boat, or valuable jewelry to a person who would appreciate it most.

- Cash Gifts: You can also leave a specific amount of money—a bequest of $5,000, for instance—to a lifelong friend, a grandchild, or a charity that is important to you.

Clarity is essential here. Instead of "I leave my car to my brother," be specific: "I leave my 2022 Ford Explorer, VIN…" to avoid any confusion.

Naming Your Primary Beneficiaries and the Residuary Clause

After handling specific gifts, the next step is to name your primary beneficiaries. These are the people or organizations who will inherit the bulk of your estate, such as a spouse or children.

One of the most powerful parts of any will is the residuary clause. This clause is your legal safety net. It designates who receives the "residue" of your estate—that is, everything left over after specific gifts are made and all debts and expenses are paid.

Why is this so crucial? The residuary clause covers assets you might have forgotten to list, property you acquire after signing your will, or specific gifts that cannot be completed because a beneficiary has passed away. Without it, those leftover assets would be distributed according to state intestacy laws, which might not align with your wishes at all.

To help you visualize how these pieces fit together, here’s a look at the most common clauses in a Texas will template.

Key Clauses in a Texas Will Template

| Clause | Purpose | Simple Example |

|---|---|---|

| Executor Appointment | Names the person or institution responsible for carrying out the will's instructions. | "I appoint my sister, Jane Doe, as Executor of this will. If she is unable to serve, I appoint my brother, John Doe." |

| Specific Bequest | Gifts a particular piece of property to a specific person or entity. | "I give my collection of antique books to my niece, Emily Smith." |

| Primary Beneficiary | Designates the main inheritors of the estate. | "I give the remainder of my estate to my spouse, Pat Jones, if they survive me." |

| Residuary Clause | Distributes any property not specifically gifted or left over. | "I give all the residue of my estate to my children, in equal shares." |

| Guardianship Clause | Names a guardian to care for minor children if both parents are deceased. | "If a guardian is needed for my minor children, I nominate my cousin, Michael Brown, to serve as Guardian." |

Understanding these basic components is the first step toward creating a document that truly reflects your wishes.

The Most Important Clause for Parents: Appointing Guardians

If you have minor children, please pay close attention: no part of your will is more important than the guardianship clause. This is where you name the person you trust to raise your kids if you and their other parent are no longer able to do so.

It is a deeply personal and often difficult decision, but making it is one of the greatest acts of love you can offer your children. If you do not name a guardian, a judge—a stranger to you and your family—will be forced to make this life-altering decision for your kids.

When choosing a guardian, consider their values, parenting style, location, and financial stability. You want to ensure they can provide a loving and stable home. And just as with an executor, always name an alternate guardian. This ensures that no matter what happens, your children will be cared for by someone you personally chose.

Handling Community and Separate Property in Texas

Because Texas is a community property state, estate planning has an additional layer of complexity. It is vital to understand the difference between your separate property and the community property you share with your spouse.

- Separate Property: This includes anything you owned before you were married. It also covers property you received during the marriage as a gift or an inheritance.

- Community Property: This is the default. It includes all property and income earned or acquired by either spouse during the marriage, with few exceptions.

Your will only has power over your separate property and your one-half share of the community property. For example, let's say a couple, John and Mary, get married. John already owned a classic car (his separate property). During their marriage, they buy a house together (community property).

In his will, John can give the classic car to whomever he wants. But he can only give away his 50% interest in the house. The other 50% already belongs to Mary by law. A well-drafted Texas will makes these distinctions clear to prevent confusion and legal fights.

Navigating the nuances of Texas property law is where having experienced guidance can make all the difference. If you need help with your estate plan, The Law Office of Bryan Fagan is here to support you.

Making It Official: Signing and Safeguarding Your Will

You have done the hard work of creating your will, a monumental step in protecting your family’s future. But that document has no legal power until it is properly signed and witnessed. This formal process is called execution, and an error here can unravel all your careful planning.

Once it's signed, deciding where to keep it is just as critical. Let's walk through how to correctly handle these final steps, transforming your will from a piece of paper into a legally binding reflection of your legacy.

