Divorce can be one of life’s most difficult transitions—but understanding your rights under Texas law can make it less overwhelming. The emotional strain is immense, and then you have the added stress of worrying about your financial future, especially the retirement savings you've worked so hard to build.

Many Texans we talk to have the same fear: that they'll automatically lose half of their entire 401(k). The good news is, in Texas, it’s not that simple. Only the portion of the 401(k) that was earned or grew during the marriage is considered community property and subject to a 'just and right' division. Here at The Law Office of Bryan Fagan, our goal is to cut through that anxiety with clear, practical guidance, empowering you to protect your financial stability.

Going through a divorce can feel like trying to navigate a ship through a hurricane, and financial worries are often the biggest waves. When you’ve spent years, maybe even decades, diligently saving for retirement in a 401(k), the idea of splitting that account can be completely overwhelming.

This guide is designed to be your roadmap, walking you through the essentials of dividing a 401(k) in a divorce according to Texas law. We'll break down the entire process, step-by-step, so you can understand your rights and the legal tools available to safeguard your future.

How Texas Law Defines Your Property

First things first, Texas is a community property state. This legal framework, laid out in the Texas Family Code, creates a presumption that nearly all assets acquired from the date of marriage to the date of divorce belong to both spouses.

But—and this is a big but—it doesn't mean a straight 50/50 split of your entire 401(k) account is inevitable. The law makes a critical distinction between what is yours alone (separate property) and what belongs to the marital estate (community property).

Here are the key aspects we'll explore together:

- Identifying Separate vs. Community Property: We’ll show you exactly how to trace and prove the portion of your 401(k) you had before you got married (your separate property) versus the portion that grew during the marriage (the community property that gets divided).

- The Role of a QDRO: You'll learn about the Qualified Domestic Relations Order, or QDRO. This is the only legal document that can correctly divide a retirement account without accidentally triggering a massive tax bill and early withdrawal penalties.

- Your Financial Options: We'll also cover what you can actually do with the funds you're awarded, like rolling them over into an IRA to keep that tax-deferred growth going for your own retirement.

A common mistake people make is thinking the divorce decree is all they need to divide a 401(k). It’s not. Without a separate, court-approved QDRO, the plan administrator is legally prohibited from distributing the funds to your ex-spouse. It’s a crucial detail that often gets overlooked but protects everyone involved.

Our goal here is to demystify this entire process. When you understand the rules of the game, you can head into negotiations with confidence and make informed decisions that serve your long-term financial health. The path ahead might look intimidating, but with the right knowledge, you can secure a stable financial footing as you start your next chapter.

Drawing the Line: Community vs. Separate Property in a 401(k)

When you’re facing a divorce, the fate of your 401(k) can feel like a massive, tangled knot. Untangling it starts with one core Texas concept: the difference between "community property" and "separate property." Getting this right is everything. It's the foundation for a fair division and protects what you rightfully earned before ever saying "I do."

Think of your 401(k) as two buckets of money. The first bucket holds every dollar you contributed before your wedding day, plus any growth on that specific pre-marital amount. This is your separate property. The Texas Family Code § 3.001 is clear here—it’s yours, and it’s not on the negotiating table.

Everything else—every contribution from you or your employer during the marriage, plus all the dividends, interest, and gains earned on that marital money—is presumed to be community property. That’s the bucket that gets divided. Our whole job is to carefully draw a bright line between these two, which requires a solid understanding asset ownership in divorce.

Tracing Your Separate Property Claim

Here’s the catch: the court automatically assumes everything is community property under Texas Family Code § 3.003. It's on you to prove otherwise, and the standard is high. You need "clear and convincing evidence" to stake your claim.

This means you need to dig up your 401(k) statements from the month or quarter right before you got married. That statement is your starting line; it establishes the value of your separate property on day one of the marriage. From there, you have to trace how that specific amount grew over the years, completely walled off from the new money that was added during the marriage.

Let's make this real with a scenario:

- Scenario: You walked into your marriage with $50,000 in your 401(k).

- At Divorce: The account has ballooned to $250,000.

- The Task: You have to prove what happened to that original $50,000. If financial tracing shows it grew to $90,000 on its own, then that entire $90,000 is your separate property, period. The remaining $160,000 is the community pie that needs to be split.

This tracing process can get complicated fast, and it’s where professional help becomes invaluable. You can learn more about the specifics here: How do I prove separate property in a divorce in Texas?

