Crafting your estate plan is one of the most meaningful things you can do for your family. It is a profound act of love, a promise to protect your assets and ensure your loved ones are cared for exactly as you wish. But the strength of that promise hinges on the expertise behind it. That's why figuring out how to choose an estate planning attorney isn't just another item on your to-do list; it's the single most important decision you'll make in securing your family's future.

Your First Step in Securing Your Family's Future

Starting the estate planning process can feel overwhelming, but it is also one of the most empowering steps you can take. A solid plan provides much more than a will; it's a complete strategy for managing your affairs if you become incapacitated and for distributing your assets with precision and care when you are gone. The alternative—grabbing a generic, one-size-fits-all template online—can unfortunately backfire, creating the very problems you were trying to avoid.

Before you begin your search for an attorney, it helps to have a baseline understanding of what's at stake. For example, knowing what is probate and how does it work makes it clear why a thoughtful, professionally crafted estate plan is so vital.

Why a Specialist Is Your Strategic Partner

Consider a blended Texas family that owns a small business. A simple will downloaded from the internet will not suffice. It likely won't address the nuances of Texas community property laws, leaving the business vulnerable and potentially sparking conflict between a current spouse and children from a previous marriage. This is where a specialized attorney becomes your strategic partner. They craft a custom plan designed to navigate these exact kinds of challenges, ensuring your wishes are honored and your loved ones are protected.

A dedicated professional ensures your plan is not only legally sound under the Texas Estates Code but also truly reflects your personal values and goals. Their role goes far beyond drafting documents; they offer counsel, anticipate potential conflicts, and help you build a legacy that lasts.

The Dangers of Inadequate Planning

Without professional guidance, families often face significant hurdles. The Texas Estates Code has very specific requirements for wills, trusts, and powers of attorney. One small mistake in how a document is drafted or signed can invalidate it completely, leading to costly court battles and immense emotional distress for your loved ones. The right attorney ensures every detail is correct from the start.

An estate plan is not a static document; it is a living strategy that should adapt to your life's changes. The right attorney becomes a long-term advisor who helps you protect what matters most as your family and assets grow.

By carefully selecting a knowledgeable and empathetic attorney, you are not just buying a legal service—you are investing in peace of mind. This guide will walk you through how to make this foundational decision with clarity and confidence. If you're just starting to think about your needs, our guide on evaluating your situation relating to your estate is a great place to begin.

Identifying True Expertise in Texas Estate Law

When you decide to create an estate plan, you place immense trust in the professional guiding you. However, a common misconception is that any lawyer can handle estate planning. The truth is, there's a world of difference between a general practice attorney and a dedicated specialist who lives and breathes this complex legal area every day.

Think of it this way: you would not ask your family doctor to perform heart surgery. You would want a cardiologist. The same logic applies here. The future you are planning for your family is simply too important for anything less than specialized expertise.

Looking Beyond a Basic Law License

Every licensed attorney in Texas has passed the bar exam, but that is just the beginning. True expertise in estate planning is built over years of focused practice, ongoing education, and a deep commitment to mastering one area of law. You need an advisor who knows the Texas Estates Code inside and out and, more importantly, understands how to apply its provisions to your unique family and financial situation.

For instance, imagine a high-net-worth individual in Houston with significant real estate holdings. A specialist will immediately understand how Texas's community property rules affect asset division. They will know how to structure trusts to minimize estate taxes and shield assets from creditors—insights that can save a family hundreds of thousands of dollars and prevent devastating legal fights.

Verifiable Credentials That Matter

So, how do you spot a genuine specialist? Look for objective, verifiable credentials that set an attorney apart. These are not just marketing points; they represent a proven commitment to excellence.

Here are a few key indicators of a top-tier estate planning attorney:

- Board Certification: The Texas Board of Legal Specialization offers a rigorous certification in Estate Planning and Probate Law. To earn it, an attorney must have substantial experience, pass a difficult exam, and receive positive peer reviews. Less than 1% of all licensed Texas attorneys are Board Certified in this specialty, making it a true gold standard.

- Professional Affiliations: Membership in elite, invitation-only groups like the American College of Trust and Estate Counsel (ACTEC) is a significant indicator. It means an attorney is recognized by their peers as a leader in the field.

- Focused Practice: Review the law firm’s website and the attorney’s biography. Do they dedicate the vast majority of their practice to estate planning, probate, and trust administration? Or is it just one service on a long list? A dedicated focus is a strong signal of real expertise.

