Divorce can be one of life’s most difficult transitions—but understanding your rights under Texas law can make it less overwhelming, especially when a family business is involved. A divorce business valuation is the process of determining the fair market value of that business so it can be divided equitably. Think of it as a professional appraisal for your house before you sell it; this step is absolutely critical for establishing a clear, objective number that protects your financial future.

Why a Business Valuation Is Your Financial Cornerstone in Divorce

When a business you or your spouse built is part of the divorce, the stakes are incredibly high. It’s often more than just a financial asset; it can represent years of effort, dedication, and personal identity. An accurate, professional valuation provides the foundation for a fair settlement. It replaces emotional arguments with objective facts, ensuring the division of your property is just and right.

Upholding Texas Community Property Law

Texas is a community property state, a principle that profoundly impacts divorce proceedings. The Texas Family Code § 7.001 requires courts to divide the marital estate in a "just and right" manner. But how can a judge achieve a fair division without knowing what the business is actually worth? It’s simply not possible.

A professional valuation provides the court with a defensible, unbiased figure to work from. It empowers you to negotiate from a position of knowledge and strength.

Without a proper valuation, you are negotiating in the dark and risk:

- Receiving far less than your fair share of the marital estate.

- Unintentionally giving away too much of what you are entitled to.

- Becoming stuck in lengthy and expensive legal battles fueled by disagreements over the business's worth.

Clarifying Separate vs. Community Property

A business is rarely a simple asset to categorize. It can often be a complex mix of separate and community property, making the valuation process even more essential.

For example, a business started before the marriage is generally considered the separate property of that spouse. However, any increase in its value during the marriage due to the time, labor, or talent of either spouse is typically classified as community property. A valuation expert can carefully trace this growth, untangling the separate and community interests to ensure only the marital portion is subject to division. This detailed analysis is a critical part of any business owner divorce.

The goal of a divorce business valuation isn't to force a sale of the company. Instead, it provides a concrete number that allows for creative settlement options, such as one spouse buying out the other's interest or trading its value for other marital assets like the family home.

Ultimately, investing in a thorough and impartial business valuation is an investment in your own financial security. It brings clarity to a complex situation, strengthens your negotiating position, and gives the court the solid information it needs to make a fair judgment.

The Three Core Methods of Valuing a Business

When it is time to assign a monetary value to a business, experts do not simply guess. They rely on established, defensible methods to determine a company's fair market value. Understanding these core approaches will help you follow the process and ensure your interests are protected.

Think of these methods as different lenses for viewing the same object. Each provides a unique perspective, and the right one depends on the type of business being valued. A skilled expert will often analyze the business through more than one lens to arrive at the most accurate and fair conclusion.

The Asset-Based Approach

The Asset-Based Approach is the most straightforward method. Imagine the business closed its doors today. You would sell every asset—desks, computers, vehicles, and inventory. Then, you would use that money to pay off every debt, from bank loans to outstanding invoices.

What remains is the business's "net asset value." This method is often used for businesses with significant tangible assets, such as:

- Real estate holding companies

- Manufacturing plants

- Farming operations

This approach calculates the worth of the company’s tangible parts if everything were liquidated. While simple, it often fails to capture the full picture, especially for businesses whose true value lies in their ability to generate future income.

The Market-Based Approach

If you have ever bought or sold a house, the Market-Based Approach will feel familiar. A real estate agent analyzes "comps"—recently sold homes in your area—to determine your home's price. Similarly, a valuation expert researches comparable businesses in the same industry that have recently been sold.

By comparing key financial metrics, like revenue or earnings multiples from these sales, the expert can establish a realistic market value. This method is highly effective when there is reliable data available on recent sales of similar companies.

The primary challenge, however, is finding businesses that are truly comparable. A local, family-owned restaurant is fundamentally different from a national chain, even if they both serve similar food. For unique or niche businesses, this approach can be difficult to apply accurately.

The Income-Based Approach

The Income-Based Approach is often considered the most forward-looking method. It does not focus on physical assets or comparable sales. Instead, it calculates value based on the business's capacity to generate income in the future. An expert will project the company's future profits or cash flow and then discount that income stream to its present-day value.

This method gets to the heart of the matter by asking, "How much profit can we realistically expect this business to make over the next several years?" This is absolutely critical for service-based businesses, tech companies, and professional practices where the value isn't tied up in physical inventory.