To make this distinction clearer, let’s break down how Texas law typically classifies the different components of a 401(k).

Community Property vs Separate Property in a 401k

| Asset Component | Property Classification | Reason Under Texas Law |

|---|---|---|

| Pre-Marriage Balance | Separate Property | Funds owned by one spouse before the marriage began. |

| Contributions During Marriage | Community Property | Earned and contributed while married, considered joint assets. |

| Employer Match During Marriage | Community Property | A form of compensation earned during the marital partnership. |

| Growth on Pre-Marriage Balance | Separate Property | Increase in value of an asset that was originally separate. |

| Growth on Marital Contributions | Community Property | Increase in value of the community's investment. |

| Loan Repayments (from marital funds) | Community Property | Repayments made with community funds create a community interest. |

This table provides a good starting point, but remember that real-life situations can have unique wrinkles. The key is solid documentation for every claim you make.

A huge mistake I see people make is commingling funds. This happens when you roll over an old 401(k) that had separate property in it into a new 401(k) during the marriage. Without perfect records, it becomes almost impossible to untangle your separate funds from the community portion, and you risk the court treating the whole thing as community property.

Ultimately, protecting your retirement savings begins with good record-keeping. Get those pre-marital statements, work with an attorney who gets the nuances of Texas property law, and do the foundational work. It ensures you’re only dividing what the law says you must, and you get to keep what you worked for long before the marriage began.

How a QDRO Legally Divides Your Retirement Account

So, you and your attorney have meticulously sorted through the 401(k), separating the community property from the separate property. The next question we always get is, "Okay, how do we actually get the money out?" Your divorce decree can state that your ex is entitled to a specific amount, but that document alone has zero power over the company managing the retirement plan.

This is where the most critical legal tool for this job comes into play: the Qualified Domestic Relations Order, or QDRO (pronounced "kwah-dro").

Think of it this way: your divorce decree grants the right to a share of the funds, but the QDRO is the special key that actually unlocks the account. It's a separate, specialized court order that gives direct, legally binding instructions to the retirement plan administrator.

Without a properly executed QDRO, the plan administrator is legally forbidden from giving a dime to anyone other than the employee spouse. Trying to pull funds out without one could trigger immediate income taxes and a brutal 10% early withdrawal penalty—a costly and completely avoidable mistake. The whole point of a QDRO is to bypass these penalties and allow for a clean, tax-free transfer of assets.

