Sarah sat in her car a few extra minutes after her shift ended, staring at the text message from her ex. The transmission on their daughter’s car had finally gone out—another unexpected expense on top of rising rent and a recent cut in overtime hours. She wasn’t trying to avoid her responsibilities, but the numbers simply weren’t adding up anymore. As she took a deep breath, the real question settled in: What Factors Can Lead to Adjustments in Child Support Obligations in Texas when life changes faster than the order on paper?

Parents across Texas know this feeling well. One unexpected bill, a job change, or a shift in family responsibilities can turn a previously manageable support arrangement into a source of stress and uncertainty. Texas law anticipates these moments of real-life upheaval. Under Texas Family Code §153.002, the best interest of the child remains the guiding star, and that includes ensuring financial responsibilities stay fair, realistic, and reflective of each parent’s current circumstances. Whether a parent loses income, gains new responsibilities, or faces a major life transition, these changes can open the door to modifying a child support order.

At The Law Office of Bryan Fagan, PLLC—a Houston-based family law firm founded by South Texas College of Law graduate and trusted Texas legal authority Bryan Joseph Fagan—we understand exactly what these moments feel like. Our “Why” has always been to empower families to reclaim peace of mind during life’s hardest transitions. We do this by offering compassionate guidance, legal education that simplifies complexity, and tailored strategies that protect what matters most.

This article will walk you through how Texas courts evaluate requests to adjust child support obligations, why certain life changes qualify for modification, and what steps you can take to ensure your child remains supported while you regain financial stability. Most importantly, you’ll find reassurance from a firm committed to standing beside Texas families with clarity, empathy, and proven legal experience.

Take a moment to exhale—you’re not facing this alone. Let’s explore your options with confidence and peace of mind.

Key Takeaways

- Material and substantial change in circumstances allows child support modification at any time, including significant income changes, new children, custody modifications, or major medical needs

- The Three-Year / 20% / $100 Rule permits modification after three years if current guidelines differ from the existing order by at least 20% or $100 monthly, even without major life changes

- Proper documentation is essential for successful modifications, including pay stubs, tax returns, medical records, and proof of changed circumstances

- The Texas Office of the Attorney General can assist with administrative modifications, but complex cases often benefit from private legal representation

- Timing matters critically since modifications typically apply from the filing date forward, not retroactively to when circumstances first changed

Understanding Texas Child Support Modification Laws

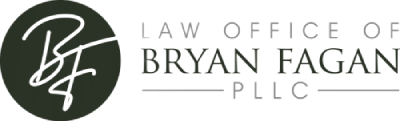

Texas Family Code Chapter 156, Subchapter E outlines the legal framework for modifying child support in Texas, ensuring that orders remain fair, accurate, and reflective of a family’s evolving needs. Families often ask: What Factors Can Lead to Adjustments in Child Support Obligations in Texas, and under the law, there are two distinct pathways that allow a court to revise an existing order when circumstances meaningfully shift. The first pathway requires demonstrating a “material and substantial change in circumstances” affecting the child or a parent since the date of the last order, as defined under Texas Family Code §156.401. This standard is intentionally flexible so courts may consider each family’s unique experiences—job loss, disability, changes in income, deployment, or shifts in a child’s medical or educational needs—while ensuring consistent application of Texas law. For a deeper exploration of what may qualify as a material and substantial change, you can review our detailed guide: What Counts as a Material and Substantial Change in Texas Child Custody Cases?.

The second pathway for modification, often referred to as the Three-Year / 20% / $100 Rule, provides a predictable alternative when significant time has passed since the last order. Under Texas Family Code §156.402, a parent may seek modification if at least three years have elapsed and the difference between the existing support amount and what the guidelines would require today is either 20% or $100. This ensures that normal financial changes over time—such as raises, cost-of-living adjustments, or fluctuations in net resources—don’t leave families bound to outdated support levels, especially in light of the updated guideline cap in Texas Family Code §154.125(a-1), which increases the maximum net resources considered for child support calculations to $11,700 as of September 1, 2025.

While cooperative co-parenting is commendable, it is critical for parents to understand that child support cannot be modified through informal agreements, verbal arrangements, or temporary understandings. Only a court-ordered modification has legal force. Paying more or less than the ordered amount, even with full agreement from the other parent, does not change your enforceable obligation and may expose you to arrears or enforcement actions. For parents wanting to better understand modification procedures or their rights, our team provides additional guidance in our resource on Texas Child Support Modifications, designed to help you make informed decisions that protect your family’s future.