Choosing an estate planning attorney with at least five years of specialized experience can significantly reduce the risks associated with improper planning. Data indicates that estates handled by attorneys with this level of experience avoid 30-50% more probate disputes compared to those managed by generalists, thanks to their deep familiarity with state-specific laws. This is especially vital in Texas, where homestead exemptions and community property rules demand absolute precision. You can discover more about the key criteria for choosing your attorney to ensure you are making an informed decision.

Ultimately, you are not just looking for someone who knows the law. You are looking for an attorney who understands how to apply it strategically to protect your family and honor your wishes. By looking for these credentials, you can find a specialist who can provide the sophisticated guidance your legacy deserves. Knowing what questions you should ask a probate lawyer during your consultation can further help you vet their expertise.

Finding an Attorney You Can Genuinely Trust

While legal skill is essential, trust is the bedrock of your relationship with an estate planning attorney. You will be sharing the most intimate details of your family life and finances with this person. You need more than a legal technician—you need an advisor who listens, understands your goals, and puts your family’s future first.

Vetting an attorney for their reputation and client-centric approach is just as important as verifying their credentials. The goal is to find someone who sees you as a person with unique hopes and fears, not just another case file.

Verifying Professional Standing and Reputation

Your first step should be a simple but non-negotiable one: confirm that any attorney you are considering is in good standing with the State Bar of Texas.

The State Bar of Texas maintains a public database where you can look up any licensed attorney. This quick search will confirm their eligibility to practice law and—most importantly—reveal any public disciplinary history. A clean record is the absolute baseline.

Next, dig deeper into their professional reputation. Look for peer reviews on respected legal directories like Martindale-Hubbell. These ratings are based on confidential feedback from other lawyers and judges. A high rating here is a strong signal that an attorney is respected by their peers for both their legal skill and their ethical standards.

The Power of Client Testimonials

While peer reviews tell you what other lawyers think, client testimonials offer a window into what it is like to work with the attorney. When reading these, look beyond the star rating and pay close attention to the words people use.

Do clients mention feeling heard and respected? Do they talk about how the attorney made complex legal concepts easy to understand? These are the hallmarks of a practice that prioritizes its clients.

Consider this scenario: One family chooses an attorney consistently praised for clear, compassionate communication and feels guided every step of the way. Another family picks a lawyer with a spotty reputation and ends up frustrated by delays and confused by jargon. The difference in their experience came down to trust.

Reputation and client reviews are powerful tools. Data shows that top-rated firms often resolve the vast majority of cases without court intervention. Online reviews also provide valuable insights, with statistics suggesting that attorneys with high star ratings across numerous reviews have significantly higher client retention. This reflects strong communication—a vital component, as a large percentage of estate disputes stem from simple misunderstandings. You can read more about what to look for in an estate planning attorney to better inform your choice.

What to Look for in Online Reviews

As you sift through online reviews, keep an eye out for patterns. Here are a few key themes to watch for:

- Responsiveness: Do clients mention that the attorney and staff were quick to return calls and emails? Or do they complain about being left in the dark?

- Clarity: Is the attorney praised for explaining things in plain English? Or do clients seem confused by legal-speak?

- Empathy: Do reviewers talk about feeling comfortable and understood during what is often a very sensitive process?

- Problem-Solving: Do any reviews highlight how the attorney skillfully navigated a particularly tricky family dynamic or complex financial situation?

Choosing an attorney you genuinely trust can transform estate planning from a daunting legal task into an empowering act of love for your family. Taking the time to do this research upfront is a small investment that pays huge dividends in peace of mind.

Making the Most of Your Initial Consultation

The first meeting with a potential estate planning attorney is not just a casual meet-and-greet; it is an interview where you are the hiring manager. This is your chance to look beyond the website and get a feel for the person who may become a trusted advisor for your family for years to come.

Walking in prepared is key. By knowing what to ask, you can turn a passive listening session into a powerful evaluation. The goal is to cover four main areas: specific experience, client process, communication style, and fees. A great attorney will welcome your questions and provide direct answers.

Questions to Guide Your Decision

Feeling confident in your choice comes down to asking the right questions and knowing how to read the answers. An attorney who is open and direct signals a relationship built on trust. Vague or evasive responses are a major red flag, potentially indicating a lack of relevant experience or a communication style that will lead to frustration.