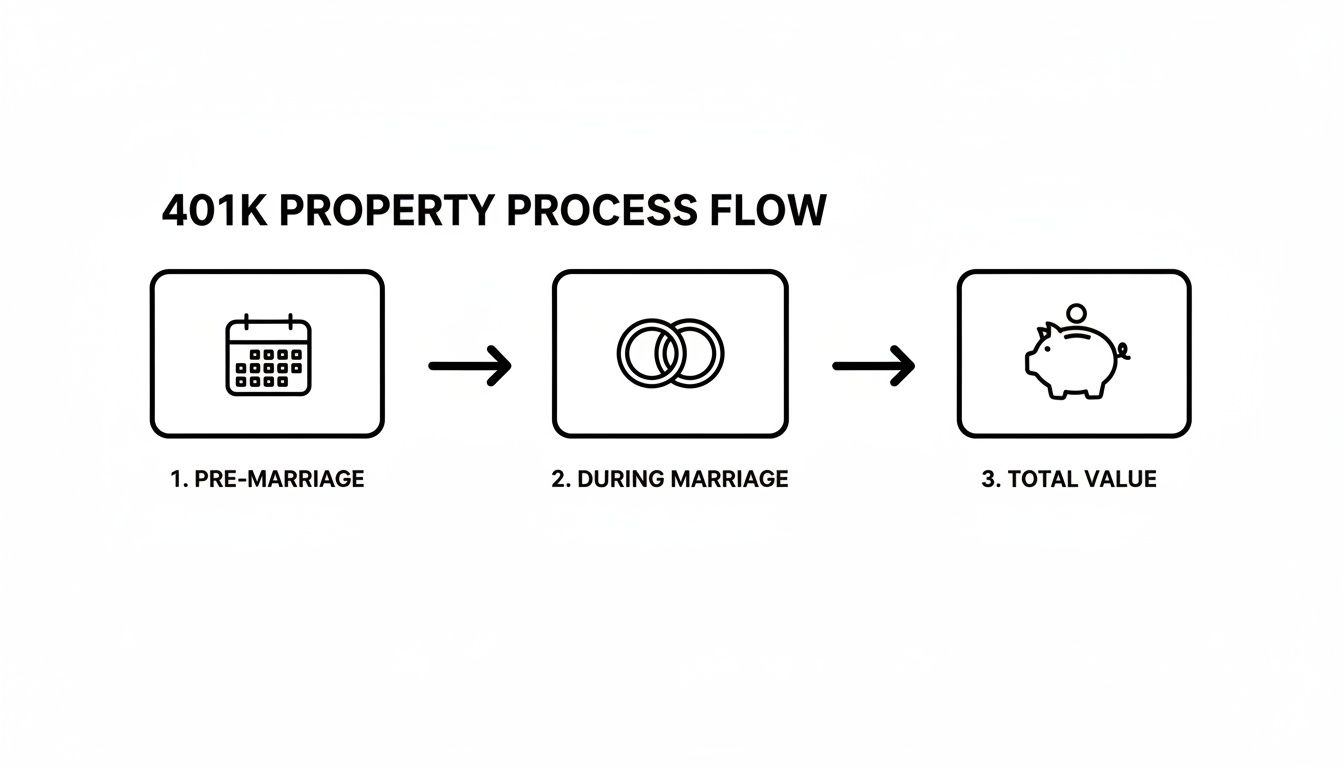

The flowchart below shows how a 401(k) goes from being a personal asset to a marital one that needs to be divided.

This visual helps you see how the account grows over the years, with the slice accumulated during the marriage becoming the community property that the QDRO is designed to split.

The Anatomy of a Well-Drafted QDRO

A QDRO is far more than just a simple form you fill out. It's a complex legal document that demands extreme precision. Here's a reality check we give our clients: every single 401(k) plan has its own unique, hyper-specific rules for what must be included in a QDRO. A generic, one-size-fits-all template from the internet will almost certainly be rejected by the plan administrator, causing major delays and frustration.

A properly drafted QDRO must be crystal clear on several points:

- The exact names and last known mailing addresses of both the plan participant (the employee) and the alternate payee (the spouse receiving the funds).

- The specific name of the retirement plan the order applies to.

- The exact dollar amount or percentage of the benefits being paid to the alternate payee.

- The number of payments or the time period the order covers.

This level of detail is non-negotiable. I've seen QDROs get kicked back for something as small as a misspelled name or an incorrect plan number.

Pro Tip: The smartest strategy is to have the QDRO drafted and then submit it to the plan administrator for pre-approval before anyone signs it, especially the judge. This proactive step confirms the language meets all the plan's technical requirements, preventing a rejection after the divorce is already finalized.

Handling Market Gains and Losses

One of the most overlooked—and most important—functions of a QDRO is to spell out what happens to the account's value between the date of divorce and the day the funds are actually moved. A 401(k) is an investment account. Its value goes up and down with the market.

Let's say your divorce is finalized on January 1, and your spouse is awarded $100,000 from your 401(k). If the QDRO doesn't get fully processed until March 1, what happens if the market has a great couple of months and the account grows? A well-written QDRO will specify that the alternate payee is entitled to any gains (or must share in any losses) on their awarded portion during that waiting period. This ensures a truly fair division based on the account's actual performance. Forgetting this language can spark huge financial fights long after you thought the divorce was over.

You can learn more about the specifics of this process by reading about how qualified plans like 401(k) plans are divided. The QDRO process is technical and requires a solid understanding of both Texas family law and federal retirement regulations. It’s a crucial step that protects everyone involved and ensures this important marital asset is handled correctly.

Your Financial Options After a 401k Division

Once a judge signs the Qualified Domestic Relations Order (QDRO), a critical chapter closes, and a new one begins. The spouse receiving the funds, known as the alternate payee, now has a big decision to make about the future of that money. This isn't just a minor detail; it's a pivotal moment that will absolutely shape your long-term financial security.

Navigating this choice requires careful thought, as the path you take has immediate and lasting tax and investment implications. The choices are distinct, and understanding each one is the key to taking control of your financial narrative after the divorce.

The Most Common Path: A Direct Rollover

For most people, the smartest and most financially sound option is a direct rollover of the awarded funds into an Individual Retirement Account (IRA) or another qualified retirement plan. This move is powerful because it preserves the tax-deferred status of your money.