As a firm dedicated to empowering families through education and strategic legal support, the family law attorneys at The Law Office of Bryan Fagan, PLLC are here to help you understand your options and pursue modifications that reflect your child’s best interests and your current circumstances. If you have questions about whether your situation meets the legal threshold for modification or need help navigating next steps, our team is ready to guide you with clarity, compassion, and proven experience.

The Three-Year Review and 20% Rule

Parents often ask What Factors Can Lead to Adjustments in Child Support Obligations in Texas, and one important mechanism is the “Three-Year / 20% / $100 Rule,” a streamlined path for modification established under Texas Family Code §156.402. This option allows parents to request a change to their child support order when at least three years have passed since the last order was signed and updated guideline calculations would result in a substantially different amount. For families seeking broader context on how modifications work, our firm provides additional insight in Understanding Texas Child Support and Material and Substantial Change.

To meet the requirements of this rule, two statutory conditions must be satisfied. First, the existing child support order must be at least three years old, measured from the date the judge signed the order—not the date payments began. Second, applying the current Texas child support guidelines must produce a difference of either 20% or at least $100 from the existing support amount. These guidelines rely on net resources calculations outlined in Texas Family Code Chapter 154, which now incorporate the updated cap on net monthly resources of $11,700 under §154.125(a-1). This ensures that support obligations remain aligned with current financial realities, including changes in income, cost-of-living adjustments, and economic shifts.

For example, if you currently pay $500 per month under an order signed four years ago and current guidelines call for $620 based on your income, the $120 difference satisfies the statutory threshold. This type of discrepancy is exactly what the Three-Year / 20% / $100 Rule is designed to address, offering parents a predictable path to updating outdated or inaccurate support amounts. It is especially helpful when changes in earnings or household finances have occurred naturally over time, even when there is no major life event.

However, this rule has an important limitation: it generally applies only when the original child support order followed guideline calculations at the time it was created. If your previous order deviated from the Texas guidelines due to an agreement between the parents or unique circumstances, you will typically need to pursue a modification under Texas Family Code §156.401 by demonstrating a material and substantial change in circumstances rather than relying on this three-year option.

Many parents mistakenly believe that they must wait three years before pursuing any child support modification, but Texas law provides two independent paths. The Three-Year Rule is simply an additional method—not the only one. You may request modification at any time when circumstances have materially and substantially changed, and the child support team at the Law Office of Bryan Fagan can help you evaluate which approach best fits your situation. For more guidance, visit our Texas Child Support Resource to explore how child support orders can adapt to meet your child’s evolving needs.

Major Life Changes That Trigger Modifications

Significant Income Changes

Income fluctuations represent the most common reason for child support modifications in Texas. Courts recognize that employment circumstances change, and child support obligations should reflect current earning capacity rather than outdated assumptions.

Job Loss or Unemployment: Involuntary job loss typically qualifies as a material and substantial change, especially when unemployment extends beyond a brief period. However, courts scrutinize voluntary job loss or deliberate underemployment. If a court believes you intentionally reduced income to avoid child support obligations, it may impute income based on your earning capacity rather than current earnings.

Salary Increases or Promotions: Significant income increases can justify upward modifications when the custodial parent demonstrates that higher support would better serve the child’s needs. Courts consider factors like the permanence of the increase and whether additional income comes from overtime that may fluctuate.

Career Changes Affecting Earning Capacity: Transitioning from high-paying employment to lower-paying work due to industry changes, health issues, or other legitimate reasons may support downward modifications. Courts evaluate whether career changes reflect genuine necessity or attempts to avoid support obligations.

Self-Employment Income Fluctuations: Self-employment income creates unique challenges for child support calculations. Courts often average income over multiple years and may impute income during periods of low earnings if they believe the business could generate higher revenue with proper effort.

New Family Obligations

Texas child support guidelines specifically account for parents supporting multiple families, making new children a recognized basis for modification.

Birth of Additional Children: When the non-custodial parent becomes legally responsible for supporting new children through birth or adoption, this creates a material and substantial change. Texas child support guidelines reduce the percentage of net resources allocated to existing children when parents support multiple households.

Remarriage and Stepchildren Responsibilities: While remarriage alone doesn’t automatically justify modification, financial obligations to stepchildren can sometimes be considered, particularly when the stepparent legally adopts the children or assumes formal financial responsibility.