Consider a successful law firm. Its value is not in its office furniture; it is in its reputation, client list, and proven ability to consistently generate revenue. That is what makes the income approach so powerful—it captures a company's true earning potential. We explore the unique challenges of this method in our guide to startup company valuations in a Texas divorce.

Each valuation method offers a different but essential perspective. The table below provides a quick comparison.

Comparing Business Valuation Methods

| Valuation Method | Core Concept | Best Suited For |

|---|---|---|

| Asset-Based | Value is based on the company's net assets (Assets – Liabilities). | Businesses with significant tangible assets, like real estate or manufacturing. |

| Market-Based | Value is determined by comparing the business to similar companies that have recently been sold. | Industries where comparable sales data is readily available and reliable. |

| Income-Based | Value is derived from the business's expected future earnings or cash flow. | Service-based businesses, professional practices, and companies with strong intangible assets. |

To get a fuller picture of the different approaches, you can explore various business valuation methods and techniques. An experienced valuation professional will analyze your specific business and determine which method, or combination of methods, provides the most accurate and defensible valuation for your divorce proceedings.

How Texas Community Property Law Impacts Your Business

Navigating a divorce in Texas requires a firm understanding of our state’s foundational legal principle: we are a community property state. This rule significantly impacts every asset you and your spouse acquired during your marriage, but its effect on a family business is especially profound. As you face a divorce business valuation, it is critical to understand how this legal framework shapes the entire process.

The law begins with a simple but powerful premise. Under the Texas Family Code § 3.003, any property acquired by either spouse during the marriage is presumed to be community property. In plain English, this means the law considers the business to be owned by both of you, regardless of whose name is on the legal documents or who managed the day-to-day operations.

The Presumption of Community Property

This legal presumption is the starting point for dividing all marital assets. The burden of proof falls on the spouse claiming an asset—or a portion of the business—as their separate property. To succeed, they must present clear and convincing evidence that the asset was theirs before the marriage, or that it was acquired during the marriage as a gift or inheritance.

Without such definitive proof, the court will treat the entire business as part of the marital estate, subject to a "just and right" division. This is why meticulous record-keeping is crucial for any business owner, particularly if your business existed before you were married.

When Separate and Community Property Mix

The situation becomes more complex when a business that began as separate property grows significantly during the marriage. This is one of the most challenging scenarios in a divorce. Was that growth due to market forces, or was it the direct result of the time, talent, and effort of one or both spouses?

If the increase in value resulted from the active efforts of either spouse, that growth is considered community property. A valuation expert must meticulously trace the business's growth, untangling the separate and community interests to determine what portion is subject to division.

A common complication arises when community funds—for example, money from a joint bank account—are used to pay a business loan or purchase new equipment for what was originally a separate property business. This can trigger a reimbursement claim, where the community estate has a right to be repaid for its contributions.