Think of it like moving a delicate plant from one pot to another without exposing its roots to the harsh air. A rollover transfers the funds directly from your ex-spouse's 401(k) into your own retirement account. This lets the money keep growing for your future, completely untouched by immediate taxes or penalties. It ensures your entire awarded amount is working for you from day one.

The Cash-Out Option: A Costly Choice

Another option is to simply take a cash distribution. While the idea of a lump-sum payout can be tempting, especially after the financial strain of a divorce, this route comes with some serious financial consequences.

Under federal law, any cash distribution from a 401(k) via a QDRO is subject to a mandatory 20% federal income tax withholding. On top of that, if you're under the age of 59½, you'll likely get hit with an additional 10% early withdrawal penalty.

Let's look at a real-world example: If you are awarded $100,000 and choose to cash out, you could lose $30,000 (or more, depending on state taxes) right off the top. Suddenly, your $100,000 award shrinks to $70,000. In contrast, a rollover keeps the full $100,000 invested and growing for your future.

This decision is especially critical in "gray divorces," which are divorces happening after age 50. In these situations, retirement accounts are often the biggest financial battleground. Your savings get split at a time when there’s very little runway to recover financially. The impact can be devastating, as a late-in-life divorce can halve your nest egg while doubling your living expenses.

Exploring Creative Negotiation Strategies

Sometimes, the best solution doesn't involve dividing the 401(k) at all. During divorce negotiations, you can explore trading your interest in the retirement account for another marital asset of equivalent value.

This is a common and surprisingly effective strategy, especially if one spouse has a strong emotional or financial attachment to a particular asset.

- Trading for the House: You might agree to give up your claim to the $150,000 community portion of the 401(k) in exchange for receiving $150,000 in equity from the family home.

- Keeping a Business Intact: An asset buyout can also be used to keep a family business whole. One spouse takes the business, and the other takes a larger share of the retirement funds to compensate.

This approach sidesteps the complexities and potential delays of the QDRO process and gives both of you immediate clarity and control over your respective assets. However, it requires a very careful valuation of all assets to make sure the trade is truly fair and equitable.

Once your 401(k) is divided, you'll need a plan for how to manage your share to create a stable retirement income. For a guide to creating a resilient retirement income stream, this resource can provide valuable insights.

Ultimately, your choice depends on your immediate needs, long-term goals, and personal risk tolerance. For a deeper dive into how these assets are handled, you might be interested in our guide on divorce and your retirement savings.

Common and Costly Mistakes to Avoid

Knowing the common pitfalls when dividing a 401(k) can save you from irreversible financial harm. We’ve seen it happen too many times—the process is loaded with technicalities where one small oversight can lead to a huge loss of retirement funds. This is absolutely not the time for guesswork; it's a time for careful, deliberate action.

The fear of financial disruption during divorce is widespread, and frankly, it's justified. Research shows that a staggering 56% of Americans believe a divorce would completely derail their retirement strategy. This isn’t just an abstract fear, either. 40% of those who have actually gone through it report that divorce did, in fact, wreck their financial plans, leaving them with substantially more financial burdens and stress. Discover more insights about these retirement plan fears.

Sidestepping these common mistakes is your best defense against becoming another one of those statistics.

Forgetting to Update Beneficiary Designations

This is one of the most devastating and easily avoidable mistakes we see. Once your divorce is final, your ex-spouse is no longer legally your spouse. But if their name is still on your 401(k) beneficiary form, the plan administrator is legally obligated to give them the funds if you pass away.

It doesn’t matter what your will says or that you’re divorced. The beneficiary designation on the 401(k) plan documents is the controlling legal instrument. We’ve seen heartbreaking cases where a new spouse and children are left with nothing because this one simple form was never updated.

Using a Generic QDRO Template

A Qualified Domestic Relations Order (QDRO) is not a one-size-fits-all document. Every single retirement plan has its own unique, strict set of rules and required language. Grabbing a generic template you find online is a recipe for disaster.

In our experience, these generic QDROs are almost always rejected by the plan administrator, sometimes multiple times. This causes significant delays, racks up additional legal fees to fix the errors, and can leave you in financial limbo for months longer than necessary.

Your QDRO must be custom-drafted to meet the exact specifications of the plan it’s being sent to. This is a task for an attorney who understands the intersection of Texas family law and federal retirement regulations.

Overlooking Outstanding 401k Loans

It's common for people to take loans from their 401(k)s. If there is an outstanding loan balance at the time of divorce, it absolutely must be accounted for. Failing to address the loan can create a major valuation error.