Changes in Child’s Circumstances

Parents navigating major life transitions often wonder What Factors Can Lead to Adjustments in Child Support Obligations in Texas, especially when a child’s medical, educational, or residential needs change. Under Texas Family Code §156.401, these shifts may qualify as a “material and substantial change in circumstances,” giving the court authority to modify an existing child support order when fairness or the child’s best interests require it. For parents seeking step-by-step guidance on how to pursue a modification, our detailed resource How to Petition for a Modification After a Change of Circumstances in Texas Family Law offers practical support rooted in current Texas law.

Medical insurance changes are a common trigger for modification. When the parent responsible for providing health insurance loses coverage or experiences employment changes that affect the availability or affordability of insurance, the court may need to reassign medical support obligations. Texas Family Code Chapter 154 requires both medical and dental support to be included in child support orders, and these obligations must remain reasonable in light of updated costs and available resources.

Children with increasing medical needs may also require additional financial support. If a child develops a chronic condition, disability, or requires long-term therapy, these expenses may justify deviating from standard guideline support amounts. Courts evaluate both the child’s medical needs and each parent’s ability to contribute, using the updated guideline caps under Texas Family Code §154.125(a-1), which now consider net resources up to $11,700 per month when calculating support.

Educational and developmental needs can likewise lead to support adjustments. When a child requires private school tuition, tutoring, or specialized educational services due to learning disabilities or unique educational circumstances, these costs may exceed normal expectations and justify a modification. Courts focus on whether these expenses serve the child’s best interests and whether the financial burden is appropriately shared based on each parent’s resources.

Significant changes in living arrangements or parenting time often require courts to recalculate child support. If a child’s primary residence shifts from one parent to the other, or if parenting time changes substantially, Texas Family Code §154.123 allows courts to consider these new circumstances when determining whether support should be increased, decreased, or reassigned. As a firm dedicated to helping families make informed decisions, the child support attorneys at the Law Office of Bryan Fagan provide guidance rooted in compassion and legal precision. For more information, visit our Texas Child Support Resource to understand how support orders can evolve alongside your child’s needs.

Special Circumstances for Modifications

Families experiencing major life changes often ask What Factors Can Lead to Adjustments in Child Support Obligations in Texas, especially when circumstances impact a parent’s ability to earn or maintain financial stability. Under Texas Family Code §156.401, a “material and substantial change” may justify modifying an existing order, and courts review each situation carefully to ensure the child’s best interests remain protected. For a deeper look at how these life events affect support, our firm offers additional insight in Child Support Modifications: Adapting to Economic Shifts and Life Changes.

Incarceration lasting 180 days or more often meets the threshold for a material and substantial change, but courts also evaluate whether the parent had assets or income opportunities and whether reasonable efforts were made to provide support before confinement. This approach balances a parent’s reduced earning capacity with the child’s ongoing financial needs. Similarly, long-term or permanent disabilities may justify a modification when supported by medical documentation, and disability benefits may be counted as income under Texas Family Code Chapter 154.

Military families face unique challenges, and deployment is a circumstance courts take seriously when evaluating support adjustments. Texas courts consider the effect of combat pay exclusions, family separation allowances, and the temporary nature of deployment to ensure that support calculations remain fair and do not penalize service members fulfilling military obligations. These considerations reflect the state’s commitment to protecting both military parents and their children.

Relocation can also impact child support, particularly when significant distance increases visitation-related travel expenses. Under Texas Family Code §154.123, courts may consider transportation costs when determining whether a modification is appropriate. This ensures that children can maintain meaningful relationships with both parents, even when geographical realities impose new financial burdens.

As a trusted resource for Texas families, the attorneys at the Law Office of Bryan Fagan guide parents through the modification process with clarity, compassion, and legal precision. For more information on navigating support adjustments, our Texas Child Support Resource provides practical guidance to help families make informed decisions that protect their future.

Essential Documentation for Child Support Adjustments

Success in child support modification cases depends heavily on thorough documentation supporting your claims of changed circumstances. Courts require concrete evidence rather than general assertions about financial changes.