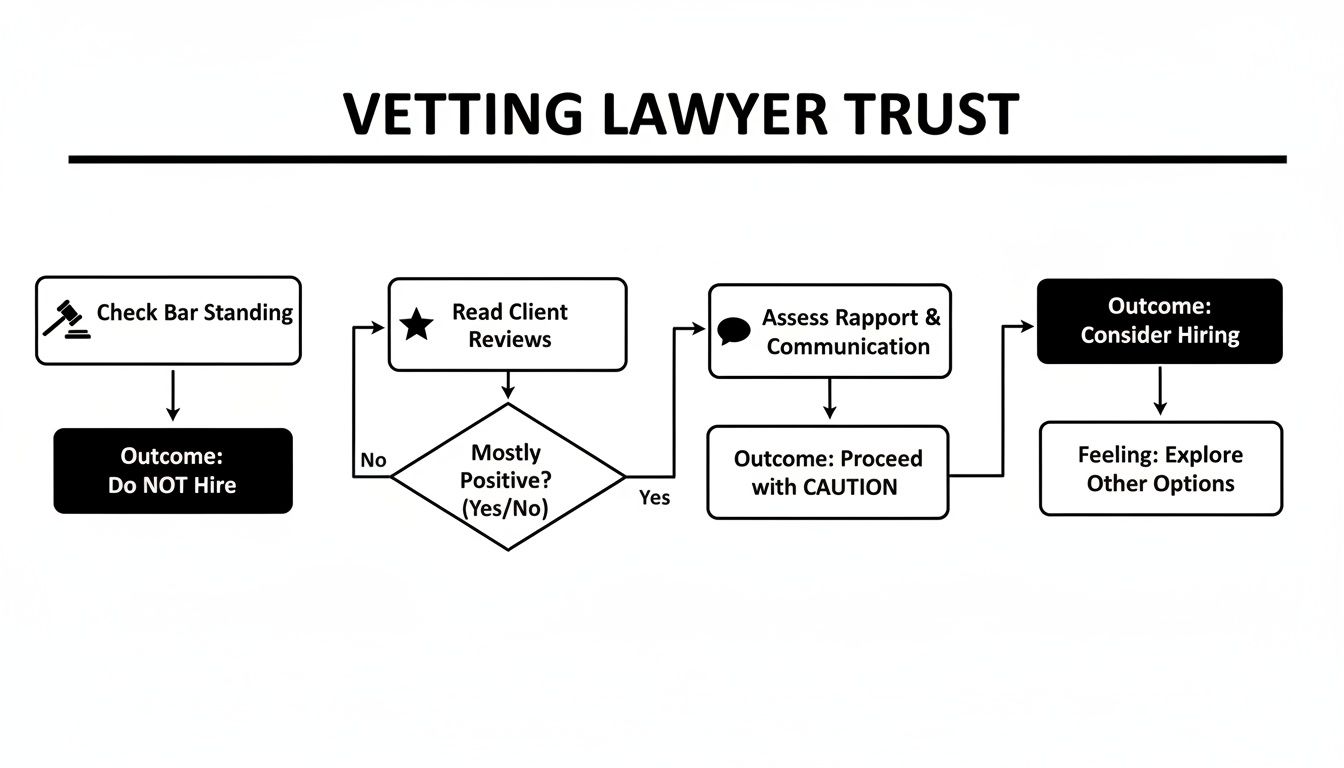

Vetting an attorney for their expertise, communication skills, and overall trustworthiness is a non-negotiable step. This flowchart breaks down the process into a clear, logical path so you know exactly what to look for.

As the chart shows, you start by confirming their professional standing, then check what past clients are saying, and finally, gauge your own personal rapport during the consultation. It’s a straightforward way to build confidence in your choice.

To ensure you cover all important points, we have put together a table of essential questions. Use this as a checklist during your meeting to get the clarity you need to make a smart decision.