The Signing Ceremony: A Practical Guide

Executing a Texas will isn't just about signing your name; it’s a formal event that must follow specific rules to be valid. Think of it as a purposeful meeting where the how and when of the signatures are everything.

Here’s a practical, step-by-step checklist to get it right:

- Gather the Right People: You (the testator) and two credible witnesses need to be physically present together at the same time. Remember, a witness cannot be someone who will inherit anything from your will.

- Make Your Declaration: State clearly to your witnesses, "This is my Last Will and Testament." They do not need to read its contents, but they must know what they are witnessing you sign.

- Sign While They Watch: You must sign the will in the physical presence of both witnesses.

- Witnesses Sign While You Watch: Immediately after you sign, each witness must sign their name to the will as you watch them. Everyone should remain in the room until all signatures are complete.

This strict, in-person requirement exists to prevent fraud and confirm you signed the document freely and with a clear mind. A procedural error, like a witness signing later or in another room, can give someone grounds to challenge your will’s validity.

Storing Your Original Will Securely

Once signed, your will is a vital legal document. The probate court requires the original, so protecting it from fire, flood, theft, or loss is essential. Here are the most common storage options:

- A Fireproof Safe at Home: This is convenient and keeps the will accessible. However, your executor must know where it is and have the key or combination. Otherwise, they might need a court order to open the safe, causing significant delays.

- A Bank Safe Deposit Box: This offers excellent security from physical threats. The major downside is accessibility. After you pass away, the bank may seal the box until your executor gets court authority to open it—creating a catch-22 where they need the will to get the authority to access it.

- With Your Attorney: Leaving the original with your estate planning lawyer is often a solid choice. Law firms have systems for safeguarding important documents and can ensure your executor can retrieve it when needed.

Key Takeaway: No matter where you store it, the most important thing is that your executor knows exactly where to find the original document. Provide them with a letter of instruction detailing its location. Be sure to clearly mark any copies as "COPY" to avoid confusion.

How to Update or Cancel Your Will

Life changes—a marriage, a divorce, a new baby, or a major financial shift are all excellent reasons to review your will. In Texas, you cannot simply cross out a name or write in the margins. Any changes must be made with the same legal formality as the original will.

- Amending with a Codicil: A codicil is a separate legal document used to make minor changes to your will. It must be signed and witnessed with the same ceremony as the original.

- Revoking with a New Will: For significant changes, the best practice is to create an entirely new will. The new document should include specific language stating that it revokes all previous wills and codicils. This clear statement prevents any conflict between old and new documents.

Formally revoking an old will is crucial. Simply tearing it up can create doubt about your intentions. Executing a new one provides a clean, legally sound record of your final wishes, setting the stage for a smoother process. For a deeper look into the court-supervised process, you can learn more about what in a will goes to probate in Texas in our detailed guide.

When a Template Is Not Enough

A last will and testament template for Texas can be a great starting point for many, offering a straightforward path to protecting their family. But estate planning is not one-size-fits-all. Life gets complicated, and those complexities often demand a more personal touch than a standard form can provide. Knowing when your situation calls for specialized legal advice is the most critical step in ensuring your will actually protects your loved ones as you intend.

After you pass away, your will typically enters a court-supervised process called probate. A well-drafted will can make this journey much smoother, but for some families, the stakes are higher, and a generic template might leave dangerous gaps.

High-Net-Worth Estates and Tax Planning

If you have a significant estate, your planning must consider potential federal estate taxes. While Texas does not have its own inheritance tax, federal laws can still have a major impact.

The 2025 federal estate tax exemption is projected to be around $13.61 million per person. Estates that exceed this threshold will face a substantial 40% federal tax. While this affects a small fraction of Americans, it is a huge consideration for high-net-worth individuals. A basic template is not built to handle the sophisticated tax planning strategies—like strategic gifting or specific trusts—needed to minimize this tax burden and preserve your legacy. You can get more details about the impact of 2025 estate planning laws on TexasEstateForms.com.