Financial Documents Required:

- Pay stubs covering the most recent 3-6 months

- Federal tax returns for the past 2 years, including all schedules and W-2/1099 forms

- Profit and loss statements for self-employed parents

- Bank statements showing income deposits and major expenses

- Unemployment benefits documentation or disability award letters

- Employment termination letters or documentation of reduced hours

Child-Related Expense Documentation:

- Medical bills and insurance statements showing increased costs

- Health insurance premium statements indicating coverage changes

- Receipts for therapy, counseling, or special education services

- Childcare invoices reflecting cost changes

- Educational expense documentation for private school or tutoring

Custody and Living Arrangement Evidence:

- Current court orders regarding custody and possession

- School enrollment records showing the child’s primary address

- Medical records listing the primary caregiver

- Documentation of actual time spent with each parent

Other Support Obligations:

- Birth certificates for new children

- Court orders establishing support obligations in other cases

- Documentation of spouse or stepchildren support responsibilities

Organizing these documents chronologically and creating clear summaries helps courts understand your situation quickly and demonstrates your commitment to transparency in the modification process.

Role of the Texas Office of the Attorney General

Parents exploring What Factors Can Lead to Adjustments in Child Support Obligations in Texas often interact with the Texas Office of the Attorney General (OAG), which plays a significant role in reviewing and modifying child support orders—especially in cases involving public assistance or those already overseen by state enforcement. The OAG evaluates whether modification criteria are met under Texas Family Code §156.401 (material and substantial change) or §156.402 (the Three-Year / 20% / $100 Rule). For a complete overview of how these legal standards apply, our firm provides an in-depth guide: What Qualifies for a Child Support Modification in Texas: A Complete Guide.

Through its administrative review process, the OAG gathers financial documents, recalculates support using current guideline requirements under Texas Family Code Chapter 154, and determines whether a modification may be appropriate. These calculations now incorporate the updated guideline cap of $11,700 in net monthly resources under §154.125(a-1), ensuring that support obligations reflect modern economic conditions. When both parents agree on the updated amount, the OAG may finalize the modification without requiring a court hearing.

However, contested cases or situations involving complex financial issues—such as business income, substantial assets, or unusual expense patterns—typically require court intervention. While the OAG can process modifications at a reduced cost for qualifying families, the agency represents the interests of the State of Texas, not either parent. This means the OAG cannot provide personalized legal advice or advocate for a parent’s individual financial or custodial concerns. In these situations, private legal representation often provides a more strategic and protective approach.

When working with the OAG, timely communication is critical. Parents must respond promptly to document requests and submit complete financial information, as delays can significantly extend the administrative timeline. In some cases, failure to provide accurate information may lead to unfavorable assumptions about income or support obligations, reinforcing the importance of careful, proactive participation throughout the review process.

For families seeking focused advocacy tailored to their unique circumstances, the attorneys at the Law Office of Bryan Fagan offer guidance grounded in compassion, clarity, and Texas Family Code compliance. To learn more about how support orders can be updated to reflect current needs and obligations, visit our comprehensive Texas Child Support Resource, designed to help parents make informed decisions that protect both their rights and their children’s futures.

Common Mistakes Parents Make

Parents often come to us asking What Factors Can Lead to Adjustments in Child Support Obligations in Texas, especially when mistakes or misunderstandings place them at financial or legal risk. One of the most common pitfalls is relying on informal agreements between parents without court approval. Under Texas Family Code §156.401, only a judge can modify a child support order, meaning private agreements—even when both parents agree—do not change the enforceable amount. When informal payments fall below the ordered amount, arrears continue to grow and can trigger enforcement actions. To better understand how legal standards apply to changing family circumstances, you can review our in-depth guide: Understanding Texas Custody and Material and Substantial Change: Key Insights for Parents.

Many parents also delay filing for modification after their financial or personal circumstances change. Texas Family Code §156.401 allows courts to adjust child support when a material and substantial change has occurred, but modifications apply only from the date a petition is filed. This means waiting months or years can result in preventable hardship, as courts cannot retroactively apply changes before the filing date. Acting promptly is essential to ensure support obligations fairly reflect current realities.

Another frequent misconception involves the Three-Year / 20% / $100 Rule found in Texas Family Code §156.402. Some parents mistakenly believe they must wait three years before requesting any modification, while others assume support automatically changes after three years. In reality, this rule provides an additional option—not a mandatory waiting period—and modification still requires filing proper paperwork and demonstrating eligibility under current guidelines, including the updated net-resource cap of $11,700 under §154.125(a-1).

Supporting documentation is also critical. Courts require concrete evidence of changed circumstances, such as income records, medical documentation, proof of increased expenses, or changes in a child’s needs. Filing without adequate documentation weakens a case and can lead to denial, even when a parent’s situation legitimately qualifies for modification. Preparation and accuracy are key to demonstrating the need for updated support.