Essential Questions for Your Attorney Consultation

This checklist is designed to help you interview a potential estate planning attorney effectively. It covers what to ask, what a good answer sounds like, and what should make you think twice.

| Question Category | Specific Question to Ask | What to Listen For (Green Flag) | What to Watch Out For (Red Flag) |

|---|---|---|---|

| Experience & Expertise | "How many years have you focused specifically on estate planning, and what percentage of your practice is dedicated to it?" | A confident, direct answer that shows a deep focus in this area. They can clearly explain why they chose this specific field of law. | Vague responses or an admission that their practice is a mix of many unrelated legal areas. A "jack-of-all-trades" is rarely a master of estate law. |

| Experience & Expertise | "Can you describe a situation similar to mine that you've handled? I'm particularly concerned about [mention a specific issue, like a blended family or business succession]." | They can walk you through an anonymous but similar scenario, explaining the strategy they used and why it worked. This demonstrates real, relevant experience. | They can't recall a similar case or seem to brush off the specifics of your situation. This might mean your needs are outside their wheelhouse. |

| Process & Timeline | "What does your process look like from today until my documents are signed? What’s a realistic timeline for getting this done?" | A clear, step-by-step explanation of their workflow: information gathering, drafting, review, and signing. They should be able to give you a solid timeframe. | A disorganized or fuzzy explanation. If they seem rushed or can't provide a general timeline, it could signal an inefficient practice. |

| Communication | "Who will be my main point of contact? If I have a question, what’s your firm's policy for getting back to clients?" | A specific answer about who you'll be talking to (the attorney, a dedicated paralegal) and a firm commitment, like a 24-business-hour response time. | "It depends," or no clear policy at all. This is a huge warning sign that you might be left in the dark when you need answers most. |

| Fees & Billing | "Do you use a flat-fee structure or bill hourly for estate planning? Can you give me a full breakdown of all potential costs?" | Total transparency. Flat-fee packages are the gold standard in estate planning, and they should be happy to provide a written fee agreement. | Any hesitation to talk about fees upfront or an unwillingness to put it in writing. Vague mentions of "other costs" without specifics are a bad sign. |

Taking these questions with you will arm you with the information you need, but don't stop there.

Assessing Personal Rapport and Understanding

Beyond the resume and fee schedule, you need to trust your gut. This is the person with whom you will share sensitive family and financial information, so you must feel comfortable. During your conversation, ask yourself:

- Do they listen to me? A good attorney listens more than they talk, especially in the first meeting. You should feel heard.

- Can they explain things clearly? When they mention something complex from the Texas Estates Code, do they break it down into plain English you can understand?

- Do I feel respected, or am I just another appointment? Your questions should be treated as important, not as an interruption.

Trust your intuition. An attorney can have a wall full of degrees, but if they make you feel small, confused, or rushed, they are not the right fit. The relationship you build is every bit as important as the documents they draft.

Choosing the right estate planning attorney is a legacy decision that will protect your family for generations. By preparing for your consultation and asking these pointed questions, you can move forward with confidence, knowing you’ve found a true partner.

Talking Money: Legal Fees and Long-Term Value

Let's discuss a crucial topic: the cost. When you are looking for an attorney, transparency about fees is not just a courtesy; it is a sign that you are dealing with a true professional. Understanding how estate planning lawyers charge for their work helps you see beyond the initial price tag to the incredible long-term value a well-crafted plan provides.

This clarity is critical, because the cost of not planning correctly can dwarf the investment you make in getting it right from the start.

Common Fee Structures in Estate Planning

In Texas, estate planning attorneys generally use one of two billing models. Knowing the difference helps you understand exactly what you are paying for.

- Flat Fees: This is the most common and client-friendly model for estate planning. The attorney quotes a single, fixed price for a specific package of documents—such as a will, durable power of attorney, and medical power of attorney. This provides total predictability with no surprise bills.

- Hourly Billing: This is more common in complex situations, like managing an ongoing trust or handling a contested probate case. If your needs are particularly intricate, it’s important to know the hourly rate and how time is tracked.

A reputable attorney will always provide a detailed, written fee agreement before any work begins. This document should clearly outline what is included and what is not, ensuring no hidden charges or ambiguity.

The True Cost of a "Bargain" Plan

It can be tempting to use a DIY online will template to save money. While these services seem like a bargain upfront, they often create devastatingly expensive problems for your family later. A generic document cannot account for the nuances of Texas law or your unique family situation.

An improperly drafted or executed will can easily be challenged in probate court, leading to months or even years of stressful and costly litigation for your loved ones. The few hundred dollars you might save on a cheap template could cost your family tens of thousands of dollars in legal fees later, completely defeating the purpose of your plan.

Think of it as an investment in your family's future security. A professionally drafted plan costs more at the start because you are paying for an expert’s knowledge, strategic advice, and the assurance that every detail complies with the Texas Estates Code. That initial investment buys priceless peace of mind.