Blended Families and Complex Relationships

Modern families are wonderfully diverse, but blended families introduce unique challenges to estate planning. A simple will template may not properly address the nuances of providing for both a current spouse and children from a previous relationship.

For instance, you may want to ensure your current spouse can live in the family home for the rest of their life, but you want the house to ultimately pass to your children. This requires a specific legal structure, like a life estate or a trust, that you won't find in a basic form. Without careful, custom drafting, you could accidentally disinherit your children or create intense conflict between your spouse and kids.

A customized estate plan allows you to create clear, legally enforceable instructions that honor all your family commitments, preventing future disputes and protecting the relationships you’ve built.

Business Ownership and Succession Planning

If you own a business, your will must include a clear succession plan. A template simply cannot tackle critical questions, such as:

- Who will take over the daily operations?

- How will your ownership interest be valued and transferred?

- Will the business be sold, and how will the proceeds be distributed?

Without a detailed plan, the business you worked for years to build could be forced into a quick sale at a low price or become paralyzed by management disputes among your family. This not only puts the company’s future at risk but also threatens your loved ones' financial security.

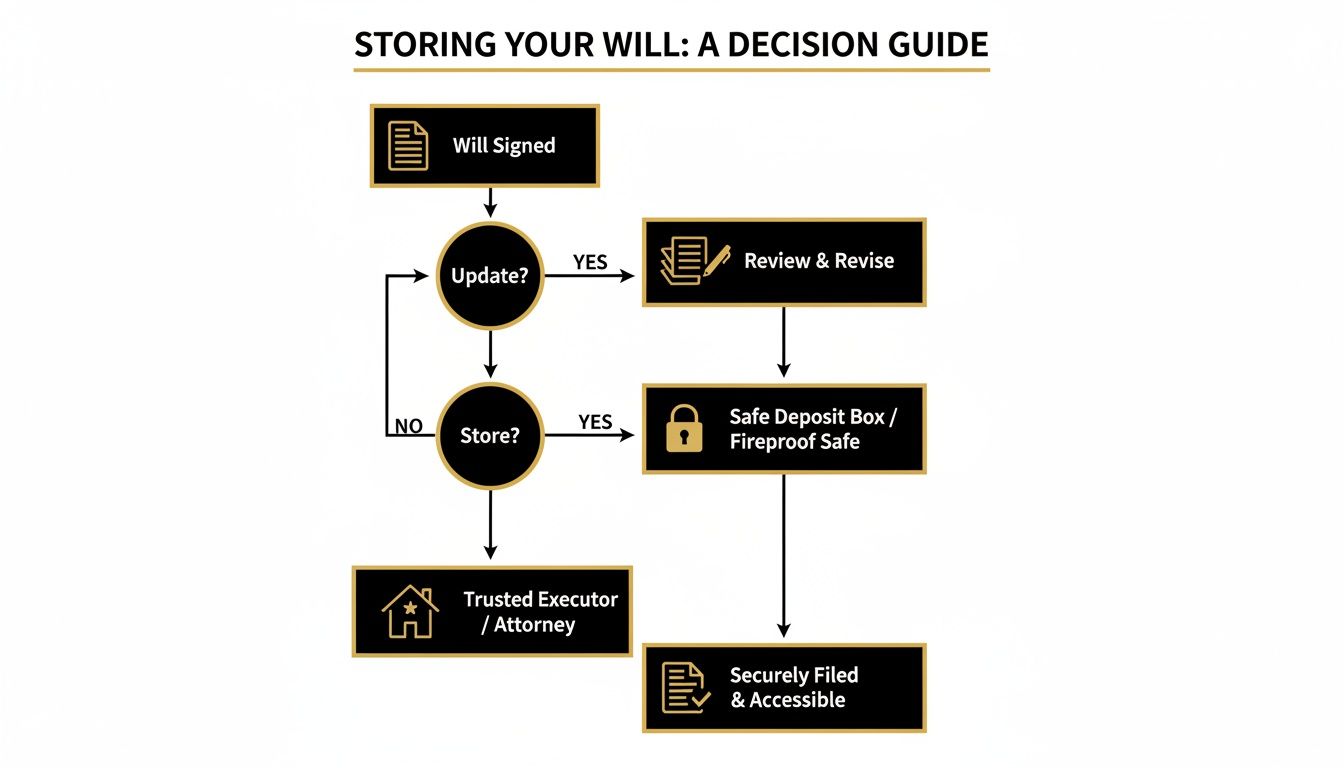

This decision tree illustrates a simplified path for managing your will after it's been signed.