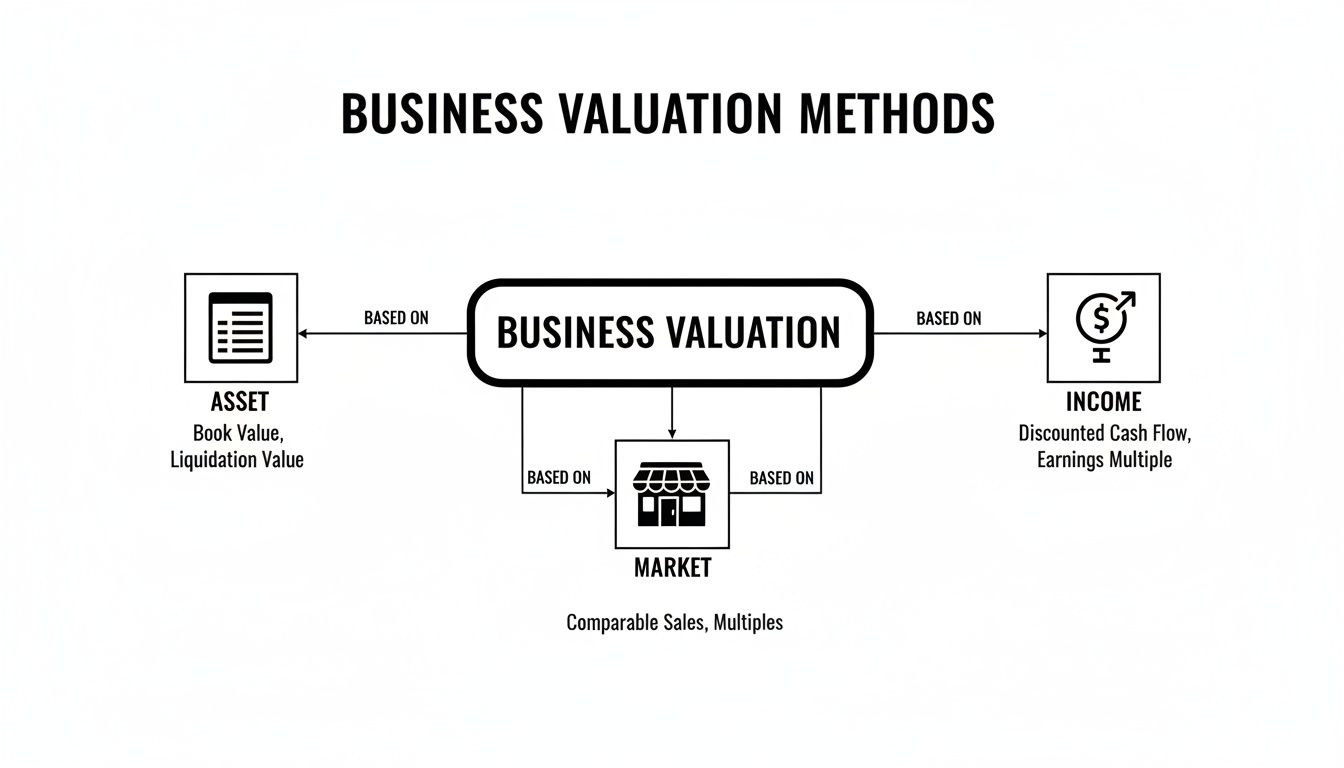

This chart breaks down the main ways an expert will look at your business to determine its value. Each method offers a different angle on what your company is truly worth.

Whether your expert relies on the asset, market, or income approach depends on the nature of your business. This is one of the first and most important decisions they will make.

The Critical Role of Goodwill

Another vital concept in a Texas divorce business valuation is goodwill. Goodwill represents the intangible qualities that make a business valuable—its reputation, loyal customer base, and brand recognition that drive revenue. Texas courts distinguish between two types of goodwill:

- Personal Goodwill: This value is tied directly to the skill, reputation, and personal relationships of one spouse. For example, the loyal patient base of a renowned surgeon is due almost entirely to their individual talent. In Texas, personal goodwill is not a divisible marital asset.

- Enterprise Goodwill: This value is attached to the business itself, separate from any individual. It includes elements that would remain even if the owner left—such as a prime location, a well-known brand name, or efficient operational systems. Enterprise goodwill is considered community property and is subject to division.

Determining how much of a business’s goodwill is personal versus enterprise-related can dramatically alter the final divisible value. A skilled valuation expert will dissect the business to make this critical distinction, a step that can have a massive impact on your financial future. These challenges become even more complex when both spouses are involved in the business, a topic we address in our article on how a couple-owned business is treated during divorce.

Understanding these Texas-specific rules is not merely an academic exercise; it is a practical necessity for protecting what you have built. The interplay between separate property claims, reimbursement rights, and the classification of goodwill is where many high-asset divorce cases are won or lost. Having an attorney who is deeply familiar with these nuances is essential for achieving a truly fair outcome.

A Step-by-Step Guide to the Business Valuation Process

The thought of valuing a business during a divorce can feel overwhelming, but breaking it down into a clear, step-by-step process can make it much more manageable. When you know what to expect, you can feel more in control and actively participate in ensuring the final valuation is as fair and accurate as possible. Here is a practical guide to the process.

Stage 1: Choosing the Right Valuation Expert

The first and most critical step is selecting the right professional. This is not a task for a general accountant; you need a specialist with credentials such as Certified Valuation Analyst (CVA) or Accredited in Business Valuation (ABV), who has a proven track record in Texas divorce cases.