Finally, parents should never reduce or stop payments without court approval. Under Texas Family Code Chapter 157, unpaid support becomes enforceable judgment debt with interest, and parents may face wage garnishment, tax refund interception, property liens, or even license suspension. When circumstances shift, the attorneys at the Law Office of Bryan Fagan guide families toward lawful, protective steps that avoid these consequences. For more information on navigating modifications effectively, visit our comprehensive Texas Child Support Resource to understand how support orders can be safely and responsibly updated.

How an Experienced Attorney Helps

Parents seeking clarity about What Factors Can Lead to Adjustments in Child Support Obligations in Texas often discover that strong legal guidance can significantly influence both the outcome of a modification request and the stability of their family moving forward. Under Texas Family Code §156.401, child support may be modified when a “material and substantial change in circumstances” occurs, and understanding how courts interpret this standard is essential. For a deeper breakdown of how courts evaluate changed circumstances in Texas, see our comprehensive guide: Understanding Material and Substantial Changes in Circumstances for Custody Modification Suits.

Professional legal support plays a critical role in evaluating whether your situation meets the statutory requirements for modification and in identifying the strongest path forward. Skilled attorneys assess income changes, medical conditions, shifts in a child’s needs, incarceration, relocation, and other major life events that Texas courts frequently examine when determining whether a modification is warranted. Early strategic analysis helps parents understand realistic expectations and the best timing for filing.

Accurate child support calculations are equally important. Under Texas Family Code Chapter 154, support is based on “net resources,” including wages, disability benefits, and certain types of military compensation. Experienced attorneys ensure these calculations are correct, especially in light of recent updates such as the increased guideline cap under Texas Family Code §154.125(a-1), now set at $11,700 in monthly net resources. When a family’s circumstances warrant deviation from guideline support, legal counsel can persuasively articulate why a non-guideline amount better serves the child’s best interests.

Evidence is often the deciding factor in modification cases, and legal professionals know how to assemble documentation that courts find credible and compelling. From financial statements to medical records, deployment papers, and transportation cost evidence, attorneys organize and present information in a manner that clearly demonstrates how circumstances have changed since the prior order. This careful preparation helps strengthen the case whether it proceeds through negotiation or litigation.

Although many child support modifications are resolved through negotiation, contested hearings are sometimes unavoidable. In such situations, the attorneys at the Law Office of Bryan Fagan effectively present evidence, cross-examine witnesses, and advocate for outcomes that reflect both legal requirements and a child’s best interests. For families seeking guidance on support modifications, our Texas Child Support Resource offers additional information to help parents make informed decisions and protect their children’s futures.

About The Law Office of Bryan Fagan PLLC

Families seeking clarity about What Factors Can Lead to Adjustments in Child Support Obligations in Texas deserve guidance grounded in both compassion and legal precision. At The Law Office of Bryan Fagan, PLLC, our mission is to educate families and protect futures by ensuring that child support orders reflect a child’s current needs and a parent’s actual financial circumstances. Under Texas Family Code §156.401, support orders may be modified when a material and substantial change has occurred, and our team is dedicated to helping parents understand how these legal standards apply to their unique situations. For a comprehensive overview of Texas child support laws, our firm provides an in-depth resource: Texas Child Support Overview.

As a leading Texas family law practice, we recognize that modifications often arise during moments of transition—job loss, increased earnings, medical changes, or shifts in parenting time. Because these issues directly affect a family’s daily life, our attorneys take time to understand each client’s circumstances and explain the legal path toward adjusting child support obligations. With updated guidelines reflecting the Texas Family Code §154.125(a-1) increase in the net resource cap to $11,700 per month, it is more important than ever for parents to ensure their support orders remain aligned with present-day financial realities.

We believe that child support orders should evolve as families evolve. Our attorneys work diligently to ensure that calculations under Texas Family Code Chapter 154 accurately reflect income, medical support, and extraordinary expenses so that support obligations remain fair and sustainable. This balanced approach protects children while also respecting the financial health of both parents, fostering stability and cooperation in co-parenting relationships.

Through transparent communication, free consultations, and educational tools designed to empower families, our firm helps parents make informed decisions about modification requests. Whether you are seeking relief from an outdated order or ensuring your child receives the support they deserve, our attorneys are committed to strategic, thorough, and compassionate advocacy every step of the way.