As the flowchart shows, a will isn't a "set it and forget it" document. It requires periodic review and secure storage to remain effective.

Providing for a Loved One with Special Needs

If you have a child or another dependent with special needs, leaving them a direct inheritance through a standard will could be a catastrophic mistake. A lump-sum inheritance could disqualify them from essential government benefits like Medicaid or Supplemental Security Income (SSI).

The proper way to provide for them is through a Special Needs Trust. This legal tool allows you to set aside funds for their care without jeopardizing their eligibility for public assistance. Creating a valid Special Needs Trust is a complex legal task that requires an attorney’s expertise; it is far beyond the scope of any online will template.

If any of these situations sound familiar, it’s a strong sign that a template is not enough. Your family’s future is too important to leave to chance.

Got Questions About Texas Wills? We've Got Answers.

When you start planning your estate, many questions can arise. It's completely normal. We have put together answers to some of the most common concerns we hear from our clients, aiming to provide you with clear, practical guidance.

If you don't see your question here, it may be a sign that your situation has unique details that would benefit from a direct conversation with an attorney.

Can I Just Handwrite My Will? Is That Legal in Texas?

Yes, you can. In Texas, a will written entirely by hand is called a holographic will, and it can be legally valid. The critical rule is that it must be written entirely in your own handwriting. You cannot type a paragraph and sign it, or have someone else write a section for you.

However, we often see these wills cause major headaches. They can be difficult to read, the language may be vague, and they are much easier for a disgruntled family member to challenge in court. While a holographic will is better than no will in an emergency, a formally prepared and witnessed will is infinitely safer for the people you leave behind.

Does My Will Need to Be Notarized to Be Valid?

Strictly speaking, no. A will does not need a notary's stamp to be legally valid in Texas. The essential requirements, as laid out in the Texas Estates Code, are that the will must be in writing, signed by you, and signed by two credible witnesses in your presence.

So why is notarization so common? Because of the self-proving affidavit. This is a separate statement that you and your witnesses sign in front of a notary. It is attached to the will and makes the probate process much smoother. With it, your executor likely will not have to track down the original witnesses to testify in court, saving your estate significant time, money, and hassle.

Can I Use My Will to Disinherit a Family Member?

Yes, you can. Texas law allows you to disinherit a child or another relative in your will. However, you must be crystal clear and direct about your intention. You cannot simply leave them out and assume the message is understood. You must include a specific statement declaring your wish.

For example, a clause might read: "I intentionally make no provision in this will for my son, John Doe, and it is my express wish that he take nothing from my estate." Without this direct language, the person you excluded could challenge the will, arguing you simply forgot about them by accident.

What if One of My Witnesses Is Also a Beneficiary?

This is one of the most common and risky mistakes. When a beneficiary also serves as a witness, it creates a conflict of interest, legally termed an "interested witness." Under Texas law, this does not automatically invalidate the entire will. However, the gift you intended to leave that specific witness-beneficiary could be voided by the court.

While there are narrow exceptions to this rule, it is not wise to rely on them. The safest and smartest approach is to always use two witnesses who have no financial stake in your will.

How Often Should I Pull Out My Will and Review It?

Your will is not a document you sign and forget. Think of it as a living document that should evolve with your life. We generally advise clients to review their will:

- Every 3-5 years, as a matter of good practice.

- Immediately after any major life event. This includes getting married or divorced, having a baby, the death of a beneficiary, or a significant change in your finances.

Keeping your will updated ensures it aligns with your current wishes and family situation. An outdated will can cause almost as much difficulty and pain for your family as having no will at all.

If you need help navigating divorce, custody, or estate planning in Texas, contact The Law Office of Bryan Fagan, PLLC today for a free consultation.