Ideally, you and your spouse will agree on a single, neutral expert. This joint approach is typically more cost-effective and can reduce conflict, as both parties trust the process from the start. If an agreement cannot be reached, each side may hire their own expert, which often results in two different valuation reports that must be reconciled later.

Stage 2: The Discovery and Document Gathering Phase

Once an expert is chosen, the process of deep-diving into the company’s financials begins. This phase, known as discovery, involves gathering all documents that tell the complete financial story of the business. Complete transparency is essential for an accurate valuation.

The expert will provide a list of required records, usually covering several years. This typically includes:

- Tax Returns: Both business and personal returns are needed to see the full financial picture.

- Financial Statements: This includes profit and loss statements, balance sheets, and cash flow statements.

- Bank Records: Statements from all business accounts provide a clear view of cash flow.

- Contracts and Leases: Key agreements with clients, vendors, and landlords must be reviewed.

- Payroll and Employee Records: These documents help the expert understand operational costs and business structure.

For a modern business, organized and accessible financial records are the foundation of a smooth valuation. Using platforms like cloud accounting solutions can simplify this data collection phase, ensuring the expert receives the precise information needed for their analysis.

Stage 3: The Expert's Analysis and Final Report

With all the documents collected, the expert begins their analysis. They will review the data, apply the most appropriate valuation methods—whether asset, market, or income-based—and consider external factors like industry trends and the economic climate. This is where their expertise is crucial, as they synthesize vast amounts of data into a coherent, defensible opinion of value.

A key part of this analysis involves "normalizing" the financials. The expert will adjust the financial records to account for any personal expenses paid by the business or one-time events that do not reflect the company's true, ongoing profitability.

The final product is a comprehensive valuation report. This detailed document outlines the expert’s entire process: the information they reviewed, the methods they chose, and their final conclusion on the business's worth. This report becomes a cornerstone piece of evidence in your divorce, serving as the factual basis for negotiations, mediation, or a judge's decision in court.

Handling Common Disputes in Business Valuation

Disagreements over a business's true worth are common in divorces involving a company. However, these disputes do not have to bring your case to a standstill. When a major asset is at stake, emotions can run high, and perspectives often clash. The key is to anticipate these challenges so you can navigate them with a clear strategy.

The goal is not to avoid disputes entirely, but to handle them efficiently, protecting your financial interests without getting mired in a costly and emotionally draining stalemate.

The Battle of the Experts and Dueling Reports

A classic conflict arises when you and your spouse each hire your own valuation expert. It is not surprising when their final reports present vastly different figures. For example, your expert might value the business at $500,000, while theirs claims it is worth $1.2 million. Such a wide gap can seem impossible to bridge.

This discrepancy typically stems from the different assumptions each expert made or the valuation methods they prioritized.

- Different Methodologies: One expert may use an income-based approach focused on future potential, while the other uses an asset-based method that only considers tangible assets.

- Varying Projections: Experts often have different forecasts for the economy or industry, leading to different projections for the company’s future earnings.

- Goodwill Disagreements: A major point of contention is often the allocation between personal goodwill (tied to the owner) and enterprise goodwill (tied to the business), which can significantly impact the value of the community asset.

When faced with two conflicting reports, the first step is for your attorney to depose the other expert. This process involves asking them detailed questions under oath to understand exactly how they arrived at their valuation. This often reveals weaknesses in their analysis or questionable assumptions that can be challenged in negotiations or in court.

Disagreements Over the Valuation Date

Timing is critical in a divorce business valuation. The specific date chosen to value the business—the valuation date—can have a massive impact on the final number. A company’s value can fluctuate significantly based on market shifts, seasonal trends, or a single major event.

For instance, a retail business valued in October would likely have a higher valuation than one valued in January, due to holiday sales. One spouse may advocate for a date when the value was at its peak, while the other will push for a date after a downturn.

In Texas, courts typically prefer to value assets as close to the date of trial as possible. However, the parties can agree to a different date, or a judge may be persuaded to use an alternative if it leads to a more "just and right" division. Proving that one date is more equitable than another is a key aspect of your attorney's legal strategy.

Normalizing Income and Owner Perks

Another common area of dispute is the "normalization" of the company's financials. Many small business owners run personal expenses through the company to reduce their tax liability. These can include car payments, family cell phone plans, or personal travel disguised as business trips.