Seeing Beyond the Price Tag

When you hire an estate planning attorney, you are not just buying a stack of papers. You are investing in a long-term relationship with a trusted advisor who will be there for your family when they need it most.

The real value is in the comprehensive protection and personalized strategy they create for you. A cheap will offers a false sense of security; a professionally crafted plan delivers genuine peace of mind. By insisting on a clear fee agreement and focusing on the long-term benefits, you can confidently choose an attorney who will protect your legacy and your loved ones.

What Happens After You Hire Your Attorney

Congratulations—you have hired an attorney. You did the hard work of finding a trusted advisor, and now the process of protecting your family’s future can begin. Think of this next phase as a partnership, where we translate your vision into solid, legally binding documents.

The journey starts with gathering all necessary details about your assets, family dynamics, and specific wishes. From there, we will draft the core documents of your estate plan, which may include your will, trusts, and powers of attorney. You will have the opportunity to review every draft, ask questions, and ensure each detail perfectly reflects your goals.

The Formal Signing Ceremony

Once the documents are exactly right, it is time for the formal signing. This is a ceremony with strict legal requirements designed to make your documents ironclad and capable of withstanding future challenges.

Under the Texas Estates Code § 251.051, a will must be signed in the presence of two credible and disinterested witnesses. "Disinterested" is a key term, meaning they cannot be beneficiaries in your will. Your attorney will manage this entire process, ensuring every legal formality is followed to the letter. This provides peace of mind that your plan is built to last.

After the Ink Dries: Your Long-Term Partnership

Your work is not finished once the documents are signed. A great estate plan is a living strategy, not a set-it-and-forget-it task. There are a few critical next steps:

- Funding Your Trust: If your plan includes a trust, you must transfer assets into it. This is a crucial step that people often overlook. Your attorney will guide you on how to retitle bank accounts, real estate deeds, and other property.

- Secure Document Storage: Your original documents are incredibly valuable. We can provide guidance on storing your estate planning documents safely so they are protected and accessible when needed.

- Periodic Reviews: Life changes, and your estate plan should change with it. It is wise to review your plan with your attorney every three to five years, or after any major life event like a marriage, birth, or significant financial shift.

Choosing an attorney is the start of a long-term partnership. They are your resource for life's changes, ensuring your plan remains effective as your family and assets grow.

Down the road, after your plan is in place, your family might need practical help with things like navigating estate sale pricing for items they inherit. This is all part of the long-term value a dedicated attorney provides.

We Hear You: Answering Your Top Questions About Finding the Right Attorney

It is completely normal to have questions when you begin the process of finding an estate planning attorney. In fact, it is a good sign—it means you are taking this responsibility seriously. We have heard nearly every concern a Texas family can have, and a few common themes always emerge. Let's tackle them head-on.

One of the first questions people ask is, "How long will this process take?" While every situation is unique, a straightforward plan—including a will and powers of attorney—can often be completed in just a few weeks. If your situation involves more complex elements, like setting up trusts or planning for business succession, it will naturally take longer. A good attorney will provide a realistic timeline from the start.

What If My Family Situation Is… Complicated?

This is a significant concern for many. We often hear from people who worry their family dynamics—such as blended families with children from multiple marriages or a painful estrangement—are too messy for a standard plan.

Let me put your mind at ease: a seasoned estate planning attorney has seen it all. Our role is not to judge your family history; it is to listen and then build a plan that confronts those challenges directly. We use specific legal tools, like carefully structured trusts and precisely worded clauses, to prevent conflict before it can start.

The right attorney doesn't just tolerate complexity—they thrive on it. They see it as an opportunity to craft a plan that provides exactly the protection your unique family needs. Your plan should be a perfect reflection of your wishes, no matter how tangled the branches of your family tree might be.

Finally, there is the big “what if.” People ask, "What if I change my mind in a few years?" Life happens. You might get married, have another child, or sell a business. Your estate plan is not meant to be set in stone forever.

You can—and absolutely should—update your documents after any major life event. A great attorney will even encourage you to check in every few years to ensure everything still aligns with your goals. Think of this not as a one-time purchase but as the beginning of a long-term relationship built on trust and designed to protect your family for years to come.

If you need help navigating divorce, custody, or estate planning in Texas, contact The Law Office of Bryan Fagan, PLLC today for a free consultation.