The loan reduces the net value of the account available for division. For example:

- Total Account Value: $200,000

- Outstanding Loan: $40,000

- Actual Divisible Value: $160,000

If your divorce decree simply splits the "$200,000" account without acknowledging the loan, the spouse who holds the account gets stuck repaying the full loan, which unfairly shrinks their final share. The QDRO and divorce decree must clearly state how the loan will be handled—whether it's assigned to one party or factored into the overall division.

Delaying the QDRO Process

Timing is everything. So many people mistakenly believe that once the divorce decree is signed, the 401(k) division is a done deal. It is not. The QDRO is the only document that actually executes the division, and delaying its completion is a huge risk.

Consider this tragic but real scenario: a divorce is finalized, and the wife is awarded a portion of her ex-husband's 401(k). Before the QDRO is drafted and approved by the court, the ex-husband unexpectedly passes away. Because there was no valid QDRO on file, the plan administrator paid the entire account balance to his new wife, who was the listed beneficiary. The first wife was left with nothing because of a procedural delay.

- Do not wait. Start the QDRO drafting process immediately after the divorce is settled.

- Submit for pre-approval. Send a draft to the plan administrator before the judge signs it. This is a pro move that ensures compliance and avoids rejections.

- Finalize promptly. Once the judge signs the QDRO, get that final, certified copy to the plan administrator as soon as humanly possible.

Avoiding these costly errors requires diligence and experienced legal guidance. Proactively addressing each of these potential landmines will help safeguard your financial future as you move forward.

Got Questions About Splitting a 401(k)? We Have Answers.

When you're trying to figure out the specifics of dividing a 401(k) in a Texas divorce, it’s natural for a lot of questions to pop up. We've put together some straightforward answers to the most common concerns we hear from our clients, giving you practical insights to help you feel more confident in the process.

Yes, absolutely. This is one of the most common and effective negotiation strategies we see. Instead of actually splitting the retirement account, one spouse can "buy out" the other's share by trading another marital asset of equal value.

For example, let's say the community property portion of the 401(k) is worth $200,000. Your half would be roughly $100,000. You might agree to give up your claim to that $100,000 in retirement funds in exchange for keeping the family home, assuming it has a similar amount of equity. This move requires a very precise valuation of both assets to make sure the trade is fair, but it can be a fantastic way for both people to walk away with what's most important to them.

What Happens if My Spouse Retires Before the QDRO Is Done?

This is a critical, time-sensitive issue that can cause huge problems. If your spouse retires and starts taking distributions from their 401(k) before a Qualified Domestic Relations Order (QDRO) is finalized and on file with the plan administrator, you could lose out on your share of those funds completely.

This is exactly why we stress the urgency of getting the QDRO drafted and approved right away. A well-written QDRO should also include specific language about survivor benefits, which protects your interest if your ex-spouse passes away before you receive your portion. Do not delay the QDRO process—it is the only legal tool that locks down your awarded share.

How Much Does a QDRO Cost?

The cost to prepare a QDRO can vary, but it's crucial to see it as an investment, not an expense. This legal document is what's required to secure what is often one of the biggest assets in a marriage.

Typically, legal fees for drafting and finalizing a QDRO reflect the complexity of the retirement plan's specific rules and the attorney's experience. When you consider that a 401(k) can be worth hundreds of thousands of dollars, the professional fee for ensuring the division is done right—avoiding costly tax penalties and securing your money—is a small price to pay for your long-term financial security.

We always tell our clients that a poorly drafted QDRO is far more expensive than a properly prepared one. The potential for rejected paperwork, serious delays, and lost funds makes professional preparation a non-negotiable part of the process.

Does a Volatile Stock Market Affect the 401(k) Split?

It absolutely does. A 401(k) is an investment account, which means its value can swing up or down every single day. If your divorce decree awards you a fixed dollar amount (like $50,000) and the market takes a nosedive before the QDRO is processed, you still only get $50,000, even though the whole account lost value.

The best practice is to specify a percentage (e.g., 50% of the marital portion) in the QDRO. This ensures you share equally in any market gains or losses that happen between the date of divorce and the date the funds are actually distributed. It's the only way to get a truly fair split of the asset's real-time value.

If you need help navigating divorce, custody, or estate planning in Texas, contact The Law Office of Bryan Fagan, PLLC today for a free consultation for tailored guidance.