These "owner perks" artificially lower the business’s stated profits. A skilled valuation expert will identify these expenses and add them back to the income statement to reflect the company’s true earning power. This process, known as normalization, is a frequent source of disagreement. The spouse who runs the business may argue these are legitimate costs, while the other spouse insists they are personal benefits that obscure the real income.

Resolving these disputes requires a thorough forensic analysis of bank statements, credit card bills, and expense reports. By clearly documenting these perks, your expert can build a strong case for a higher, more accurate business income, leading to a fairer valuation and a more just division of your marital estate.

Frequently Asked Questions About Divorce Business Valuation

Divorce is complex, and adding a business to the equation can feel overwhelming. The process of a divorce business valuation often raises specific concerns about cost, fairness, and the future of the company you have dedicated your life to. My goal is to provide clear, direct answers to the questions I hear most often, so you can move forward with confidence.

How Much Does a Business Valuation Cost in a Texas Divorce?

This is often the first question clients ask, and the answer is: it depends. The cost of a professional valuation varies based on several key factors. For a small, straightforward business with immaculate financial records, the cost may be a few thousand dollars.

For a more complex company with multiple locations, significant assets, or disorganized financial records, the process requires a much deeper analysis. If the situation is contentious and requires a forensic accountant to uncover hidden assets or reconstruct financial histories, the cost will increase accordingly.

It is helpful to view this expense not as a cost, but as an investment in a fair outcome. A thorough valuation can prevent you from losing tens of thousands—or even millions—of dollars that are rightfully part of the marital estate. I can provide a more accurate estimate of potential costs during a free consultation after learning about your specific situation.

Does a Valuation Mean We Have to Sell the Business?

Absolutely not. In fact, a forced sale is usually the last resort. The primary purpose of a valuation is to establish a firm dollar amount for the business, providing a solid basis for negotiation.

Once that value is determined, it opens up a variety of creative solutions that allow the business to continue operating smoothly. The most common outcomes include:

- A Buyout: One spouse purchases the other’s share of the business.

- Asset Offset: The spouse managing the business keeps it, and the other spouse receives marital assets of equivalent value, such as the family home, retirement funds, or investment accounts.

- Structured Payout: The buyout occurs over time through a structured payment plan, which is an excellent solution when there is not enough cash or other liquid assets for an immediate lump-sum payment.

The valuation provides the necessary data to facilitate these agreements while adhering to the "just and right" division standard required by Texas law.

What if My Spouse Is Hiding Business Assets or Income?

The suspicion that your spouse is manipulating the finances can be deeply unsettling, and it is a concern we take very seriously. If you believe your spouse is intentionally undervaluing the business, deferring income, or hiding assets, it is crucial to act quickly.

This is where the legal process becomes your most powerful tool. We collaborate with skilled forensic accountants who specialize in uncovering financial discrepancies. Through the formal discovery process, we can legally compel the disclosure of documents that might otherwise remain hidden.

We use legal tools like subpoenas and depositions to obtain bank statements, credit card records, vendor payment histories, and other financial data directly from the source. This cuts through any attempts to conceal the truth and enforces complete transparency, holding the other party accountable for presenting an accurate financial picture.

Protecting your financial future is my top priority. We will not hesitate to use every legal tool at our disposal to ensure every asset is accounted for, so the valuation is based on facts, not fiction.

Can We Use an Old Valuation or an Online Calculator?

Let me be direct: using a generic online calculator or a valuation that is more than a year old is one of the riskiest mistakes you can make. A business’s value is not static; it is a dynamic figure that fluctuates with the market, industry trends, and the company's current performance.

An outdated valuation is essentially worthless in a Texas courtroom. For your divorce, you need a current, comprehensive, and defensible valuation conducted by a qualified expert. This report is not just a document; it is a piece of evidence. The expert who prepares it must be prepared to testify in court and defend their findings under cross-examination.

Attempting to save money with a cheap online tool or an old report almost always backfires, leading to a profoundly unfair settlement. A proper valuation is non-negotiable for protecting your financial future and ensuring the final property division is truly equitable.

If you need help navigating divorce, custody, or estate planning in Texas, contact The Law Office of Bryan Fagan, PLLC today for a free consultation.