At times of uncertainty or financial strain, the child support team at the Law Office of Bryan Fagan stands ready to guide you with knowledge, empathy, and proven experience. To learn more about the modification process and your rights under Texas law, visit our comprehensive Texas Child Support Resource, where you can access tools, articles, and next steps designed to protect your family’s long-term wellbeing.

Step-by-Step Checklist for Child Support Adjustments

Step 1: Identify Your Legal Basis Determine whether your situation involves a material and substantial change (income shifts, new children, custody changes, medical needs) or qualifies under the three-year / 20% / $100 rule.

Step 2: Gather Essential Documentation Collect comprehensive financial records, child-related expense documentation, custody evidence, and proof of changed circumstances as outlined in the documentation section above.

Step 3: Consult with an Experienced Attorney Schedule a consultation to evaluate your case strength, understand potential outcomes, and receive guidance on procedural requirements and strategic considerations.

Step 4: Choose Your Filing Method Decide whether to proceed through the OAG administrative process or file directly in court, considering factors like case complexity, urgency, and whether the other parent is likely to agree.

Step 5: File and Serve Your Modification Request Submit required paperwork to the court with continuing exclusive jurisdiction over your case and ensure proper service on the other parent according to Texas procedural rules.

Step 6: Participate in Negotiation Opportunities Engage constructively in mediation or settlement conferences when available, as agreed modifications often resolve faster and maintain better co-parenting relationships.

Step 7: Prepare for and Attend Court Hearings Present evidence clearly, respond honestly to questions, and follow your attorney’s guidance during proceedings. Be prepared to explain how changed circumstances affect your ability to pay or the child’s needs.

Step 8: Implement the New Order Once the judge signs your modified order, update wage withholding arrangements, payment processing systems, and personal records. Comply strictly with the new terms to avoid enforcement issues.

Conclusion

Navigating changes in child support can feel overwhelming, especially when life shifts in ways you didn’t expect. But understanding your rights—and knowing that Texas law is designed to adapt to real-life circumstances—can bring a sense of clarity back into the picture. Whether you’re adjusting to new financial realities, taking on different parenting responsibilities, or simply wanting to make sure everything is fair and up to date, you’re already taking the right steps by educating yourself.

If you find yourself wondering what your next move should be, that’s where our team comes in. Working with an experienced Texas family law attorney can make the process smoother, less stressful, and far more predictable. At The Law Office of Bryan Fagan, PLLC, our mission is to give families the support and guidance they need to regain peace of mind during life’s hardest transitions. We’re here to help you protect your children, your financial stability, and your future.

As you think about what comes next, consider this: life doesn’t stay the same, and neither should a child support order that no longer fits your reality. When you’re ready to explore your options, we’re here to walk that path with you, one informed decision at a time.

Frequently Asked Questions

Child support can be modified when a parent experiences a “material and substantial change” in circumstances—things like job loss, significant income changes, a shift in the child’s needs, new medical expenses, or changes in custody. Texas also allows a review every three years if the guideline amount differs by at least 20% or $100.

Letting conflict override the child’s best interest. Judges look for stability, cooperation, and a willingness to co-parent. Hostile communication, inconsistent routines, or trying to alienate the other parent often backfires quickly.

Evidence is key. Text messages, emails, witness statements, counseling notes, and well-documented parenting patterns help show manipulation—especially when it harms the child or disrupts co-parenting. Courts look for repeated behaviors, not isolated moments.

There’s no automatic schedule. Adjustments happen when a parent files for modification due to major changes, or once every three years under the Texas guideline review rule. Support doesn’t change on its own—you have to request it.

Substantial changes include job loss, major income increases, new medical or educational needs, disability, significant parenting-time changes, or increased childcare costs. These must meaningfully affect financial responsibilities or the child’s well-being.

An unstable parent is someone whose behavior or circumstances create unpredictable or unsafe environments for a child. This could involve substance abuse, untreated mental health disorders, chaotic living conditions, or patterns of neglect.

Ignoring court orders, speaking poorly about the other parent, showing inconsistency in parenting duties, exposing the child to unsafe situations, or generating unnecessary conflict. Courts value reliability, maturity, and child-focused behavior.

It’s a parenting concept—not a legal rule—suggesting that the first 3 minutes after waking, the first 3 minutes after reconnecting after time apart, and the last 3 minutes before bed are the most meaningful for child bonding and emotional security.

This rule describes a parenting schedule where one parent has the child about 80% of the time and the other has around 20%. In Texas, this often resembles the Standard Possession Order, where one parent has primary custody and the other has assigned visitation.